Downtown Montevideo, Uruguay. (Source: Shutterstock.com)

MEXICO CITY—Uruguay’s state-owned regulator ANCAP is still in discussions for offshore exploration deals that could be finalized later this year with four international oil companies (IOCs) regarding six awards related to the Open Uruguay Round bidding process in 2022.

“These awards are still under negotiation between ANCAP and the companies, but we are very close to signing [them],” ANCAP energy transition professional Cecilia Romeu told Hart Energy at the two-day AAPG-Energy Opportunities event in late March in Mexico City.

“Hopefully, within this year, 2023, we will have these contracts signed,” Romeu said.

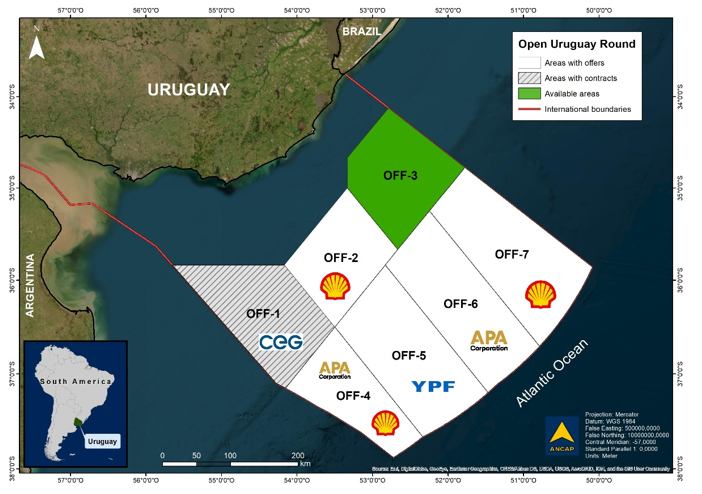

Last year, Uruguay awarded bids to the Challenger Energy Group (CEG) for the OFF-1 area, Shell (OFF-2 and OFF-7), Argentina’s state owned YPF (OFF-5), APA Corp. (OFF-6) and a consortium of both APA (operator) and Shell (OFF-4).

At the moment, the only area available for future bidding rounds is area OFF-3, Romeu said.

ANCAP runs the Open Uruguay Round, which includes two bid rounds per year. The process offers a predictable schedule, so companies have time to present all the documentation to qualify up until the last working days of April for the first round and October for the second round.

“I think the main strength of this regime is the predictable schedule. Companies already know the dynamics and it's easier to follow,” Romeu said. “This regime has been in place since 2019, and we’ve had very good results.”

The round offers very moderate work commitment requirements and companies could have an area for six years before committing to a well, ANCAP announced in statements on its website.

E&P production projects are subject to Uruguay’s national environmental regulations, and ANCAP promotes the adoption of the industry's best practices and technologies aligned with such regulations and with an aim on conducting sustainable activities, according to ANCAP.

“As a consequence of all these new contracts, we are going to have new exploratory activities that will include workstation studies, more assessment of the petroleum geology, evaluation of the respective resources and reprocessing of existing data from an enormous database available, and also licensing of data by companies,” Romeu said.

Uruguay’s second energy transition

Uruguay is a small country of just over 3 million people that is tucked away in southern South America and bordered by Brazil to its north and Argentina to its south.

Over the last four years, in terms of its electric power generational matrix, about 97% of its energy has come from renewable sources: hydro, biomass and wind, Romeu said.

“So, we are good in terms of electricity… and that's why we say that we’ve had a successful first energy transition, for the power sector,” Romeu said. “Now, the government’s focus is on moving towards a second energy transition for the rest of sectors, mainly transport and industry, where it's more difficult to reduce the greenhouse gas emissions.”

Green hydrogen is seen as the energy source to drive Uruguay’s second energy transition.

“We believe green hydrogen production will be the key for achieving this decarbonization goal for the rest of the sectors,” Romeu said. “So we are focused on that project, which is very important not only for ANCAP but at a country level.”

Recommended Reading

E&P Highlights: Dec. 2, 2024

2024-12-02 - Here’s a roundup of the latest E&P headlines, including production updates and major offshore contracts.

TotalEnergies Awards SBM Offshore FPSO GranMorgu Development Contract

2024-11-15 - SBM will construct and install a floating production, storage and offloading vessel for TotalEnergies alongside its partner Technip Energies, the company said.

E&P Highlights: Nov. 18, 2024

2024-11-18 - Here’s a roundup of the latest E&P headlines, including new discoveries in the North Sea and governmental appointments.

What Chevron’s Anchor Breakthrough Means for the GoM’s Future

2024-12-04 - WoodMac weighs in on the Gulf of Mexico Anchor project’s 20k production outlook made possible by Chevron’s ‘breakthrough’ technology.

Falcon, Tamboran Spud Second Well in Australia’s Beetaloo

2024-11-25 - Falcon Oil & Gas Ltd., with joint venture partner Tamboran, have spud a second well in the Shenandoah South Pilot Project in the Beetaloo.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.