Despite moves by EQT, Chesapeake and other gassy E&Ps, natural gas prices will likely remain in a funk for at least the next quarter, analysts said. (Source: Shutterstock)

With a mild winter ending and natural gas storage staying at higher-than-normal levels, EQT Corp., the largest U.S. natural gas producer, became the latest producer to slash production this week. The company joins a number of other producers that have scaled back production as natural gas prices remain stubbornly low.

EQT said March 4 it had started to cut gross production by about 1 Bcf/d in late February in “response to the current low natural gas price environment.”

The Henry Hub natural gas front month futures price rallied at the news, climbing about 7% to $1.96 per MMBtu, the highest since prices fell below $2 per MMBtu at the beginning of February. While it was some rare positive recent news for natural gas, prices remain lower than at any time since the COVID-19 outbreak at the beginning of 2020.

TD Cowen analysts wrote that EQT’s curtailment should help the E&P position for a rebound later in the year, but that the overall natural gas market is in for continued pain in the short term.

“All else equal, EQT's move can help the market move closer to balance by mid-fall, helping preserve the contango for 2025, but also signal that near-term pain is perhaps reaching a maximum threshold,” TD Cowen said in a March 4 commentary.

EQT expects to maintain the curtailment through March and then re-assess. The upshot: A total of about 30 Bcf to 40 Bcf in U.S. gas production will be taken off the table in first-quarter 2024.

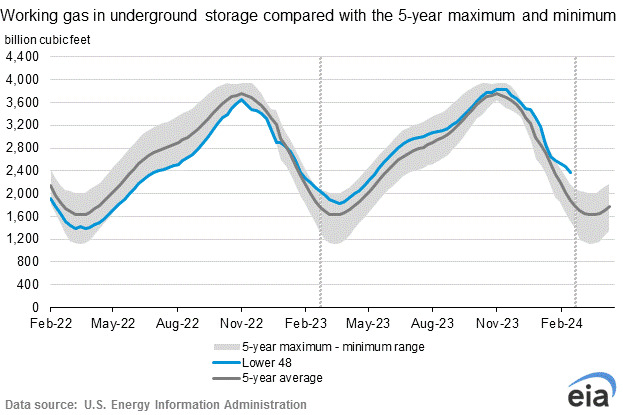

On Feb. 29, the U.S. Energy Information Administration reported that U.S. natural gas storage levels had declined by 96 Bcf in the middle of February to a total of 2.37 Tcf. While the withdrawal was larger than predicted by market analysts surveyed by Bloomberg, continued mild weather forecasts dampened expectations of a surge in demand.

Most of the withdrawal for the week came in the Eastern U.S., according to analytical firm RBN Energy. The surplus will most likely rise again, thanks to the mild weather at the end of February. Even with the decline, storage levels remain 26.5% above five-year averages.

Besides the weather, a big driver for low natural gas prices has been production in the Permian Basin. Natural gas production in the area is tied to associated gas produced during crude oil drilling—in contrast to gas-focused plays like the Marcellus Shale in Appalachia.

Crude oil prices remain profitable in the Permian, meaning that companies don’t have an economic incentive to cut production of gas. U.S. production in the Lower 48 hit a record of 106 Bcf/d in December 2023, even though storage levels were already close to records.

Other gas-production areas will continue to adjust to the current market, said Alex Gafford, senior energy analyst at East Daley Analytics.

“The Haynesville is also at risk for shut ins with higher breakeven costs than Appalachia, however, historically we have seen stricter rig cuts as opposed to shut ins out of the Haynesville,” Gafford said. “This year rigs have fallen from an average of 54 in December 2023 to about 45 today. This is also half of the rig count we saw in March last year of about 90 rigs.”

EQT joins Chesapeake, Comstock Resources and Antero Resources in recent announcements that they would be cutting production or pull back. On Feb. 20, Chesapeake announced it would defer placing wells in production and reduce drilling and completion activities. Antero said on Feb. 14 that it expected its natural gas production to decline by 3% in 2024, and that its drilling and completion capex budget would decrease by 26%.

Comstock Resources plans to reduce the number of operating drilling rigs to five from seven in the Haynesville Shale.

While EQT has moved to cut production, the company plans to continue to develop its play, putting it in a strong position for an eventual market recovery, according East Daley.

“We estimate EQT will begin bringing back production in May as historically it took EQT about two months to recover production to prior levels,” Gafford said. EQT holds 1 Bcf/d capacity on the Mountain Valley Pipeline, which is expected to begin service around June 1.

“This would mean recovery to EQT’s 2023 production levels by the end of June,” he said.

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

Equinor’s Norwegian Troll Gas Field Breaks Production Record

2025-01-06 - Equinor says its 2024 North Sea production hit a new high thanks to equipment upgrades and little downtime.

ProPetro Agrees to Provide Electric Fracking Services to Permian Operator

2024-12-19 - ProPetro Holding Corp. now has four electric fleets on contract.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.