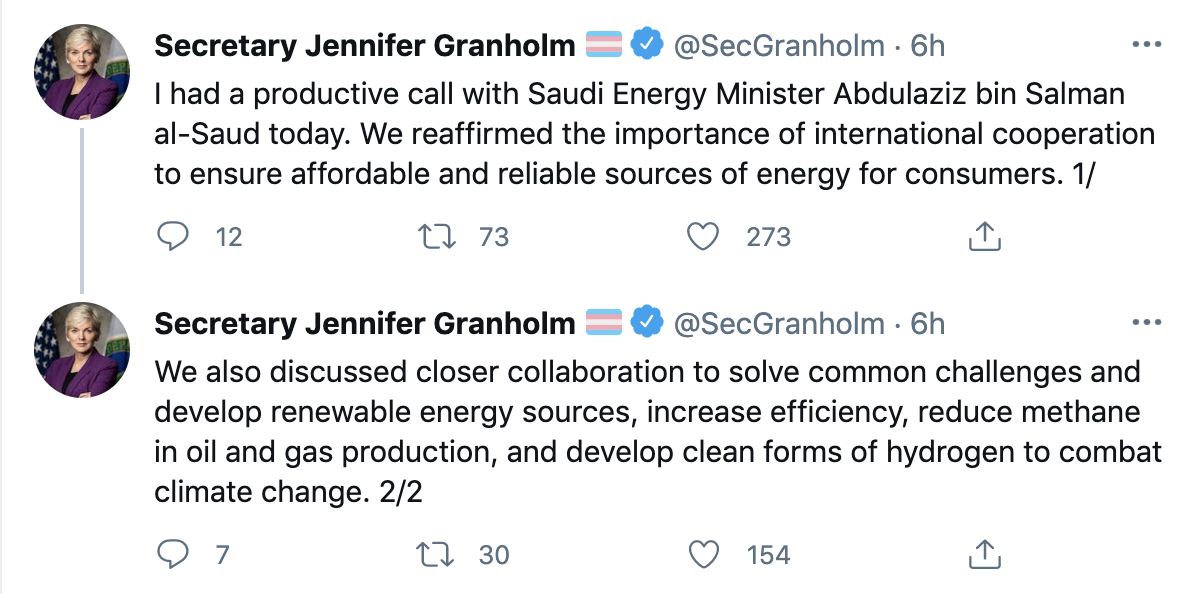

U.S. Energy Secretary Jennifer Granholm held a telephone call with Saudi energy minister Prince Abdulaziz bin Salman to reaffirm the importance of international cooperation to ensure affordable and reliable energy for consumers, she said on Twitter.

It was the first call to Saudi Arabia from a U.S. official ahead of an OPEC meeting since U.S. President Joe Biden took office.

OPEC+ will debate two key options on April 1 for oil policies from May and beyond, including a rollover of existing cuts and a gradual increase of production, three OPEC+ sources said.

OPEC and allied producers, a grouping known as OPEC+, are cutting output by a little more than 7 million bbl/d to support prices and reduce oversupply. Saudi Arabia has added an additional 1 million bbl/d to those cuts.

Two OPEC+ sources said the increase would not exceed 500,000 bbl/d.

The April 1 virtual meeting is scheduled to start at 1300 GMT.

Oil prices rose on April 1 on hopes that OPEC and its allies will keep production curbs in place when they meet on April 1 plus optimism over a U.S. government spending plan.

Brent crude was up by 91 cents, or 1.5%, at $63.65/bbl by 0849 GMT. WTI in the U.S. was up 99 cents, or 1.7%, at $60.15/bbl.

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Liberty Energy, DC Grid to Collaborate on Turnkey Power Solutions

2025-01-08 - Liberty Energy’s power solutions and DC Grid’s direct current systems will offer rapidly deployed, scalable and sustainable power for data centers, among other uses.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.