On July 12, the last date for the EIA’s report, the total amount in U.S. storage was 3.21 Tcf, 17% above the 5-year average. (Source: Shutterstock)

A high demand for power generation and production slowdown have kept summertime natural gas storage injections below the 5-year average, the U.S. Energy Information Administration (EIA) reported July 24.

Several natural gas producers curtailed production when Henry Hub prices fell beneath $2/MMbtu in February. However, overall U.S. production has remained flat for the year, at about 3.15 Tcf/m.

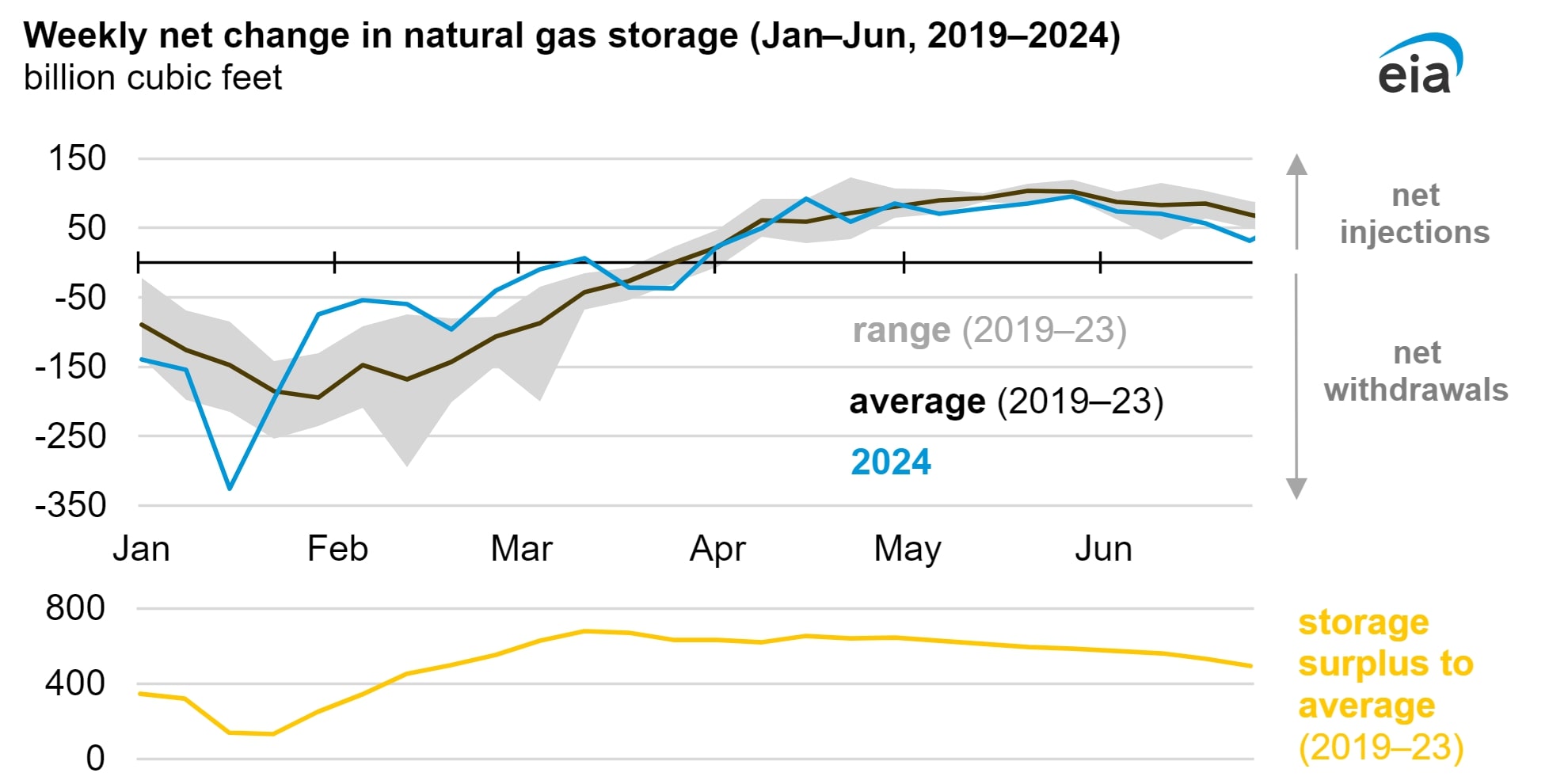

Since April, natural gas storage injections in the Lower 48 states totaled 950 Bcf, according to the EIA’s weekly report on July 18. The summer injection season is from April to the end of October. So far, the amount injected into storage has been 166 Bcf, or 15%, less than the average injection during the same time period from 2019 to 2023.

Gas storage levels remain high, thanks to record production levels in 2023 and a warmer-than-typical winter. Since February 2024, overall storage levels have exceeded the benchmarks set over the prior five years. On July 12, the last date for the EIA’s report, the total amount in U.S. storage was 3.21 Tcf, 17% above the 5-year average.

The primary difference for storage injections is natural gas consumption, which jumped by 3% in the second quarter of 2024, driven primarily by the need for power generation. The start of summer 2024 faced hot temperatures and cheap natural gas prices, making the commodity more appealing to utilities.

Another factor may have been a drop in the amount of wind energy available to the grid. Weather conditions in 2023 led to a decline in the amount of wind-generated electricity available for the first time since the 1990s, the EIA reported in April.

The same conditions may have continued into 2024. Reuters reported on July 24 that U.S. wind-produced power had fallen to a 33-month low.

Recommended Reading

Florida Fuel Distributors Palmdale, Combs Oil Merge

2025-01-08 - Palmdale Oil’s acquisition of Combs Oil Co. combines two Florida-based fuels and refined products distributors.

Energy Transfer’s Lake Charles LNG Closer to FID with Chevron Deal

2024-12-19 - Energy Transfer entered a 20-year agreement to supply Chevron with 2 mtpa of LNG from its Lake Charles LNG export facility, which is awaiting a final investment decision.

Martin Midstream Terminates Merger Agreement Following Pushback

2024-12-29 - Martin Midstream Partners will continue operating as a standalone publicly traded company following termination of its deal to merge with Martin Resource Management Corp.

Exxon Mobil Completes Purchase of FPSO Offshore Guyana

2024-12-19 - Exxon Mobil Corp. paid $535 million to SBM Offshore for the FPSO, which will operate the unit through 2033.

Allete Gets OK From FERC for $6.2B Sale to Canada Pension Plan, GIP

2024-12-20 - Allete Inc. announced its acquisition by the Canada Pension Plan Investment Board and Global Infrastructure Partners in May.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.