U.S. natural gas storage. (Source: Shutterstock)

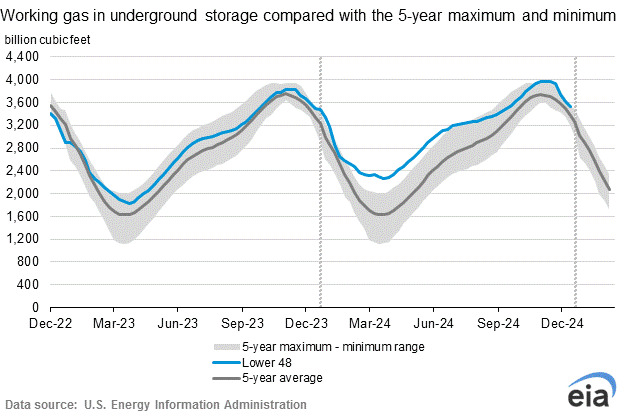

The U.S. Energy Information Administration (EIA) reported that the nation’s natural gas storage levels for the week ending Dec. 20 fell by 93 Bcf from the week before to a total of approximately 3.53 Tcf in storage.

Stocks of natural gas are currently 166 Bcf above the EIA’s five-year average and 14 Bcf above last year’s total.

Meanwhile, during the last full week of 2024, natural gas front-month futures at the Henry Hub remained at the highest levels in two years. During early trading, the Henry Hub price had fallen $0.04 to $3.68/MMBtu.

Henry Hub prices have been at or above $3.50/MMBtu since mid-December.

The EIA released the data on Dec. 27, a Friday, instead of the usual Thursday because of the Christmas holiday.

Recommended Reading

Energy Transition in Motion (Week of March 14, 2025)

2025-03-14 - Here is a look at some of this week’s renewable energy news, including a record-breaking year for solar capacity additions.

Energy Transition in Motion (Week of March 28, 2025)

2025-03-28 - Here is a look at some of this week’s renewable energy news, including another record for renewables power capacity growth.

Energy Transition in Motion (Week of Feb. 14, 2025)

2025-02-14 - Here is a look at some of this week’s renewable energy news, including a geothermal drilling partnership.

First Solar Continues to Ride Growth Streak Fueled by Incentives, Demand

2025-02-26 - First Solar ended 2024 with a contracted backlog of 68.5 gigawatts valued at $20.5 billion, having sold a record 14.1 GW of modules.

Solar, Clean Energy Face Headwinds Amid Post-Election Uncertainty

2025-01-22 - With a new Trump administration taking charge, renewable energy, including solar, may face headwinds that stagnate project development or continue it at a slower pace, analysts say.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.