The Bakken and Niobrara are following the trend of many unconventional shale plays in the U.S.—costs are down, and thanks to the technology that’s continuing to evolve, production and completion efficiencies are up.

Only 10 fields in the world produced more than 1 million barrels a day (MMbbl/d) last year—and the Bakken Shale was one of them, said Jack Stark, COO and president of Continental Resources Inc., who spoke at Hart Energy’s DUG Bakken and Niobrara conference in March.

The Bakken averaged 1.1 MMbbl/d of production in 2016 between North Dakota and Montana, which Stark attributed to technology strides and greater understanding of the geology, adding there is more to come.

If the Bakken were a separate country, it would rank 19th in world production, Stark said.

“There are only 10 fields in the world that produce in excess of 1 million barrels per day, and the Bakken ranks among the top 25 largest oil fields in the world based on cumulative production—it has produced 2 billion barrels [Bbbl] to date,” he said.

To track the industry’s progress, Stark reviewed details of a presentation he gave in 2007. “What I was struck by is the success we’ve had as an industry in cracking the code in the Bakken—and we’re not done yet,” he said.

What Stark called “the compounding value” of transferring technology from one basin to another is but one great lesson from the Bakken Shale. It’s working in spades for Continental as the company celebrates its 50th anniversary this year.

Ten years ago, the initial Bakken wells were fracked with crosslinked gel, and only 10 to 20 frack stages in a typical stimulation. The average EUR was 335,000 barrels of oil equivalent (boe).

Today, Continental has transitioned to drilling much longer laterals, and it uses slickwater fracks with as many as 50 stages per well.

The average EUR is now 980,000 boe for the company.

The rest of the industry has moved forward in a similar fashion. Since 2005, North Dakota has seen a twelvefold increase in oil production, defining a whole new class of oil for the country, Stark said. In 2011, there were 12.7 Bbbl of estimated recoverable reserves in the Bakken, according to the North Dakota Industrial Commission.

Since Continental and others have entered the play, the geologic model has evolved with the Three Forks formation becoming more prominent. In 2008, the company drilled its first two Three Forks wells and was impressed enough with the results to continue drilling some step-out wells that confirmed the potential.

“What we did not know at the time was: Is this incremental oil we’ve found, or are we just tapping from the Bakken somehow?” Stark said. “In 2009, we drilled another Three Forks well, stimulated it and it flowed 1,000 barrels per day, and that essentially doubled our reserves for the field. We drilled other benches that tested nicely—we clearly had found a petroleum system all the way from the top of the Bakken down to the bottom of the Three Forks.”

In addition, technical advances have improved drilling times and oil recovery, he said.

Since 2011, Continental’s drilling times are 3x faster. “It’s everything—better bits, better mud motors, geosteering, all aspects, and also working with our service providers,” Stark said.

In 2014, Continental could drill a Bakken well in 17 days. “We thought we had the code cracked, and yet we weren’t even close. We thought we’d reached our technical limit, but our guys came to me and said, ‘No, we’ll take it on down to 11,’” Stark said.

Continental’s Bakken reserves per well have increased 3x, and costs are lower. The wells are also performing above the type curve, and Stark said the company is getting the same returns on its Bakken wells at $50 oil that it used to get at $80 oil.

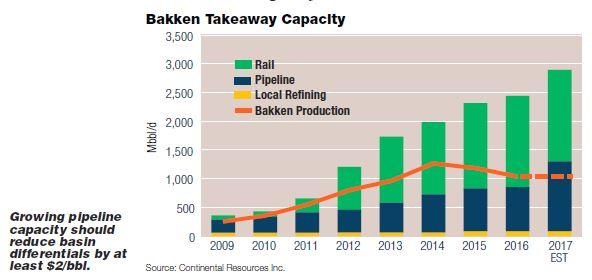

Bakken production could reach 1.08 MMbbl/d by year-end 2017 if the industry completes all the drilled but uncompleted wells (DUCs) and enough rigs are added, Stark said.

However, he warned: “without a rig increase, you won’t keep production flat.” Continental alone has 187 DUCs to complete.

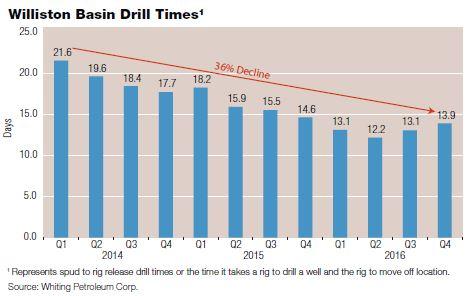

Technology is driving down drilling times.

Production momentum

Whiting Petroleum Corp. made a 10,000 boe/d, three-well pad in the Williston Basin and brought it online in February with IP rates averaging 3,509 boe/d per well. Jim Volker, chairman, president and CEO, revealed the details of the two-section Loomer 44-33 pad in a keynote speech at the DUG conference.

The Loomer TFH had an IP rate of 3,005 bbl of oil and 4.584 million cubic feet (MMcf) of gas, according to the North Dakota Industrial Commission, which removed the wells from confidential status. Loomer 2H had an IP rate of 2,585 bbl of oil and 3.691 MMcf of gas. Loomer TFHU tested 2,802 bbl of oil and 4.538 MMcf of gas.

The Loomer pad is in McKenzie County, N.D., and all three wells were drilled in December 2015. Proppant averaged 8.9 million pounds per well, Volker said.

“So, how’s it done? We’re super-fracking these wells,” he said.

Perforations in these two-section laterals are totaling about 1,680. “That’s 40 stages with an average of about 42 perforations per stage,” Volker said.

Sand averages 5,357 pounds per perforation, or about 900 pounds per lateral foot. Diverters are being pumped once or twice per stage, dividing the stages into two or three. “Thus, we’re getting great, homogenous frack jobs up and down the wellbore. That’s how it’s done,” he said.

Whiting has about 5,300 locations to drill in the basin, with about 4,800 of these in the core of the play. Of its 736,000 gross and 444,000 net Williston acres, 99% are HBP.

“We are well on our way to an over-1.5 million barrel EUR type curve,” Volker said. “We are very pleased with this. We think it is very indicative of what the industry can accomplish during tough times.

“You have more time to concentrate on being more efficient and getting the most bang for your buck. That certainly played out for us here with raising those EURs.”

These high-intensity completions in the basin are accomplished in seven to 10 days. Drill time has declined about 30% from 2014. Advancements in drillbits make them heat-resistant, and advancements in mud-motor technology have provided more torque. “So we’ve been able to really reduce the drill times, and I believe that trend will continue into 2018 and beyond,” Volker said.

Among 17 wells Whiting completed between December 2015 and November 2016, first-90-day rates have averaged more than 1,200 boe/d—or about 20% more than the next-highest IP rate producer with at least 10 completions online for at least 90 days in that time frame.

“We’ve been able to raise both our 60-day and 90-day rates more than 80% since December of 2014,” Volker added.

Properties that were sold carried lease operating expenses (LOE) between $15/bbl and $20/bbl. “We’re concentrating now in just the Bakken and Niobrara [in Weld County, Colo.] where LOE is only about $8 a barrel,” he said.

Of its 119,000 boe/d of net production, 91% is from the Williston Basin. The balance is predominantly from its Redtail play (157,000 gross acres, 132,000 net) in the Denver-Julesburg (D-J) Basin with wells landed in the Niobrara A, B and C and in the Codell.

There, it plans to complete 105 DUCs this year and test 50 frack stages rather than 40, and with 8 million pounds of sand per 7,500- foot lateral vs. 4.5 million. At this rate, the 105 completions would pump more than 800 million pounds of sand.

The company expects to produce about 40 MMboe this year and spend $1.1 billion in capex, with about 96% of that devoted to drilling and completion: $580 million in the Williston Basin (five rigs); and $420 million in the D-J Basin (one rig and 105 DUC completions).

Niobrara potential

Scott Reasoner, COO at PDC Energy Inc., said that the Denver-based company owns about 96,000 acres in the core of the company’s Wattenberg Field area in the Niobrara with estimated potential of about 1 Bboe. PDC increased reserves from a series of downspacing efforts and by identifying other productive zones.

“We feel like the rates of return here are competitive with any of the other plays in the basins in North America,” Reasoner said at the conference. “In the D-J Basin, it’s important to be in Wattenberg Field because the Niobrara isn’t the same everywhere.”

According to Reasoner, the Niobrara gas-oil ratio variation in the Wattenberg is critical, with varying liquids content across the core areas. The inner core area is about 45% gas and 55% liquids, making this the area with the highest GOR ratio.

Reasoner presented a gross EUR analysis of 2,500 wells in the Wattenberg Field core area. The inner core had a three-phase (P50) industry average of 600,000 boe, the middle core had 460,000 boe, and the outer core had 311,000 boe.

PDC is drilling long laterals with an average length of 7,000 feet that are tapping Niobrara A, B and C benches, as well as Codell. Its average stage spacing for fracturing went from 200 feet to 170 feet, which, according to Reasoner, has resulted in an approximate 30% increase in the production of the wells.

“We’ve also switched over from sliding sleeve to plug-and-perf, and we don’t plan to go back,” he said.

For 2017, PDC is planning to drill about 70% of the wells as medium- or extended-lateral ventures. He also noted that they are down to 1,100 pounds of proppant per foot and have decreased spud-to-spud drill times to 12 days for extended (2-mile long) laterals and seven days for 1-mile long laterals.

Reasoner also said that the company has tested 145-foot frack spacing with good results.

“If that’s successful, we may test 100-foot spacing this year,” he said.

Nick Spence, COO of development at SRC Energy, formally Synergy Resources Corp., said that SRC has about 60,000 acres, also in the greater Wattenberg area. Its contiguous acreage provides the company with the ability to drill longer laterals, which enhances the company’s economics.

“We can drill laterals that are about 1.5 to 2 miles long,” Spence said.

SRC’s 2017 development plans include drilling a gross of 68 (gross) mid-length laterals (up to 7,500 feet) and 34 long laterals (up to 10,000 feet) in the Greeley Crescent development area. The company also plans to complete 52 mid-length laterals and 43 long laterals (gross). According to Spence, it takes them about six to eight days to complete a mid-length well and seven to 10 days to complete a long lateral.

This year, they will have two operating pads, Bestway and Fagerberg. From their Evans pad where they are currently underway, there will be 22 wells drilled, 13 long laterals and nine extended-reach wells, which will have a length of up to 12,000 feet.

“Because the Niobrara is variable across the play, we plan to customize every frack stage according to what the rock tells us it needs,” Spence said.

Recommended Reading

Occidental to Up Drilling in Permian Secondary Benches in ‘25

2025-02-20 - Occidental Petroleum is exploring upside in the Permian’s secondary benches, including deeper Delaware Wolfcamp zones and the Barnett Shale in the Midland Basin.

Exxon Sits on Undeveloped Haynesville Assets as Peers Jockey for Inventory

2025-04-09 - Exxon Mobil still quietly holds hundreds of locations in the Haynesville Shale, where buyer interest is strong and inventory is scarce.

Early Innings: Uinta’s Oily Stacked Pay Exploration Only Just Starting

2025-03-04 - Operators are testing horizontal wells in less developed Uinta Basin zones, including the Douglas Creek, Castle Peak, Wasatch and deeper benches.

Antero Stock Up 90% YoY as NatGas, NGL Markets Improve

2025-02-14 - As the outlook for U.S. natural gas improves, investors are hot on gas-weighted stocks—in particular, Appalachia’s Antero Resources.

Oklahoma E&P Canvas Energy Explores Midcon Sale, Sources Say

2025-04-04 - Canvas Energy, formerly Chaparral Energy, holds 223,000 net acres in the Anadarko Basin, where M&A has been gathering momentum.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.