Tomeka McLeod (left), vice president of hydrogen and carbon capture and storage for BP, speaks during the Reuters hydrogen conference in Houston with Plug Power’s Sanjay Shrestha, Inpex Americas’ Gonzalo Ramirez and EDP Renewables’ Ana Quelhas with Bracewell’s Tim Urban as moderator. (Source: Hart Energy)

The U.S. has an opportunity to be a global leader in low-carbon hydrogen production but the path forward is clouded today with uncertainty about tax credits, demand and an incoming administration that will need to be educated, hydrogen players say.

Executives from BP, EDP Renewables, Inpex and Plug Power gathered recently for a Houston hydrogen conference to discuss the state of clean hydrogen in the U.S. The discussion took place more than two years after President Joe Biden’s signature climate legislation, the Inflation Reduction Act, was passed and nearly a year after proposed rules for the hydrogen production tax credit (PTC) known as 45V were unveiled to the disappointment of many.

Hydrogen, which can be sustainably produced from various feedstocks that include natural gas with Carbon Capture and Storage and renewable energy, is considered a hopeful way to lower greenhouse-gas (GHG) emissions given it produces only water vehicle when burned. It can be used in transportation, power generation and industrial processes. However, hydrogen is more expensive than its fossil fuel alternatives, leaving producers reliant on incentives to help bring down costs.

High hopes for hydrogen have seemingly been replaced with cautious optimism and worry with low final investment decisions (FID), even as movement is seen with federally-funded hydrogen hubs. Final guidance has yet to come from the U.S. Treasury Department and Internal Revenue Service on how companies can qualify for a credit of up to $3/kg of hydrogen produced.

“We’re at a really pivotal point right now and the U.S. still really has an opportunity to be a leader in clean hydrogen, particularly with 45V if we can actually get 45V set up in the right way, one that is more color agnostic,” said Tomeka McLeod, BP vice president of hydrogen and CCS. “If we think about blue hydrogen, for example, some things…still need to be landed and hammered out: the use of RNG, renewable natural gas, the use of certified natural gas, which would reduce the overall carbon intensity. But in the initial guidance [that] was not really laid out and not clear.”

Steam integration should have some value in the overall carbon intensity, she added, noting it would allow blue hydrogen projects to get the full $3/kg PTC. That “could make our projects some of the most competitive projects globally.”

Bipartisan issue

Hydrogen producers meeting certain prevailing wage and registered apprenticeship requirements could qualify for a credit ranging from $0.60/kg of hydrogen produced to $3/kg, depending on the lifecycle GHG emissions from hydrogen production, including its power source.

However, to capture the credit—available for 10 years for facilities that start construction before 2033—hydrogen producers must have used electricity from a clean power facility built within three years of a hydrogen plant entering service and produce clean power from the same region as the hydrogen producer.

They must also provide proof of purchase of clean power, which comes in the form of an energy attribute certificate, that must be matched to production on an hourly basis, “meaning that the claimed generation must occur within the same hour that the electrolyzer claiming the credit is operating,” the Treasury Department said. The proposed rules include a transition to allow annual matching until 2028.

The proposed requirements are known as the three pillars to building a clean hydrogen industry.

“I completely believe there is an opportunity with the new administration because there is definitely a bipartisan aspect to clean hydrogen to be able to show what we in the U.S. can do,” McLeod said.

BP, which has scaled back on some renewable energy investments as it seeks higher returns, aims to have five to 10 hydrogen projects online globally this decade. In October, BP said it stopped 18 early-stage hydrogen projects.

RELATED

BP, Pulling Back from Renewables, Enters $5.8B JV with JERA

The company is focused on electrolytic hydrogen and hydrogen from natural gas with a carbon capture and storage component. In the U.S., efforts are centered on the Gulf Coast and in the Midwest, where the company is part of the Midwest Alliance for Clean Hydrogen Hub. Its Whiting refinery, which utilizes hydrogen, is also in the Midwest.

Cautiously optimistic

Inpex is also focused on hydrogen in the Gulf Coast region, specifically the Houston Ship Channel, where it has partnered with industrial gases company Air Liquide, LSB Industries and Vopax Exolum Houston to develop a large-scale, low-carbon ammonia production and export project. If the development proceeds as planned, the project’s first phase could produce more than 1.1 million metric tonnes per annum of green ammonia by 2027, according to LSB.

Inpex’s blue ammonia project depends on tax credits, said Gonzalo Ramirez, vice president of clean ammonia for INPEX Americas.

“We need to wait a little bit to see what happens with 45V but we indeed are moving ahead. We have different phases right now in green. … Hopefully everything’s going to be favorable for all these production projects that we are developing,” Ramirez said.

RELATED

Despite Progress, Hydrogen Faces ‘Sobering Realities’

The Japan-based company is not only focused on regulatory frameworks in U.S. but also in Europe and Asia.

Plug Power, which runs fuel cell and energy businesses, is “cautiously optimistic” about the future of hydrogen given its bipartisan nature, said Sanjay Shrestha, president of Plug Power.

“I think we all as an industry need to educate this incoming administration and collaborate and make sure that the momentum that is already here continues,” Shrestha said, “and we can actually do the right thing from a national energy security perspective.”

If 45V is properly implemented, it could address some of the demand challenges, he said, which is another critical piece of scaling the sector. If the cost of renewable electricity decreases and companies secure the $3/kg PTC, the economic value proposition becomes more attractive for some of the industrial applications, he said.

“And then you’re no longer talking about 300 tons per day of liquid hydrogen market. Instead, you’re talking about going after 25,000 tons per day of the hydrogen opportunity,” Shrestha said, referring to opportunities to move from gray to green hydrogen in refining, ammonia and methanol applications.

Shrestha added that Plug Power is positive about the outlook “despite some of the gyrations we’ve seen in the last two years.” In addition to building fuel cell systems, the company manufactures electrolyzers, which uses electricity to split water molecules into hydrogen, as well as liquefaction technologies. The company also provides onsite storage and produces hydrogen from plants in Georgia, Tennessee and soon Louisiana—with another plant in the works in Texas.

Growing uncertainty

EDP Renewables isn’t in the hydrogen production business, but the renewable energy the company produces is crucial to the process.

“I think everybody looked at the U.S. as a very promising market to really develop renewable hydrogen projects and close the funding gap,” said Ana Quelhas, managing director of hydrogen for EDP Renewables. “The reality is that as the time goes by, the uncertainty is just growing and growing and growing, and now we’re at the point in time where there’s a big question mark with the implementation of the 45V. Obviously, that’s very bad for investors.”

The company’s hydrogen-related projects are more advanced in Europe, where policy is more robust with funding mechanisms and demand-side incentives.

“The certainty of the regulatory framework is providing us the ability to move forward with projects. Over there we have much more concrete projects much closer to get to final investment decision than here,” Quelhas said. “Having said this, the fundamental reason why we’re developing renewable hydrogen is there.

“There’s tremendous potential for the market in the United States in particular to be a very powerful economy when it comes to promoting renewable hydrogen. We’re just lacking now the visibility on the path forward.”

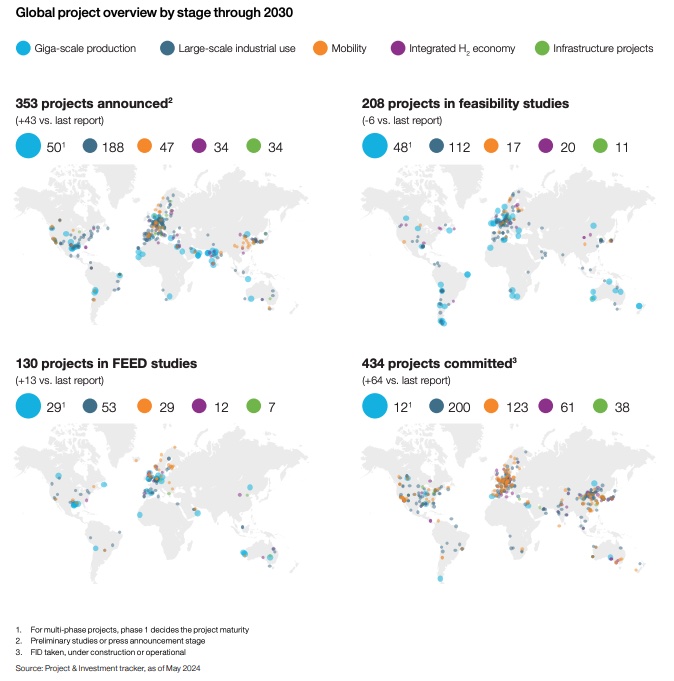

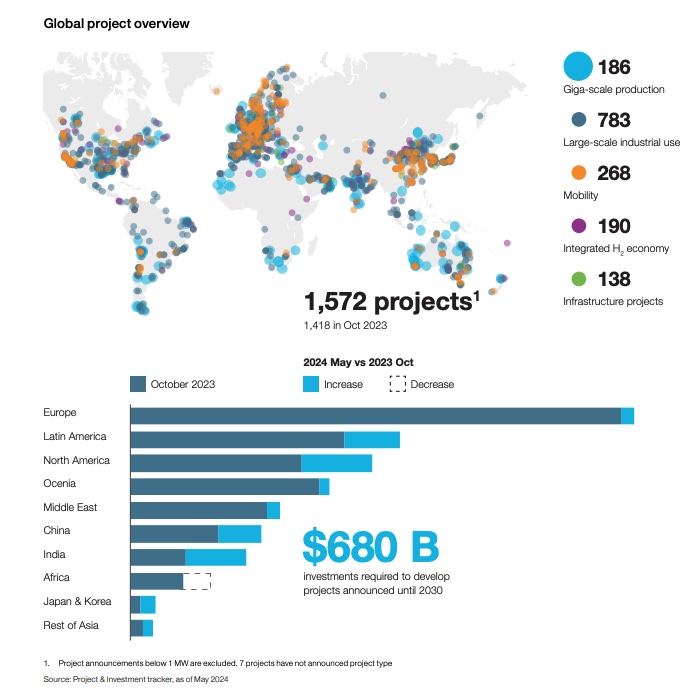

The Hydrogen Council reported in September that the number of clean hydrogen projects reaching FID is growing globally. In the joint report with McKinsey & Co. called Hydrogen Insights 2024, analysis showed clean hydrogen projects that reached FID and committed investment grew from about $10 billion across 102 projects in 2020 to about $75 billion across 434 projects in 2024.

“I think the entire industry, the entire value chain … is almost shovel ready and we’re eager to take FID on the projects,” Quelhas added. “We really need to be ready. It’s not if the opportunity will be there; it’s when the opportunity is there. And we have to work to make sure that when is sooner than later.”

Recommended Reading

Baker Hughes to Supply Multi-Fuel Gas Tech to TURBINE-X

2025-03-17 - Baker Hughes will provide TURBINE-X with its NovaLT gas turbine is capable of running on different fuels including natural gas, various blends of natural gas and hydrogen.

Element Six, Master Drilling Announce Tunnel Development Partnership

2025-02-19 - Element Six and Master Drilling will deliver a diamond-enabled solution designed to increase tunneling development speed, reducing costs and minimize the environmental impact of tunnel construction.

No Drivers Necessary: Atlas RoboTrucks Haul Proppant, Sans Humans

2025-03-04 - Atlas Energy Solutions and Kodiak Robotics have teamed up to put two autonomous trucks to work in the Permian Basin. Many more are on the way.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

New Era Helium, Sharon AI Cement Permian Basin Data Center JV

2025-01-21 - New Era Helium and Sharon AI have created a JV, Texas Critical Data Centers, and are working on offtake gas supply agreements and site selection.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.