Wax deposition in miles-long crude pipelines—especially the subsea variety—may be out of sight but remains a preoccupation in the oil and gas industry.

In Gulf of Mexico (GoM) subsea pipelines, wax crystallization is a major issue. Due to cold water temperatures at the seabed, waxy components in crude oil are more likely to reach what is known as wax appearance temperature (WAT), which is dependent on the type and concentration of the components.

Paraffin problems can include pipeline pressure losses due to higher viscosity and deposition of wax on surfaces.

In extreme cases, wax buildup may cause pumping pressure requirements that exceed the pipeline’s rating, stopping flow completely.

Heating the pipeline is one of the three most common management solutions, the others being chemical treatments and mechanically pigging the line to scrap away buildup.

There’s also prevention and remediation schedules that rely on computer modeling of how and when wax deposition happens.

A study at the University of Tulsa analyzed wax deposition and removal temperatures to develop a model for prevention and treatment. Likewise, research at the University of Texas at Austin (UT-Austin) showed that paraffin deposition continues in certain locations depending on whether flexible composite pipe (FCP) or steel pipe is used.

Researchers with the Tulsa University Paraffin Deposition Projects, including Nagu Daraboina, a chemical engineering professor, examined the wax deposition and removal characteristics at various temperatures to create an accurate modeling paradigm for prevention and treatment.

The team used a novel dynamic microscopic visualization technique to “understand the removal mechanisms as the deposit is exposed to varying temperature gradients,” according to their paper, “Visualization of thermal removal mechanism of paraffin deposits: Providing guidelines for minimum temperature requirements.” The study was published in The Science and Technology of Fuel and Energy of ScienceDirect on Aug. 25.

Daraboina noted, “Active heating is used for prevention as well as remediation. Some operators choose to constantly heat the pipe wall to prevent the production fluid from ever dropping below the WAT in the first place. This has been done using hot fluid circulation,” although other options, potentially more expensive and more carbon intensive, are possible.

Past research had shown that heating wax deposits above WAT would reduce the wax’s crystal density over time, lowering its yield stress to the point that shear forces from the oil flow would wash away large wax chunks. Unsurprisingly, higher temperatures make the process faster and remove more wax.

According to the Tulsa University paper, a two-step removal process involving counter-diffusion and detachment occurs.

“Counter-diffusion process is caused by the radial temperature difference between the oil and the heated pipe. This diffusion allows wax crystals to melt and diffuse back into the oil stream and more oil to become trapped in the crystal network of the deposit,” the paper states. “During this step, little change in the overall wax thickness is observed. This weakens the deposit integrity over time and leads to the second removal step, a detachment of wax chunks from within the deposit.”

Based on this analysis, a comparison between the shear stress at the wax-oil interface and the yield stress of the deposit dictates the minimum temperature required for removal—a key finding for model development.

From this, Daraboina and his research team arrived at an accurate understanding of the deposit and removal process, with the findings providing “a basis of understanding for model development.”

Because there are currently no methods of detecting actual wax deposits in pipelines, operators rely on computer models to inform prevention methods or to schedule remediation. For operators using heat to control these deposits, understanding the WAT threshold helps them make appropriate temperature settings.

‘Cold finger’

Due to supply chain issues and inflation, producers are increasingly turning from steel pipe to FCP or other composite-based pipes, which offer the additional advantage of being impervious to corrosion.

Zion Research estimated the current market for FCP at $2 billion per year, with projects to expand the market to $2.9 billion by 2030. FCP and related pipes are mainly used for short-haul gathering systems.

But the switch creates questions about how operations need to be adjusted due to differences between pipe materials.

In the realm of flow assurance, a significant question concerns the rate of paraffin deposition, prevention and removal in composite pipes.

One question: are the mechanics of paraffin deposition in FCP similar to those in steel? Researchers wanted to know if it was possible to apply the same modeling or strategies as those used in steel pipes.

Those researchers, including Yingda Lu, assistant professor at the Hildebrand Department of Petroleum and Geosystems Engineering at UT-Austin, have been working to answer that question since 2021.

Lu said preliminary results show heat transfer plays a dominant role in wax deposition on different materials. He and Hildebrand cohort Derek Burmaster, a doctoral student, published “Surface Material Effects on Wax Deposition in Noncoated Pipelines” earlier this year in the American Chemical Society’s Energy & Fuels journal.

Paraffin content deposits vary by field. The Bakken tends to have higher concentrations than Texas and Oklahoma basins.

The temperature difference between oil and pipe is among the main variables affecting deposition rates. In their paper, Lu and Burmaster said current wax deposition theories see the process starting with a gel layer forming on a cold pipe wall. The process is affected by the pipe’s surface properties.

They noted that existing study results regarding wax deposition on different materials neglect to consider the difference in thermal conductivities of pipe materials — and a failure to control surface temperature across pipe materials during paraffin deposition testing.

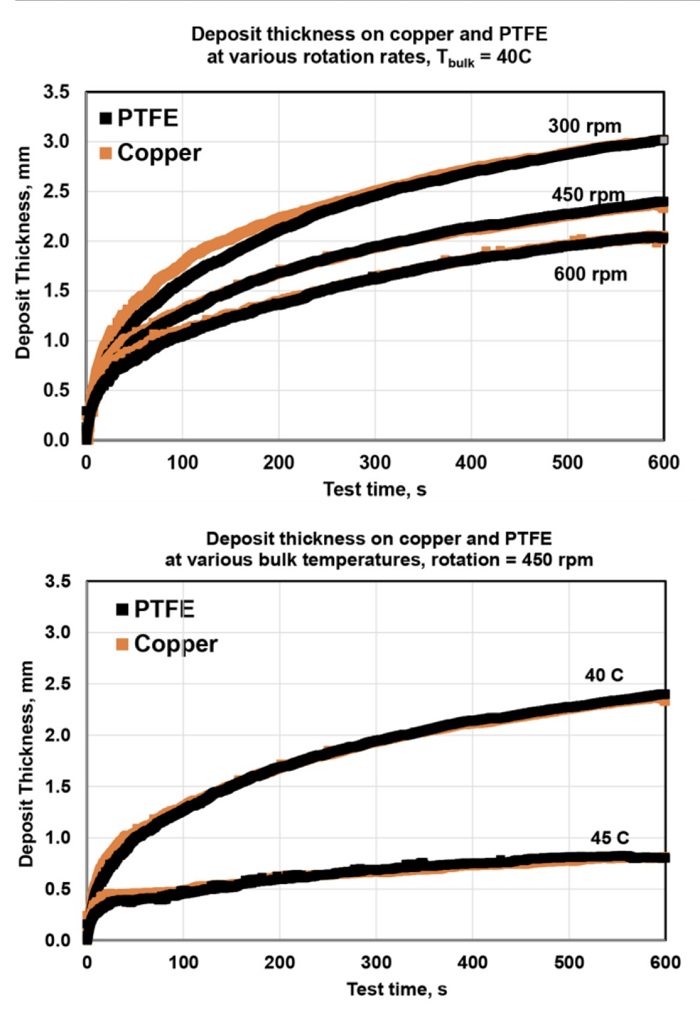

For materials, the UT-Austin researchers chose uncoated copper and polytetrafluoroethylene (PTFE) to represent metal and plastic pipelines because of their well-defined surface energies.

The team designed a customized “cold finger” to generate the wax deposits, in which a cold rod is inserted into hot oil for paraffin deposits to build on. Unlike conventional designs in which the cold finger is made of the same material, Lu and team designed a “composite” cold finger that had two layers to maintain constant surface temperature—assuring that the only influencing factor in paraffin deposition was the pipe material in question.

In compiling the results, Lu noted, “When surface temperature is maintained at a constant level, the difference in paraffin deposition on uncoated copper and PTFE surfaces is fairly small, indicating paraffin deposition on different materials is primarily controlled by heat transfer.”

Building on these findings, the team is characterizing the adhesive strength between deposits and different pipe materials to see whether deposits formed on certain surfaces are easier to remove.

Recommended Reading

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.