When the Inflation Reduction Act was signed into law on Aug. 16, 2022 by President Joe Biden, $370 billion in the legislation represented the largest investment in clean energy and climate-related programs.

Funding has been steadily doled out by federal agencies to states and taxpayers, ranging from those seeking energy efficiency home improvements and residential clean energy tax credits, to companies seeking billions of dollars to pursue large manufacturing facilities, utility-scale renewable energy projects or to advance technologies.

Tracking how much of the appropriated funds has been obligated is a monumental task with numbers frequently changing as awards, loans and tax credits are granted by the various agencies responsible for distributing the money. However, several trackers manned by public policy groups, analysts and others have surfaced to help keep tabs on the public dollars. Plus, some federal agencies regularly share what they’ve done with the money and what remains.

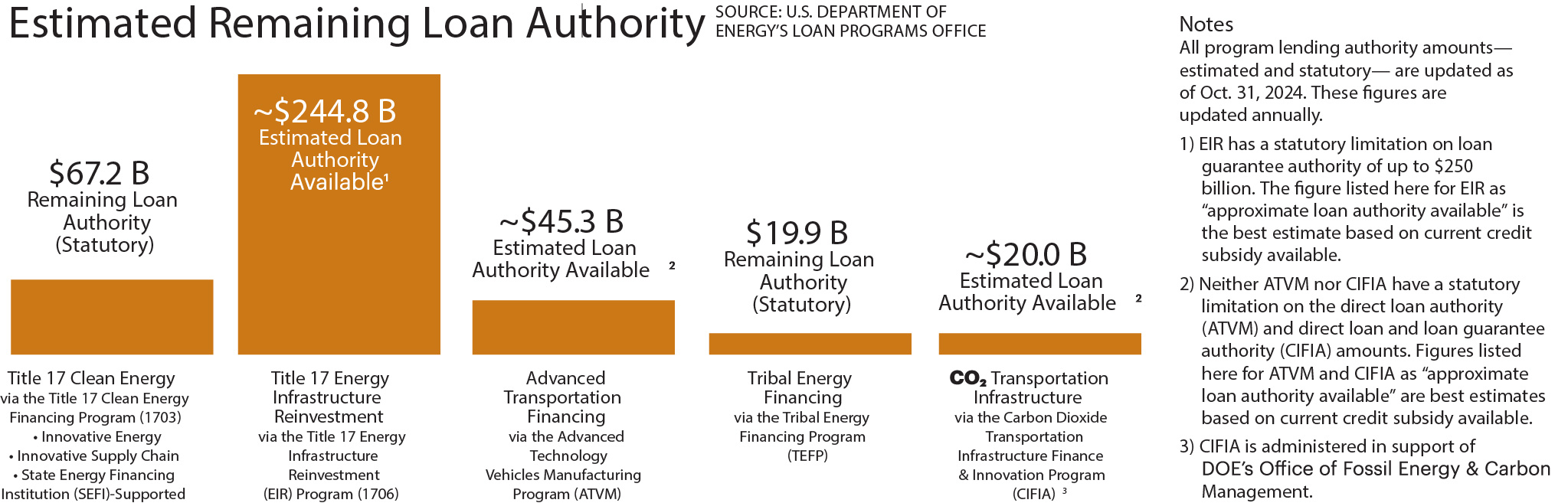

The U.S. Department of Energy’s Loan Programs Office (LPO), for example, issues a monthly application activity report on statutory and estimated available loan and loan guarantee authority across its programs. This includes the Title 17 Energy Infrastructure Reinvestment (EIR) program created by the IRA to provide loan guarantees for projects that reinvest in old energy infrastructure to reduce emissions and support clean energy development.

The IRA appropriated $5 billion to carry out EIR through Sept. 30, 2026, with a total cap on loans of up to $250 billion. As of Oct. 31, 2024, the EIR program had about $244.8 billion in estimated loan authority available, according to the LPO.

In all, the LPO said it was appropriated $11.7 billion to support issuing new loans.

The U.S. Department of Agriculture (USDA) reported in November that it had invested more than $2.7 billion through its Rural Energy for America Program (REAP) for more than 9,900 renewable energy and energy efficiency improvements. Nearly 7,000 of the projects were funded by more than $1 billion provided by the IRA, the USDA said.

Several nongovernmental groups have been tracking spending. Atlas Public Policy’s Climate Program Portal is among the online resources available to public officials, advocates and 501(c)(3) nonprofit organizations to track federal investments in climate initiatives. It focuses on investments from the IRA and the Infrastructure Investment and Jobs Act.

Other trackers include the Rhodium Group’s Clean Investment Monitor, a joint project with MIT’s Center for Energy and Environmental Policy Research, and the Inflation Reduction Act Tracker, a joint project of Columbia Law School’s Sabin Center for Climate Change Law and the Environmental Defense Fund.

Some efforts feature trackable databases while others have focused on how much investment the IRA has generated in certain states. But some lack information, such as loans and tax credits, that would paint a more accurate picture. Another challenge is that information is quickly outdated as awards and loan guarantees are approved.

“It’s really hard to find this information,” Joe Brazauskas, senior counsel for Bracewell, told Oil and Gas Investor when asked about how much IRA money is left. He cited Politico, saying the Environmental Protection Agency has obligated roughly 80% of its funds and the Interior Department maybe about 25%, with just under $50 billion left in terms of obligations.

“The Biden administration is certainly attempting to obligate as many funds as possible to buttress against a potential for Trump to try to claw back some of this money,” said Brazauskas. “When the funds have already been obligated, when there’s contractual agreements that are already signed … is an example of funds that will, interestingly enough, have to be administered by the next administration.”

For agencies like the Environmental Protection Agency or the Department of Energy that still have massive pots of money available, “the next administration is going to come in and examine those programs,” he said.

After some analysis, the new administration may consider repurposing unobligated dollars.

“It’s quite possible that certain programs that bolster things like carbon capture and sequestration or utilization are ones that potentially a Trump administration will want and may want to continue with,” Brazauskas said, “although I haven’t really seen a signal to say we ought to preserve some of that functionality. But I do think that there will be a lot of scrutiny on these programs and … how that money might be used in other places.”

Recommended Reading

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

2025-03-13 - Hedge fund giant Citadel’s acquisition includes approximately 60 undeveloped Haynesville locations, sources told Hart Energy.

Stonepeak Acquires Stake in Woodside’s Louisiana LNG for $5.7B

2025-04-07 - Investment firm Stonepeak purchased a 40% interest in a project Australia’s Woodside Energy bought last year for $900 million.

Glenfarne Deal Makes Company Lead Developer of Alaska LNG Project

2025-03-28 - Glenfarne Group LLC is taking over as the lead developer of the Alaska LNG project with the acquisition of a majority interest in the project from Alaska Gasline Development Corp.

Will TG Natural Resources Be the Next Haynesville M&A Buyer?

2025-03-23 - TG Natural Resources, majority owned by Tokyo Gas, is looking to add Haynesville locations as inventory grows scarce, CEO Craig Jarchow said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.