(Source: Shutterstock)

Energy companies are releasing their second-quarter 2024 earnings soon, and with that comes dividend announcements.

Here is a selection of upstream and midstream dividends declared in the week of July 8.

Enterprise Products Partners

Enterprise Products Partners LP’s board of the directors of its general partner declared a cash distribution on July 10 to Enterprise common unitholders for the second quarter 2024.

The quarterly distribution will be approximately $0.53 per unit, $2.10 annualized, and will be payable Aug. 14 to common unitholders of record as of July 31.

The dividend is 5% more than last year’s second quarter distribution.

Enterprise also repurchased $40 million of its common units in second quarter 2024. Including these purchases, 50% of its $2 billion buyback program has been used.

Genesis Energy

Genesis Energy LP’s board of directors of its general partner declared a quarterly distribution on July 11 on its common and Class A convertible preferred units.

The distributions for the quarter ended June 30 will be paid on Aug. 14 to holders of record as of the close of business on July 31.

Common unit holders will be paid a quarterly cash distribution of $0.15 ($0.60 on an annualized basis) for each common unit held.

Preferred unit holders will be paid a cash distribution of approximately $0.95 ($3.79 annualized) per common unit.

Headquartered in Houston, Genesis is a diversified midstream MLP with operations located in the Gulf Coast, Wyoming and Gulf of Mexico.

Pembina Pipeline

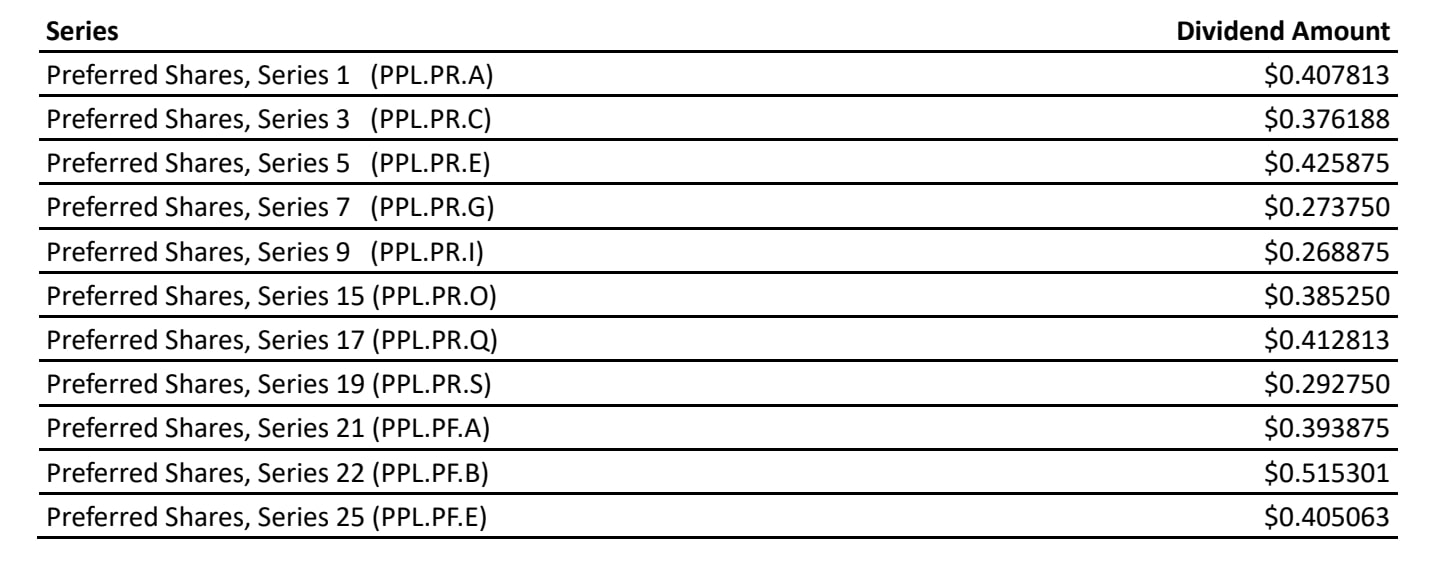

Pembina Pipeline Corp.’s board of directors declared quarterly dividends for the company’s preferred shares on Series 1, 3, 5, 7, 9, 15, 17, 19, 21, 22 and 25.

Series 1, 3, 5, 7, 9, 21 and 22 preferred share dividends are payable on Sept. 3 to shareholders of record on Aug. 1. Series 15, 17 and 19 preferred share dividends are payable on Oct. 1 to shareholders of record on Sept. 16. Series 25 preferred share dividends are payable on Aug. 15 to shareholders of record on July 31.

Series 1’s dividend is CA$0.41 per share (US$0.30). Series 3 is CA$0.38 per share (US$0.28) and Series 5 is CA$0.43 per share (US$0.32).

The rest of the dividend amounts, which are in Canadian dollars, can be found in the chart below.

Phillips 66

Phillips 66’s board declared a quarterly dividend on the company’s common stock, the company announced on July 10.

The $1.15 per share dividend is payable on Sept. 3 to shareholders of record as of Aug. 20.

Phillips 66 is an integrated downstream energy provider with a portfolio in the midstream, chemicals and refining businesses.

Riley Exploration Permian

Oklahoma City-based Riley Exploration Permian’s board declared a cash dividend on the company’s common stock of $0.36 per share.

The dividend is payable Aug. 8 to stockholders of record by July 25.

Targa Resources

Targa Resources Corp. declared a quarterly cash dividend of $0.75 per common share, or $3 on an annualized basis, for second-quarter 2024.

The dividend will be payable Aug. 15 on all outstanding common shares to holders of record by July 31.

Recommended Reading

Court Rejects Activists’ Protest of Woodside LNG Pipeline Project

2025-03-31 - Woodside Energy Group prevailed against environmental groups’ arguments to stop a pipeline to Louisiana LNG in a case that originated before the Australian company bought the project.

Burgum: US Electrons are ‘Mission Critical’ in Cyber War with China

2025-03-28 - Natural gas will play a key role in feeding energy to tech providers like Microsoft Corp. as China innovates in the AI arms race at breakneck speed, Interior Secretary Doug Burgum said at CERAWeek by S&P Global.

E&P Execs Level Scathing Criticism at Trump's Drill Baby Drill 'Myth'

2025-03-26 - E&P executives pushed back at the Trump administration’s “drill, baby, drill” mantra in a new Dallas Fed survey: “’Drill, baby, drill,’ does not work with [$50/bbl] oil,” one executive said.

14 Energy Execs Send Open Letter to Canadian Government

2025-03-26 - The leaders requested the government to ease environmental regulations and encourage investments to expand the country’s energy industry.

Venture Global Asks FERC to Approve Calcasieu Pass Opening

2025-03-25 - Shell’s CEO says he expects an update to the company’s ongoing arbitration with Venture Global.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.