Alta, the operator of the asset, agreed to pay $115 million to buy Ultra Petroleum’s 50% stake in a position spanning 73,000 net acres. (Image: Hart Energy)

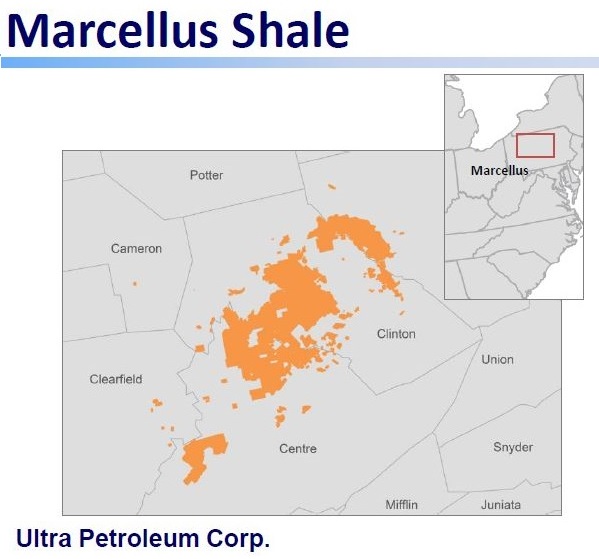

Ultra Petroleum Corp. (NASDAQ: UPL) will exit its 73,000-net-acre Marcellus Shale position after it signed and closed a deal in late December to sell the nonoperated assets to an affiliate of Alta Resources LLC.

The $115 million deal includes the sale of gathering system assets jointly owned by Alta, which also operates the Marcellus assets for Ultra. The company’s core position is in Centre and Clinton counties, Pa. Ultra owned a 50% working interest in the field.

Ultra, based in Houston, said the deal isn’t expected to affect the company’s $1.4 billion borrowing base while proceeds add the equivalent of roughly 75% of third-quarter adjusted 2017 EBITDA to the company’s coffers. Ultra is still marketing its noncore Uinta Basin oil assets, where it holds about 8,000 net acres and averaged third-quarter 2017 production of 2,324 barrels of oil equivalent per day.

The divested Marcellus assets include current net production of 30 million cubic feet per day, which contributed a proved developed producing PV-10 value of $79 million to the bank syndicate’s borrowing base.

Alta Resources, a private E&P headquartered in Houston, is led by CEO Joseph G. Greenberg. The company was founded in 1999. George P. Mitchell, regarded as the father of shale gas for his pioneering role in developing the Barnett Shale, was a longtime partner with Alta prior to his death.

Michael D. Watford, Ultra’s chairman, president and CEO, said the streamlining of its portfolio will allow the company to focus on higher-return assets in the Pinedale Field, which includes 78,000 net acres in Sublette County, Wyo.

“We also believe it makes sense to bring the value of these assets forward and use these proceeds to help deleverage our balance sheet and further improve liquidity,” he said. “We are currently working with CIBC Griffis & Small to begin marketing our Uinta Basin package and we hope to announce the sale of that asset in the coming months.”

In a November conference call, Watford said the company dealt with shut-ins in the Marcellus “and issues with the enterprise gathering system in Pinedale.”

Ultra’s Pinedale Pipeline infrastructure also offers advantages over the company’s Appalachian peers “with burdensome fixed minimum volume commitments.” The company said it has a variable cost structure with no current contractual commitments.

In 2014, Ultra bought part of its Pinedale position from with Royal Dutch Shell Plc (NYSE: RDS.A) for $925 million. As part of the deal, the company traded a portion of its Marcellus Shale properties to Shell.

Also in 2014, Ultra divested a majority of its Marcellus position due to widening basis differentials for natural gas prices.

As of December, Ultra was running seven operated rigs and one nonoperated rig in the Pinedale Field. The position includes an inventory of 4,900 vertical locations and an estimated 1,600 horizontal locations.

Kirkland & Ellis advised Alta Marcellus Development LLC on the acquisition of Ultra’s Marcellus asset.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Liberty Capitalizing on Power Generation as Completions Stay Flat

2025-01-31 - New Liberty Energy Inc. CEO Ron Gusek says company is ‘uniquely positioned’ to deliver modular units for data centers.

Diversified, Partners to Supply Electricity to Data Centers

2025-03-10 - Diversified Energy Co., FuelCell Energy Inc. and TESIAC will create an acquisition and development company focused on delivering reliable, cost efficient net-zero power from natural gas and captured coal mine methane.

Baker Hughes, Frontier Form CCS, Powergen Partnership

2025-03-03 - Baker Hughes will provide technology solutions to support the Sweetwater Carbon Storage Hub being developed by Frontier Infrastructure in Wyoming.

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

VoltaGrid to Supply Vantage Data Centers with 1 GW of Powergen Capacity

2025-02-12 - Vantage Data Centers has tapped VoltaGrid for 1 gigawatt of power generation capacity across its North American hyperscale data center portfolio.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.