The inimitable marriage of hydraulic fracturing and horizontal drilling has crossed an economically defining threshold as shale reservoirs approach what can best be described as “sub-unconventional,” which translates to permeability up to two magnitudes of order lower than the pre-2017 trend.

With the unconventional sector oriented to produce from reservoirs much tighter than those of earlier developed assets, the pressure to increase production and lower completion costs is magnified exponentially. Accordingly, as these ultratight pay zones respond largely to contact frequency, the onus is on operators to extend the frac stage length and/or enhance hydrocarbon flow within each stage, while reducing cycle time on location. The operative phrase here should be “effective stage length,” as longer stages and the frequency of fracture clusters therein can be counter-productive to maximum reservoir drainage unless flow uniformity is an integral consideration in the frac design.

For contemporary unconventional stage fracturing, it can be argued that biodegradable frac diverters have, somewhat unceremoniously, emerged as the single most effective tool for balancing higher reservoir productivity with lower completion costs and risks. Frac diverters effectively plug perforations and the near-wellbore heel clusters, where casing friction drives a disproportionate volume of frac fluid, while redirecting flow to mid-interval and outer toe fractures that intrinsically are less accepting of the proppant delivery medium (Figure 1). Moreover, biodegradable frac diverters help minimize friction and pressure-induced casing integrity issues.

Importantly, field data have proved that the engineered design and application of biodegradable frac diverters deliver across-the-lateral flow uniformity, generally boosting production rates from 18% to 40%, with corresponding increases in EURs, while reducing spread costs by more than 12% on average.

To put into proper context the emergent role of diverters in exploiting these contact-responsive rocks, a look at the current permeability landscape and corresponding fracture stage lengths is in order.

Permeability and stage length

Given the latest trend in unconventional targets, the U.S. shale community is once more redefining acceptable reservoir quality. The pay zones put onstream during the mercurial growth spurt of 2004 to 2009 were loosely characterized as “yesterday’s dry holes,” but more pointedly described source rocks that historically were dismissed as sub-par assets. North Texas’ gas-rich Barnett Shale is the first play to profitably complete and produce the source rock from vertical wells. Primarily driven by the need to avoid water, horizontal wells were later landed in the Barnett and staged-fractured with several completions along the lateral, yielding healthy economic returns in the process. With the Barnett as the petri dish, the unconventional horizontal completion process was refined elsewhere and, of course, evolved into oil reservoirs after the precipitous drop in gas prices.

The current trend—and one having a profound influence on reservoir stimulation response—is toward developing reservoirs with at least one and up to two orders of magnitude less permeability than the values recorded during the earlier growth explosion. The shallow migration of hydrocarbons into these extremely impermeable rocks fall into a category best described as “contact type” reservoirs, unlike the pay zones of 2004-2009 that relied on high degrees of conductivity and infrequent contact to maximize production. For those “conductivity-type” rocks, ceramic and other high-yield, but expensive, proppants were used consistently in shale completions. Owing to the trendy emphasis on contact and frequency, a less costly low- to moderately conductive proppant pack is sufficient to generate economic production rates. Most operators, in fact, disregard American Petroleum Institute’s guidelines that call for proppant best suited for the respective closure stress level, opting instead to stimulate with extremely close fracture spacing (3 m [10 ft] in many cases). For this discussion, 12 m (40 ft) will be used as a minimum spacing between clusters.

Precisely determining permeability is another matter altogether. Assessing permeability through conventional pressure transient methods is difficult and very time-consuming in these ultratight reservoirs. Ostensibly, visual estimates by the mud logger is a simpler approach but, at best, provides only order of magnitude approximations and cannot be quantified with any degree of confidence.

Alternatively, the Pixler method is among the most commonly used proxies to more precisely determine permeability. The Pixler method uses gas chromatographic readings to plot the mathematical relationship of C4 and C5 values (heavy gases) and total gas, which is occasionally referred to as the “wetness ratio.” It is important to understand that these values will remain more qualitative than quantitative until they are calibrated against other datasets, usually core data. However, the assumption that the high peaks of this ratio represents higher permeability generally holds true.

Close spacing leads to yet another opportunity to enhance project economics by first increasing the linear distance comprising a stage, followed by optimizing the frac fluid distribution within the spacing. For example, consider a starting point of four clusters per stage that is subsequently improved to six, eight or 10 clusters. The stage grows from three times, 12 m to 36 m (40 ft to 120 ft), to nine times, 12 m to 110 m (40 ft to 360 ft). Notably, the math can be a bit tricky when first building stages, as one must account for the first cluster at 0 m (0 ft), progressively increasing to 12 m, 24 m and finally reaching a stage length of 36 m with four clusters.

Above all, extending the stage length reduces the number of cycles that can stress and cause a failure to casing couplings, while also requiring fewer plugs. The savings in plug costs is clearly evident in the Delaware Basin, where price tags range from $3,900 to $6,900 per set. The wireline crew efficiency, the pumping company’s nonproductive time fees and the reduced risk of parted casing further augment the savings equation.

However, reducing time on location represents by far the single most influential cost-saving component. Consider the case of a mid-sized service company in the Delaware Basin, using a fixed-cost model where time on location and materials are priced separately. Under this pricing model, a 12-hour reduction in total on-location time would result in a roughly 12% spread cost reduction.

To fully capture the time-reduction benefits, the injection rate must be faster than that of the original design, which will speed up the process while not reducing the concentration of materials loaded into the fractures. Likewise, reducing cycle time minimizes the very real risks of parted casing, which increases each time a stage is pumped.

Casing integrity issues

One of the issues in lengthening frac stages is the level of pipe friction between the heel and toe clusters. The increase is a relatively linear relationship to length, meaning that doubling the stage length from 36 m to 110 m increases the friction threefold. For example, take the variations in pipe friction values in a 10-cluster frac stage, assuming all perforations are open. In this example, the differences between the toe cluster and the heel cluster range from a minimum of 41.4 psig up to 140.4 psig, depending on the pumping rate. These values may seem insignificant, but when added to the variation in closure stresses between cluster locations, they can contribute to project complexity and decrease the ability to open all of the perforations.

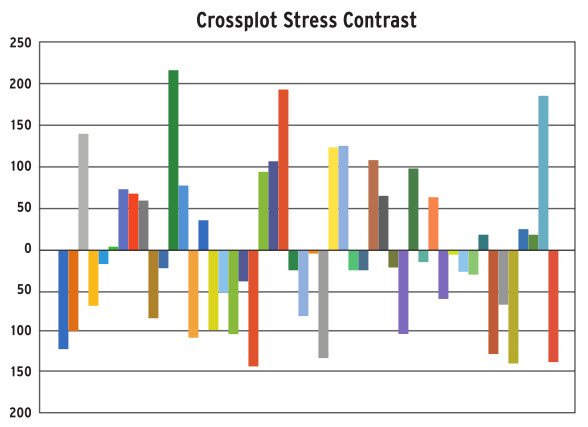

Figure 2 displays the actual contrast in minimum horizontal stress in a Third Bone Spring well, reflecting the wide difference in the maximum closure stress between perf clusters. The broad closure stresses, combined with pipe friction, dramatically alters interstage flow with increasing differential pressures.

Limited entry perforation, which has been used in the stimulation community since the late 1950s, has been seen as a viable methodology for addressing the differential pressure issues. Using limited-entry perforation, the heel in Figure 2 would have to be perforated using few and very small perforations, compared to the numerous and large perforations at the toe. This common practice, however, has lost some favor, largely because myriad issues surrounding the detection and mitigation of closure stress differences is not well appreciated but will emerge with time.

Integrating drilling data with neural networks can deliver a synthetic log, which yields the rock properties that can generate stresses along the wellbore. These stresses are used to select perforation spacing to better take advantage of “like” stresses, thus improving the perforation opening. Afterward, minimum pressure drops between perforations can be designed. This methodology also represents the foundation for the engineered application of biodegradable diverters to increase fracturing stage lengths while maintaining average cluster spacing similar to the original completion design.

‘Art’ of diversion

The majority of biodegradable diverters used in stimulations are formulated with water insoluble polylactic acid (PLA), a compound that is largely free of patent protection, thereby attracting numerous market participants. Likewise, given the capacity to degrade into benign lactic acid, PLA finds application in medical implants as a building block for anchors, screws, plates, pins, rods and for use as a mesh. Importantly, for fracturing applications, the degraded material is water soluble, facilitating removal during the wellbore cleanup process.

For the many PLA-based biodegradable diverter suppliers drawn to the fracturing market by the wholesale expiration of patents, maintaining product quality and delivering an application-specific design is an art unto itself. First, to withstand being altered into the small, and tough, particle size required for fracturing, the primarily corn-based composition must be ground in a cryogenic environment to harden the material, while preserving its properties.

Designing the material to sufficiently plug and divert flow in a fit-for-purpose manner requires particular expertise. For example, care must be exercised to ensure particles are sufficiently sized to pass through the valves without lodging in the valve seat and plugging the pumps.

Generally, the proper design of a biodegradable PLA diversion plug requires at least three different meshes of materials. In a compact demonstration of the process, an inordinately large mesh material is used first, followed by a mid-range material to plug the voids left by the initially large mesh material. Finally, a very fine mesh material fills in the remaining, typically near-microscopic, voids left in the frac pack.

The final step is analyzing the pressure trends to ascertain the material did in fact plug off the predetermined points and expose new formation, thus enabling diversion to take place. Net pressure matching enables the analyst to understand the environment(s) the diverter has affected. Stated simply, in some cases the diverter may simply plug off perforations and extend the flow into perforations that were taking less fluid before the diverter was placed. Closing off a fracture generates pressure sufficient to open perforations/fractures closed prior to the diverter coming into play.

Post-frac observations

Reservoir performance evaluations validate the capacity of biodegradable diverters to improve fracture contact during the completion operation and the undeniably positive influence on production. Hints of the eventual diverter-reservoir performance relationship can be traced to the roots of Frac Diagnostics LLC, borne out of participation in a multitude of microseismic mapping projects. In observing those projects, especially early in the evolution of the unconventional completion process, an odd phenomenon became apparent.

While the original plan assumed fractures would evolve evenly from the wellbore, the microseismic mapping projects consistently showed the general basinwide tendency of the heel perforation cluster/fracture to generate a much longer fracture than those at the mid-point and especially at the toe cluster. In the latter stages of this study, biodegradable diverters were used, and, in those cases, a more uniform fracture geometry was distributed in the same stage interval (Figure 3), with appreciable increases in production rates (Figure 4).

Explained another way, if the heel stage in the nondiverter frac, for example, is significantly longer than the frac incorporating a diverter, the effective frac length, defined as the portion of the frac that yields conductivity and can deliver production, is appreciably longer/stage.

This imbalance in fracture length could not be dismissed as an inconsequential anomaly, as the post-frac production data made available showed the wells incorporating diverters outperforming their counterparts by 8% to 18%, with regard to the time between load recovery and hydrocarbon volumes high enough to consider the cleanup complete and the well put on production. Theoretically, this makes sense given the time-worn issue of conductivity and formation damage resulting from proppant placement.

At the end of the day, the use of biodegradable diverters carries distinctive benefits in terms of increased production, lower completion costs and maximum asset value. However, as with any aspect of an unconventional completion, avoiding potential risks requires careful attention to both design and execution.

Typically, biodegradable diverters are used to double the length of the frac stage while achieving interstage transition with, as noted, fewer plugs and less pipe integrity risks. Using a “spread rate” pricing system and treatments pumped at a higher-than-usual rate to shorten the time required to extend each stage, the running of fewer plugs and less time on location combine for documented cost savings of up to 28%. Conversely, the economic benefits can be compromised with inefficient logistics failing to make all required materials readily available on location and inaccurately designing the diverter for the targeted application and reservoir characteristics.

When used to reverse production declines and maximize EUR, the diverter typically is run innerstage to open perforations and redistribute frac fluid and proppant. Field recaps show 12% to 40% higher EUR values. However, the risks of screenout increase significantly if the diverter or application is designed improperly or very few perforations are found to be open.

All things considered, the case can easily be made that from a mathematical perspective, biodegradable diverters are the only tools available to both lower the denominator (costs) and increase the numerator (production yield) in the value-return on investment equation of unconventional wells.

References available.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.