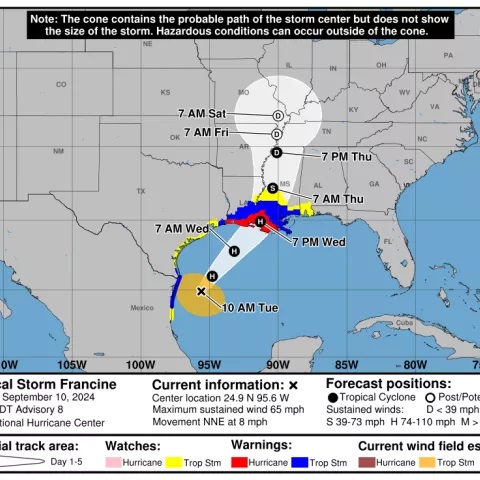

The U.S. National Hurricane Center’s most recent update, issued at 4 p.m. CST on Sept. 10, said a Hurricane Watch was in effect for Louisiana’s Lake Maurepas, Lake Pontchartrain and metropolitan New Orleans. (Source: Shutterstock)

Hurricane Francine forced the shut-in of nearly 24% of offshore oil (412,070 bbl/d) and 25.5% of gas (494 MMcf/d) production in the Gulf of Mexico (GoM) as it barreled toward Louisiana’s coast, with the potential to also affect LNG facilities.

Tropical Storm Francine was upgraded to a hurricane Tuesday night.

The Bureau of Safety and Environmental Enforcement (BSEE) reported evacuations at 130 platforms and two non-dynamically positioned (DP) rigs. Three deepwater DP rigs had moved off, according to the BSEE’s latest update on Sept. 10. The statistics are based on a survey of 33 companies by BSEE. The evacuated rigs make up about 35% of those in operation in the GoM.

The GoM production accounts for 15% of total U.S. crude oil production, or nearly 2 MMbbl/d, according to the U.S. Energy Information Administration.

BSEE said it has activated its Hurricane Response Team and is monitoring offshore oil and gas operators in the Gulf as they evacuate platforms and rigs in response to the storm.

RELATED

US Gulf Coast Residents Flee, Oil Production Shut as Francine Intensifies

Among those reportedly evacuating non-essential personnel in the GoM was Murphy Oil Corp., Reuters reported. A Murphy Oil spokesperson said the company anticipates minimal impacts to its operations.

The U.S. National Hurricane Center’s most recent update, issued at 4 p.m. CST on Sept. 10, said a Hurricane Watch was in effect for Louisiana’s Lake Maurepas, Lake Pontchartrain and metropolitan New Orleans.

A tropical storm warning is in effect for the Alabama coast from the Mississippi/Alabama border to the Alabama/Florida border. A hurricane warning for the southwestern coast of Louisiana from Sabine Pass to Cameron, home to some of the largest U.S. LNG export terminals, has been changed to a tropical storm warning.

A storm surge warning was also discontinued for the Texas coast west of Sabine Pass.

As the storm approached, U.S. natural gas futures climbed about 3% on Sept. 10 as oil and gas producers cut output ahead of a hurricane expected to make landfall on Sept. 11, Reuters reported.

Front-month gas futures for October delivery on the New York Mercantile Exchange rose $0.62 cents, or 2.9%, to settle at $2.232/MMBtu, Reuters reported.

Although gas prices rose, Francine is expected to cut demand by curtailing gas flows to Gulf Coast LNG export plants and cause homes and businesses to lose power.

Because more than 75% of U.S. gas production comes from shale basins in Pennsylvania, West Virginia and Ohio, as well as the Permian Basin in West Texas and eastern New Mexico, analysts said hurricanes were more likely to reduce gas prices by cutting demand through power outages and knocking LNG export plants out of service.

That is different from 20 years ago when about 20% of the nation's gas came from the federal offshore GoM.

Back then Gulf Coast hurricanes usually caused gas prices to spike higher, but now the offshore region produces only about 2% of the country's gas, Reuters reported.

In the spot market, pipeline constraints caused next-day gas prices at the Waha Hub in the Permian Basin to fall to an all-time low and average in negative territory for a record 34th time this year.

Waha prices first averaged below zero in 2019. It happened 17 times in 2019, six times in 2020 and once in 2023.

RELATED

Hurricane Threatens LNG and Power Demand as Francine Forms in GoM

Recommended Reading

Pearl Energy Investments Closes Fund IV with $999.9MM

2025-02-04 - Pearl Energy Investments’ Fund IV met its hard cap within four months of launching and closed on Jan. 31.

Q&A: Pearl Energy Investments Rides the Downturns for 250% ROI

2025-02-25 - Billy Quinn, founder and managing director of Pearl Energy Investments, leads a team that thrives amid the oil and gas investment cycles.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Haslam Family Office: ‘We Need Hydrocarbons’

2025-01-29 - The managing director of HF Capital—the office for Tennessee's Haslam family—says that as long as oil, gas and other energy sources are lacking capital, there’s an investment opportunity.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.