TXO estimates that this single position holds about 200 Bcf to 300 Bcf of natural gas with 25 Bcfe estimated per drill well. (Source: Shutterstock/ TXO Parnters)

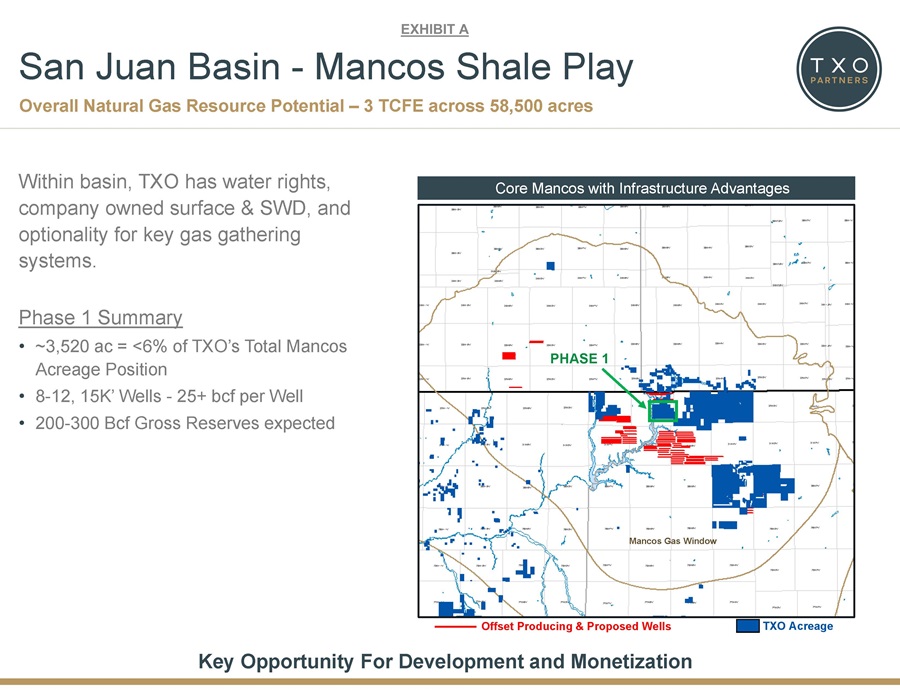

TXO Partners announced Jan. 16 a potential play of 3 Tcfe of oil and gas assets in the Mancos Shale of the San Juan Basin.

The San Juan Basin lies along the border of northwest New Mexico and southern Colorado.

“The Mancos Shale is an upcoming, giant natural gas field where we hold a 58,500 contiguous-acre position that is held by production,” said Bob R. Simpson, TXO chairman and CEO, in a press release.

On an oil-equivalent basis, the company believes the field could yield five times its current reserve base. Offset drilling on the acreage adjoining the field has confirmed results, the company said.

TXO plans to exploit a 3,520-acre parcel of the field as Phase 1 development in the play, said Gary D. Simpson, TXO president of production and development.

The company estimates that this single position holds about 200 Bcf to 300 Bcf of natural gas with 25 Bcfe estimated per drill well. The position also has the potential to almost double its existing natural gas reserves, TXO said.

“We expect to drill, develop, and monetize at an economically opportune time and pace,” Gary Simpson said.

Recommended Reading

Google, SLB, Project Innerspace Form Geothermal Partnership

2025-03-06 - The geothermal partnership between Google Cloud, SLB and Project Innerspace takes shape as energy demand surges, driven in the U.S. by data center growth, the rise of electrification and an increase in manufacturing activity.

Smackover Lithium Derisks Direct Lithium Extraction Technology

2025-03-11 - With the completion of a final field test, the Smackover Lithium joint venture's direct lithium extraction technology moves toward commercialization, Standard Lithium says.

E&Ps’ Subsurface Wizardry Transforming Geothermal, Lithium, Hydrogen

2025-02-12 - Exploration, drilling and other synergies have brought together the worlds of subsurface oil drilling and renewable energies.

Baker Hughes, Hanwha Partner to Develop Small Ammonia Turbines

2025-02-03 - Baker Hughes, in partnership with Hanwha Power Systems and Hanwha Ocean, aim to complete a full engine test with ammonia by year-end 2027, Baker Hughes says.

The Chicken or the Egg? Policy and Tech Needed to Enable Hydrogen Market

2025-04-11 - Hydrogen project developers ask themselves the famous ‘chicken or the egg’ conundrum as they lean on policy, incentives and technology to bridge cost gaps.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.