In all, eight areas spanning just less than 15,000 acres offshore Massachusetts, New Hampshire and Maine were offered Oct. 29. (Source: Shutterstock)

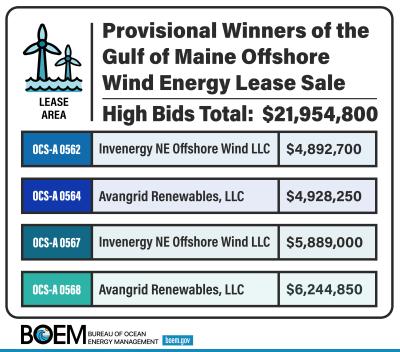

The first commercial U.S. lease sale for floating offshore wind in the Atlantic brought in nearly $22 million in winning bids, with two companies each winning a pair of leases, according to the U.S. Bureau of Ocean Energy Management (BOEM).

Avangrid Renewables and Invenergy each provisionally landed development rights during the Gulf of Maine offshore lease auction Oct. 29 after one round of bidding. The four lease areas have the potential to power more than 2.3 million homes, according to BOEM.

Total winning bids were far less than the $757 million garnered for five lease areas in late 2022 during the first U.S. Pacific offshore wind sale, another area ripe for floating wind. Just last month, BOEM postponed a lease sale offshore Oregon after it received bidding interest from only one of the five companies that qualified to participate.

Still, the latest sale results signal that some wind developers are willing to invest in the nascent floating offshore wind sector, even as the offshore wind sector continues to recover from costs, supply chain issues and other challenges that led to contract renegotiations and a few project cancellations in recent years.

“Today’s lease sale further opens the door for American floating wind leadership. This is a step to further developing and deploying innovative floating wind technology,” said National Ocean Industries Association President Erik Milito. “With floating wind, we can harness wind resources that were previously out of reach, positioning the U.S. as a global leader. Our expertise and workforce can be at the forefront of building the first generation of floating wind projects worldwide.”

In all, eight areas spanning just less than 15,000 acres offshore Massachusetts, New Hampshire and Maine were offered Oct. 29. The four leases with winning bids are located offshore Massachusetts, where Avangrid and partner Copenhagen Infrastructure Partners are building the 806-megawatt (MW) Vineyard Wind 1 project.

The U.S. is targeting 15 gigawatts (GW) of floating offshore wind capacity by 2035 and 30 GW of offshore wind capacity by 2030.

“With ten approved offshore wind projects capable of powering over 5 million homes, we are well on our way to a clean energy future,” said Secretary of the Interior Deb Haaland. “Today’s successful auction marks yet another critical step in our fight against climate change. Together, we can create good paying jobs, build a domestic supply chain and ensure that the momentum of this offshore industry continues for generations to come.”

Invenergy NE Offshore Wind was the high bidder for the 97,854-acre OCS-562 lease with its bid of about $4.9 million and the 117,780-acre OCS-567 lease with a bid of about $5.9 million.

Avangrid Renewables was the high bidder for the 98,565-acre OCS-564 lease with a bid of about $4.9 million and the 124,897-acre OCS-568 lease with a bid of about $6.2 million, according to BOEM.

“Securing these lease areas provides a unique opportunity to advance our growing business at a significant value, and reinforces our unwavering commitment to helping the New England region meet its growing need for reliable, clean energy,” Avangrid CEO Pedro Azagra said in a news release.

The leases also provide an opportunity for the companies to advance floating wind technology.

Most offshore wind fields utilize fixed-bottom turbine foundations attached to the seabed in shallow water. Deepwater wind developments, however, require turbines to be moored to floating structures.

In 2023, there was only about 270 MW of floating offshore wind operating capacity globally, according to the International Renewable Energy Agency. However, the global pipeline contained 244 GW of floating wind projects.

Recommended Reading

USD Completes Final Asset Sale of Hardisty Terminal

2025-04-13 - USD Partners was obligated to sell the Hardisty Terminal, in Alberta, Canada, after entering a forbearance agreement with its lenders on June 21 2024.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

BP Forecasts Dip in First-Quarter Upstream Production

2025-04-13 - BP anticipates a quarter-over-quarter decline in upstream production when it reports earnings later this month.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.