Infinity Natural Resources CEO Zack Arnold to Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas. (Source: Shutterstock.com)

Infinity Natural Resources' shares climbed more than 10% from the pre-trading price of $20 per share, giving a $52,700 per flowing boe/d public market valuation for its oily Utica and gassy Marcellus portfolio.

The private-equity-backed E&P’s shares opened at $22.16 Jan. 31, when trading began on the NYSE as INR at about 12 p.m. EST with an initial volume of 96,000 shares.

Volume by 1:20 p.m. totaled 2.8 million shares. The intraday high by that time was $23; the low, $22.

Shares at 1:20 p.m. traded at $22.38.

The price valued Morgantown, West Virginia-based Infinity at $52,700 per flowing boe/d for its third-quarter-end output of 25,000 boe/d, up from the Jan. 30 pre-trading offering price of $20 or $47,100 per flowing boe/d.

The Jan. 30 pricing raised $265 million and gave Infinity a $1.18 billion market cap. The $22.38 intraday price Jan. 31 made for a $1.32 billion market cap. Shares outstanding total 58.9 million.

Underwriters have the option of selling an over-allotment of up to 2 million shares in the first 30 days of trading.

The IPO is the first of a U.S.-focused E&P pureplay since Haynesville Shale-focused Vine Energy’s offering in 2021. It was bought later in 2021 by Chesapeake Energy, which is now Expand Energy.

BKV Corp., an integrated Barnett producer and electric utility, went public last September. An Australia-focused E&P, Tamboran Resources, IPO’ed with a U.S. listing last summer.

Hart Energy spoke with Infinity co-Founder and CEO Zack Arnold after trading began on Jan. 31. The stock was $21.81 just prior to market close with total volume of 4.7 million shares.

Pearl Energy Investments owns 49.3% of shares; NGP owns 16.4%. Arnold and Infinity CFO David Sproule each own 3%.

Nissa Darbonne: The stock’s off to a great start, Zack.

Zack Arnold: I think that's a sign that our advisers and [book-runners] Citi, RBC Capital Markets and Raymond James helped us price the deal correctly. We’re really excited about it.

ND: What are your next plans? You’re going to continue to drilling and completing more wells. But do you think you're going to buy some of the neighbors?

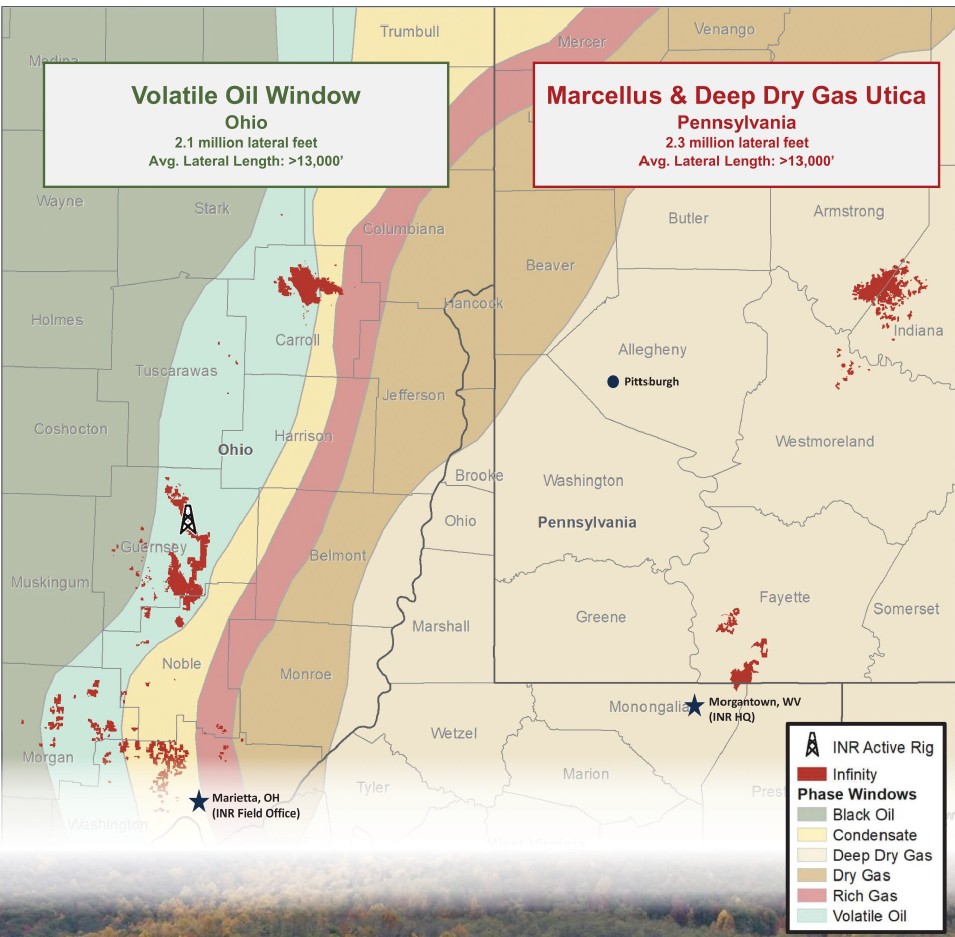

ZA: We have been active both in drilling and acquiring assets since our entry into the play. I think you should expect to continue to see us investing our energy in both fronts: executing our drilling and development in Ohio and in Pennsylvania as well as looking for other opportunities to augment our portfolio.

ND: In the roadshow and culminating with the pricing, did folks assign one value to your oily Ohio asset and a different value to the gassy Marcellus property and the $20 [per share] became the number they settled in on between the two?

ZA: I'm sure each individual investor thought about the value of those two assets and how the balance of assets we have compares us to other names, either in the [Appalachian] Basin or out-of-basin and reached a value expectation related to that.

But I don't have any transparency into the specific asset allocation that each investor was thinking about.

ND: About the neighbors again, will your D&C and acquisition focus be weighted to Ohio and oil? I haven’t seen Infinity adding gas property.

ZA: I think we'll continue to look in the entire basin, whether it's Ohio, Pennsylvania or northern West Virginia. When we find an asset that we think we can drive value with, we're going to chase it.

ND: Are you interested in adding property outside Appalachia?

ZA: An important part of the message we were delivering is that we are headquartered in Appalachia, our team is from Appalachia, and that's where we're going to focus all of our energy.

ND: Are you interested in putting your gas property on the market? It looks like the stock’s buyers were interested in how you have the two different phases: You can focus more or less on one or the other depending on which commodity is netting the best rate of return?

ZA: Yeah, I think the investors really liked that balanced story and the fact that we can develop high-quality gas assets or high-quality oil assets in the same basin with the same rig and the same team.

We could pivot very quickly from one commodity to the other.

Historically, we've done that. We're currently drilling and completing wells in Pennsylvania in our dry-gas window as well as drilling in Ohio.

ND: Your last reported boe/d was the 25,000 from third-quarter-end. Are you able to share what year-end 2024 boe/d was?

ZA: We haven’t disclosed that yet.

ND: We’ll find out in your fourth-quarter earnings report?

ZA: Yes.

ND: And your IPO’s process itself seemed to run right on schedule—just easy-breezy from filing the S-1 on Oct. 4 to pricing yesterday [Jan. 30] and within range and number of shares.

ZA: We had fantastic advisers at every level, whether it was Pearl, helping us think about how to put the business together to position for this; and Citi, Raymond James or RBC, helping us through the materials and with presenting the company and the assets to investors; and Kirkland & Ellis and Latham & Watkins, helping coordinate with the SEC.

We couldn't have done this on the timeline that we executed on if we didn't have the best advisors in the industry.

ND: Both oil and gas prices are strong right now. Was it just luck that you hit your IPO timeline in this bifecta of strong commodity prices? Or did you anticipate it?

ZA: I think it was less about trying to make sure every specific star was aligned and more about just knowing that you did all the work you could to present your story to the market.

There are things that are outside your control from the moment you launch. From the launch last Tuesday [Jan. 21] until the time we closed [Jan. 30], gas was down 22%.

So, while commodities have been supportive, there was definitely a little bit of a gust of headwind as we started this process.

RELATED

NatGas Prices, E&Ps Take a Hit from DeepSeeking Missile

ND: Who were some of the IPO’s buyers?

ZA: I can’t say. We’ll wait until they make their public filings.

But we’ve been very proud of the investor group that we put together. We have a good, solid book of balanced investors between great-quality, long-only names as well as best-in-class hedge funds.

ND: And what should Hart Energy’s readers know that we didn’t discuss here?

ZA: It’s important that I thank the folks that were part of it: Pearl and NGP; the underwriters, managers and co-managers; and the law firms.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.