An offshore wind farm. (Source: Shutterstock)

The Biden administration said Dec. 11 it is proposing an offshore wind lease sale in the Central Atlantic, offering development rights across nearly 278,000 acres with the potential to power more than 2.2 million homes.

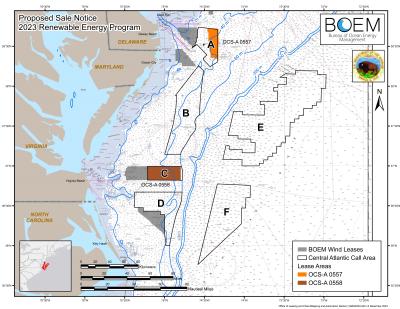

The proposal, which comes amid efforts to boost offshore wind capacity to 30 gigawatts by 2030, includes one area covering 101,443 acres offshore Delaware and Maryland and a 176,505-acre area offshore Virginia, the U.S. Interior Department said in a news release. The proposal also comes as the offshore wind industry grapples with higher costs and supply chain constraints.

“Since the start of our administration, the Department of the Interior has approved the nation’s first six commercial-scale offshore wind energy projects,” said Secretary Deb Haaland. “Today’s announcement is another step forward in the Biden-Harris administration’s pursuit of a clean energy future.”

So far, the U.S. has held four offshore wind lease auctions during the current administration, including offshore New York, in the Pacific and in the Gulf of Mexico. The record-setting New York Bight lease sale brought in $4.4 billion in winning bids from six companies in February 2022. The nation’s first offshore wind sale in the Pacific Ocean in December 2022 brought in more than $757 million in winning bids for five lease areas; however, the first-ever federal wind auction in the Gulf of Mexico ended with only one winning bid. The single high bid was for $5.6 million.

RELATED

First GoM Wind Lease Sale Lures Just One Winning Bid

Ørsted Stock Plummets After Offshore New Jersey Wind Projects Canceled

US Offshore Wind Strategy Evolves as Country Plays Catch-up With World

The Interior Department said it will get comments on the proposed Central Atlantic sale during a 60-day public comment period, which begins following publication of the proposed sale notice in the Federal Register. The U.S. Bureau of Ocean Energy Management is also seeking feedback on bidding credits to bidders involving workforce training programs, the domestic offshore wind supply chain and a fisheries compensatory mitigation fund.

Additional areas offshore Maryland are also being considered for future leasing, BOEM announced separately. Identified acreage will be analyzed further and considered as a wind energy area for possible inclusion in a wind lease sale as early as 2025, BOEM said.

Recommended Reading

Powerhouse: Enbridge Boosting Renewables, NatGas to Meet Surging Demand

2024-12-18 - As the need for clean and lower-carbon power grows, Enbridge is among the companies taking an all-of-the-above approach.

Energy Transition in Motion (Week of Jan. 10, 2025)

2025-01-10 - Here is a look at some of this week’s renewable energy news, including guidance on technology-neutral clean electricity credits.

Solar, Clean Energy Face Headwinds Amid Post-Election Uncertainty

2025-01-22 - With a new Trump administration taking charge, renewable energy, including solar, may face headwinds that stagnate project development or continue it at a slower pace, analysts say.

First Solar Continues to Ride Growth Streak Fueled by Incentives, Demand

2025-02-26 - First Solar ended 2024 with a contracted backlog of 68.5 gigawatts valued at $20.5 billion, having sold a record 14.1 GW of modules.

Energy Vault Begins Construction of Battery Storage Project in Australia

2025-02-24 - Energy Vault says it will use a special inverter which enables advanced grid support functionalities for the project.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.