U.S. Energy Development Corp. recently brought online a five-pad J.T. Morris pad (pictured) in Reeves County, Texas. (Source: U.S. Energy)

U.S. Energy Development Corp. continues to expand its footprint in the Permian Basin and beyond with operated and non-operated investment.

Fort Worth, Texas-based U.S. Energy recently brought online a five-well J.T. Morris pad in Reeves County, Texas, according to records filed with the Texas Railroad Commission (RRC) in May.

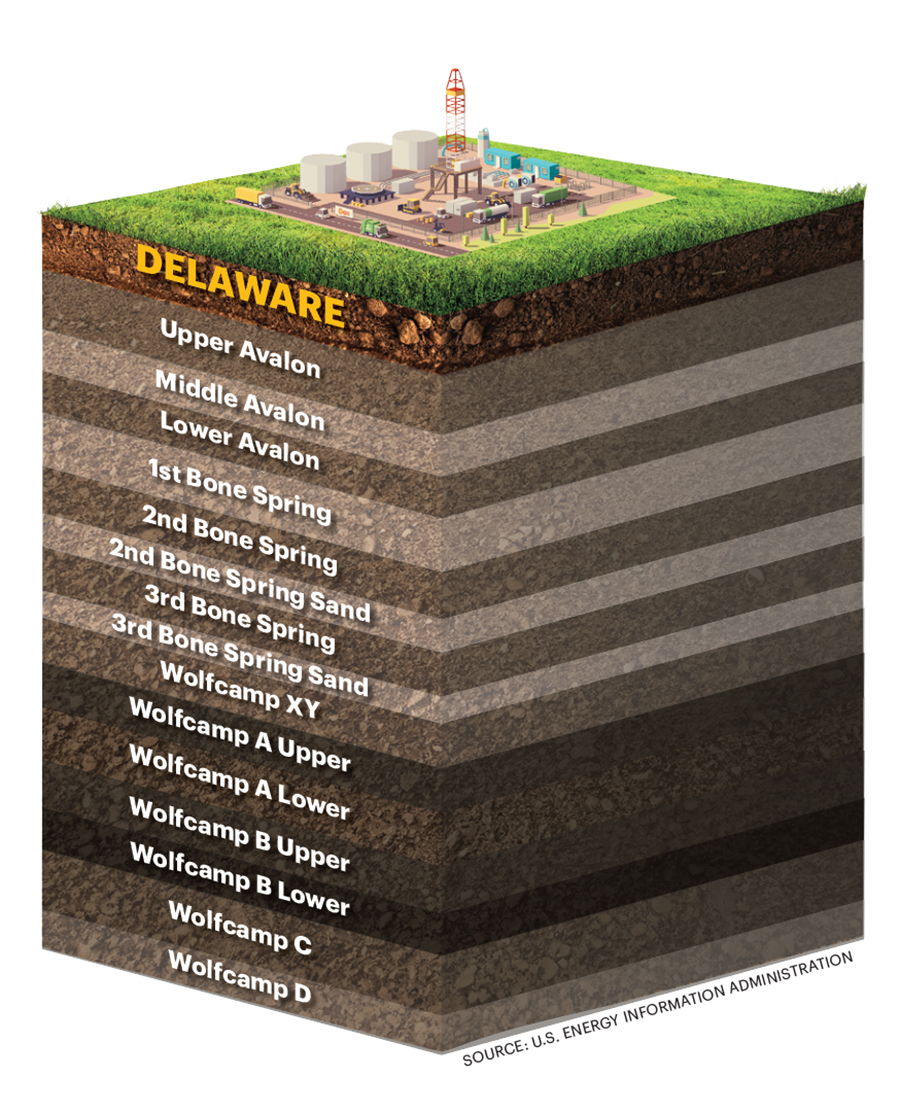

The J.T. Morris wells were drilled at an average vertical depth of around 10,610 ft targeting the Bone Spring and Wolfcamp intervals.

“We were very fortunate to contract an active rig to accompany our experienced drilling consultants,” said Kevin Duncan, vice president of operations for U.S. Energy, in a statement. “Our completion team with the support of our service providers efficiently executed our completion design.”

“This combination resulted in exceptional drilling and completion performance as illustrated with our cost savings,” he said.

U.S. Energy developed the J.T. Morris pad with support from Atlantic Energy Partners.

Following the J.T. Morris project, U.S. Energy said it brought online a two-well Westway 2122 pad in Reeves County in mid-June.

RELATED

Decoding the Delaware: How E&Ps Are Unlocking the Future

U.S. Energy expects to allocate more than $750 million across its shale footprint over the next 12 months, but the majority of that spend is earmarked for the Permian Basin.

The company plans to pick up an additional rig in October to accelerate drilling activity in the Delaware Basin.

U.S. Energy, partnering again with Atlantic Energy, plans to begin work on a new five-well pad in Reeves County this fall.

“Jordan Jayson and his team at U.S. Energy have done a great job developing our Delaware Basin prospects on time, under budget and with wells hitting our type curves,” said Atlantic Energy CEO Richard Jennings in the statement.

U.S. Energy deployed over $600 million and closed more than 19 acquisitions in 2023, virtually all of which were in the Permian.

The company made a $225 million investment in the Mascot project, a stacked pay asset in the core of the Midland Basin.

The deal included a 25% stake in the Midland County project, which is majority owned by Midland Petro D.C. Partners, for $225 million in cash.

U.S. Energy has also continued investing in its non-operated platform in the Permian and other resource plays.

Last year, the company drilled capital into the Haynesville Shale, the Barnett Shale and the Powder River Basin.

RELATED

US Energy Buys $225 Million Stake in Midland Basin’s Mascot Project

Recommended Reading

CNOOC Starts Production at Two Offshore Projects

2025-03-17 - The Caofeidian 6-4 Oilfield and Wenchang 19-1 Oilfield Phase II projects by CNOOC Ltd. are expected to produce more than 20,000 bbl/d of crude combined.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

Exxon Enlists Baker Hughes to Support Uaru, Whiptail Offshore Guyana

2025-02-03 - Baker Hughes’ will provide specialty chemicals and related services in support of the Uaru and Whiptail projects in the Stabroek Block.

TechnipFMC Awarded EPCI for Equinor’s Johan Sverdrup Phase 3

2025-03-25 - The Johan Sverdrup Field, which originally began production in 2019, is one of the largest developments in the Norwegian North Sea.

Production Begins at Shell’s GoM Whale Facility

2025-01-09 - Shell’s Whale floating production facility in the Gulf of Mexico has reached first oil less than eight years after the field’s discovery of 480 MMboe of estimated recoverable resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.