The risk inherent with a typical fracturing operation is tied to the fact that an abrasive mixture of sand, water and/or propane gel is pumped downhole at a very high rate for an extended period. The fluids and high pumping speed combine to create a mixture that causes a range of erosion issues that can ultimately compromise the mechanical integrity of well control barriers, usually at the surface. Leaks, compromised frac valves and erosion in the pumping line can follow, which can lead to the uncontrolled release of hydrocarbons at the surface during fracturing. However, these events do not happen without any prior indicators, and they typically involve a chain of contributing factors and warning signs before any blowout occurs.

The drilling-related incidents Wild Well Control typically experiences for unconventional plays tend to relate to high-pressure pockets or narrow margin wells when additional wells have been drilled on the flanks of a field to investigate pressure regimes. Repetition and familiarity establish complacency and mishandling of the situation by personnel unaccustomed to managing an unconventional well control event, which can compromise well integrity downhole. In these situations, crossflow events can occur, whereby reservoir influx from high-pressure zones can leak into lower pressure zones, inhibiting proper development of the field and resulting in loss of production.

Wild Well responds to a blowout resulting from compromised wellhead equipment. (Source: Wild Well Control)

Developing a risk management program

The appropriate, engineered redundancy of barriers, whether operational or mechanical, is the only way to mitigate operators’ risks throughout fracturing operations. Wild Well encourages all clients to develop a robust risk management program that supports them with identifying, analyzing and mitigating the well control risk throughout the well life. This, of course, includes proper assessment of equipment risks, making sure all drilling and pumping are properly selected, fit for purpose, correctly rated and properly installed. However, the importance of considering the human factor cannot be overstated. For example, proper training in the form of crew awareness orientation plays an important role in helping the crew develop an understanding of how a simple well control event can quickly escalate and compromise well control barriers, resulting in a blowout. If key personnel members are not confident that they have ownership in the decision-making process, they will not be able to serve as an effective line of defense against well control events.

Concerns in unconventionals

Most unconventional plays in the U.S. are drilled underbalanced because the majority of these plays do not have natural fractures. It is a procedure where the wellbore is kept at a pressure lower than the formation being drilled. This approach improves operational efficiency as the wells are drilled faster, smoother and with the overall cost of the wells maintained at competitive levels. However, as the hydraulic fracturing activity increases, well control problems begin to increase due to these induced fractures. These increasing well control problems draw attention to the importance of implementing conventional well control practices of using hydrostatic columns higher than the formation’s pore pressure.

As the number of unconventional wells has increased dramatically across the U.S., frac hits or “frac bashing” is now a common issue for some U.S. operations, in which fracture-initiated well-to-well communication events can create production losses and mechanical damage. Some operators are suspending their drilling operations to allow others to complete their fracturing operations, but there is room for further collaboration between operators to mitigate the hazards of impact. It is an area that could be further enhanced by operational guidelines, standardizing operations or regulation.

In particular, one of the main well control issues with unconventional plays is blowouts due to faults in casing design. Before the hydraulic fracturing of the well, the maximum allowable surface fracture pressures are typically calculated. The fluid gradient inside and outside the pipe is accounted for during this assessment. During fracturing, additional pressure is exerted from the surface and a ballooning effect is created on the production casing. If this effect adds more tension load that is not accounted for, it will cause an issue. During fracturing, the production casing typically cools down as the thermal load on it reduces. Frac fluids are delivered at ambient temperatures, which are colder than downhole temperatures. This design issue can lead to frac stacks and wellheads being ejected in extreme scenarios.

Typical response plan

Wild Well’s typical response to a blowout event resulting from hydraulic fracturing is an attempt to regain hydrostatic control of the well and reinstate a mechanical barrier to the surface by “capping” the well. The typical capping process involves four stages:

1. Wild Well personnel respond to the event and conduct a site assessment;

2. Any compromised equipment is removed from the surface;

3. Capping of the well is performed; and

4. The final phase is recovering the wellbore and getting it back into production mode or to an abandoned state.

Most blowout events involve compromised wellhead equipment at the surface, whether it is a production or frac tree or a BOP. These components are checked for pressure sealing integrity. If they fail, they should be removed and replaced with properly rated equipment to reinstate the pressure seal.

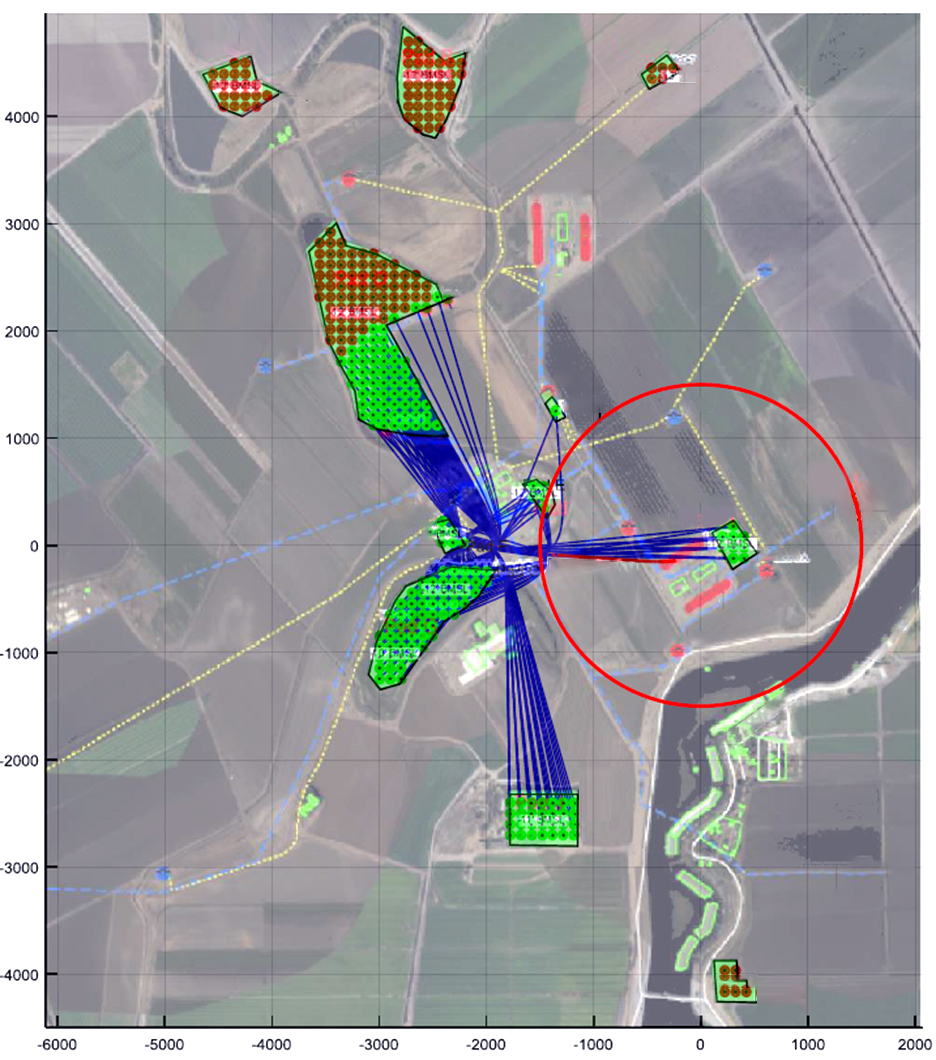

Additionally, Wild Well advises on how to enhance well placement to maximize productivity from the wells and perform the correct survey quality checks. Well-specific plans for frac and relief wells are developed that focus on anti-collision well placement issues that can typically pose a hazard on high-density wells on small footprint pads (Figure 1). Survey management helps to eliminate uncertainty, which is a key criterion for relief well success if a blowout cannot be managed at the surface. Relief wells can be relied upon to regain hydrostatic control of a well’s subsurface, and wellhead spacing is critical from a relief well and response standpoint.

FIGURE 1. A feasibility study, including well-specific plans for frac and relief wells, focuses on anti-collision well placement issues. (Source: Wild Well Control)

Engineering capability example

The production casing failed in a recent fracturing operation. The casing provided a conduit for delivering fracturing fluids at a high rate and pressure at the surface. Wild Well responded, capped the well and worked with the operator to perform a hydraulic pressure transient analysis to investigate the sudden high-pressure release from the well because of the casing failure and attempted to analyze the structural ailures. A computational fluid dynamics (CFD) analysis was incorporated with mechanical model assessment, and a model was built to recreate what happened on the well (Figure 2). Once the pressure distribution was completed, a mechanical model was built and those forces applied upon it to understand the possible failure points.

FIGURE 2. A CFD analysis of pressures is depicted before and 3 ms after the breach. (Source: Wild Well Control)

The analysis revealed that during the millisecond of peak pressure while fracturing, there was recoil of the casing due to the production casing failure. At the time, the operator was embarking on a campaign to upsize its pressure release system after realizing that it was too small. Wild Well’s analysis and modeling support the fact that the pressure release system did not affect the performance of the system as the recoil force in the string alone was enough to launch the wellhead and cause the blowout.

Recommended Reading

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.