The transportation of equipment used to separate ethane from natural gas. (Source: Shutterstock)

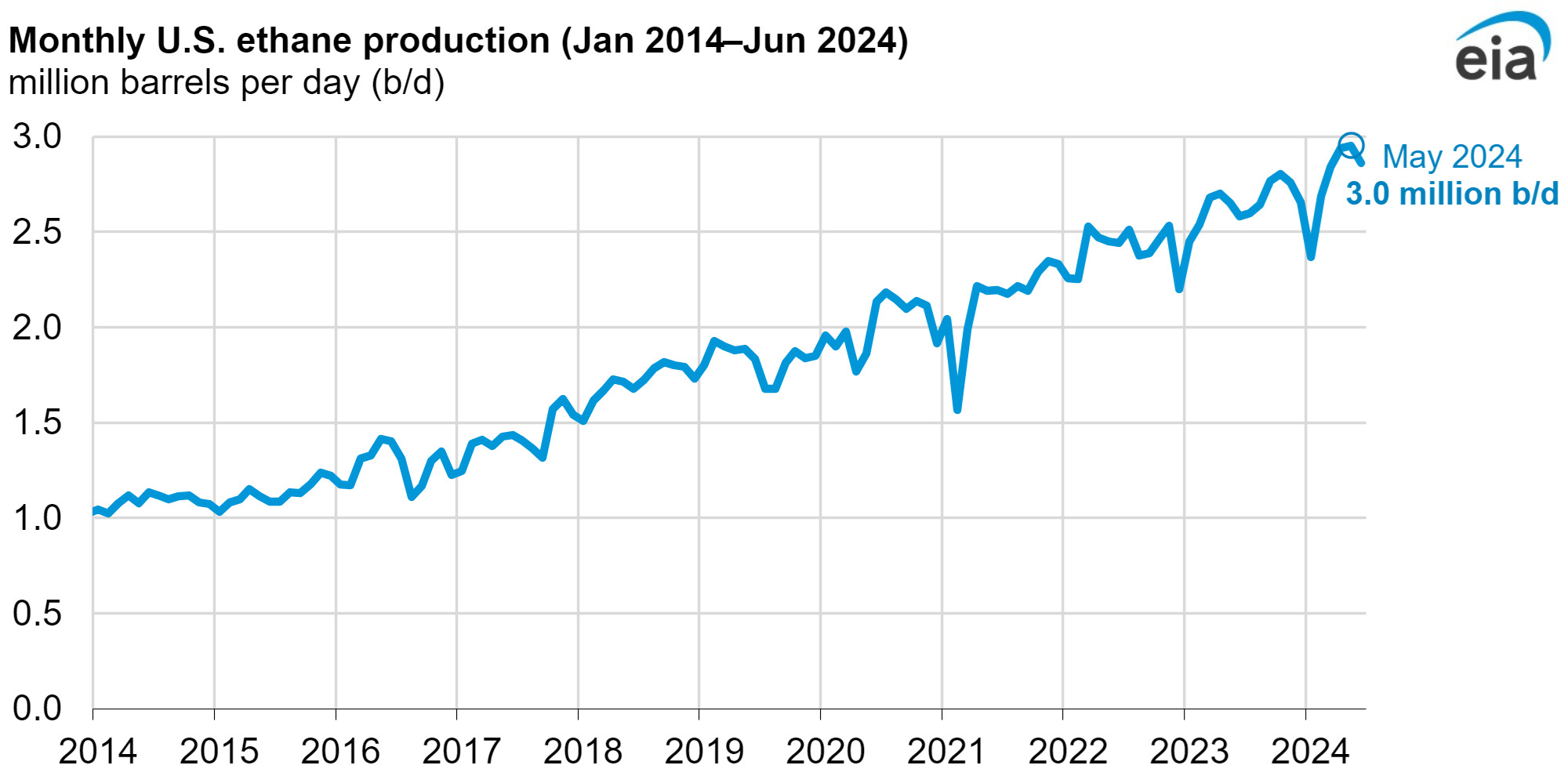

Ethane production hit record highs in the first half of the year, a sign that prices for the key NGL product are not likely to rise soon, an analyst said.

According to the U.S. Energy Information Administration, the country’s ethane production hit a record 30 MMbbl/d in May, tripling the daily average from 10 years ago. The rise in ethane stocks follows the country’s rise in natural gas production, especially in the Permian Basin.

In 2024, ethane producers in the Texas Inland and New Mexico refining districts easily led the U.S. with 62% of total production in the first half of 2024—averaging 1.7 MMbbl/d, according to the EIA. The top Appalachian refining district, which includes most of Pennsylvania and West Virginia, was a distant second at 327,000 bbl/d of ethane.

Ethane is the key chemical feedstock for the production of ethylene, which is used to make plastics and resins. Almost all ethane in the U.S. is refined at natural gas processing plants, where the liquids in wet gas are separated from methane to create NGL.

Midstream companies have focused on building natural gas processing plants in the Permian over the last decade. The basin produces more associated gas as it matures, and strong NGL demand in 2023 and 2024 helped make up for weak natural gas prices since the beginning of the year.

The overall demand is unlikely to support bullish ethane prices in the coming months, said Rob Wilson, senior director at East Daley Analytics.

“EDA believes ethane storage builds will lower ethane price, incentivizing more ethane rejection at the end of 2024 and into 2025,” Wilson wrote in an email to Hart Energy. “Basically, too much supply growth in the face of minimal demand growth until the tail-end of ’25.”

Ethane rejection means not extracting the chemical from natural gas before sending the gas downstream.

“The record ethane supply is because of gas constraints,” Wilson said. “There’s nowhere to put gas, so Permian processing plants are maxing out recoveries. We actually expect a little bit more ethane rejection as Matterhorn ramps up.”

The Matterhorn Express Pipeline provides natural gas egress from the Permian to Katy, Texas, just northwest of Houston. The 2.5 Bcf/d line began major commercial operations in October.

RELATED

Matterhorn NatGas Pipeline Ramps Up Faster Than Expected

After ethane production hit the 3 MMbbl/d record in May, producers responded with cuts. U.S. production fell to 2.86 MMbbl/d in June, according to East Daley.

On Oct. 25, Mont Belvieu prices for ethane were trading at $0.21/gallon. East Daley forecasts the price of EDA to fall under and remain at $0.20/gallon for the next 12 months.

“The next meaningful capacity expansions on the demand side do not occur until 2026,” Wilson said.

Two plants in Southeast Texas and Louisiana are scheduled to open over the next three years. The CP Chem/Qatar Golden Triangle polymers plant in Orange County, Texas, has an assumed in-service date in July 2026, with ethane demand ramping up to 120,000 bbl/d in mid-2027, Wilson said. The ShinTech ethylene cracker project in Plaquemines, Louisiana, is scheduled to open at the end of 2027 and will consume about 30,000 bbl/d of ethane.

Recommended Reading

Targa Pipeline Helps Spark US NGL Production High in 2024

2025-01-23 - Analysts said Targa Resources’ Daytona line released a Permian Basin bottleneck as NGLs continued to grow.

NatGas Prices, E&Ps Take a Hit from DeepSeeking Missile

2025-01-28 - E&Ps such as Expand Energy and EQT Corp. saw share prices drop on news of less power-intensive AI, but analysts predict the natural gas market will rebound as LNG exports and overall power demand continues to increase.

EQT: Gas Demand Likely to Outpace Midstream Sector’s Ability to Supply

2025-02-19 - Most infrastructure projects being built will not come online for another year—too late for the quickening pace of gas demand.

EIA: NatGas Storage Plunges, Prices Soar

2025-01-16 - Frigid weather and jumping LNG demand have pushed natural gas above $4/MMBtu.

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.