The company has been authorized to list its shares on the New York Stock Exchange under the ticker symbol “INR.” (Source: Shutterstock/ Infinity Natural Resources)

Infinity Natural Resources is eyeing a potential market value of up to $1.2 billion through an IPO.

The Appalachia producer plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share, Morgantown, West Virginia-based Infinity Natural Resources said Jan. 21.

Underwriters will also have a 30-day option to acquire up to an additional 1.98 million shares. Citigroup, Raymond James and RBC Capital Markets are acting as joint book-running managers for the offering.

Infinity expects to generate approximately $268.8 million through the offering, assuming underwriters exercise their options to purchase additional shares. The company aims to use the proceeds to repay existing debt and for other general corporate purposes.

The company has been authorized to list its shares on the New York Stock Exchange under the ticker symbol “INR.”

The company is expected to officially price the offering on Jan. 30 before trading begins on Jan. 31, according to U.S. Securities and Exchange Commission data.

RELATED

Utica Oil E&P Infinity Natural Resources’ IPO Gains 7 More Bankers

Infinity is the latest energy company testing the public markets with an IPO. Last week, oilfield services firm Flowco Holdings listed its shares on the NYSE.

Shares for Flowco, a provider of artificial lift and production optimization services, are trading at around $30 per share after FLOC shares opened at a public purchase price of $24 per share on Jan. 16.

LNG developer Venture Global is aiming for a huge valuation of around $110 billion through an upcoming IPO.

Barnett Shale gas producer BKV Corp. successfully IPO’d in September 2024.

Energy stocks outperformed the S&P500 in 2021 (+2,560 bps) and 2022 (+8,200 bps), Pickering Energy Partners Founder Dan Pickering said in a Jan. 17 commentary.

But energy stocks underperformed the S&P 500 in 2023 (-2,700 bps) and 2024 (-1,890 bps).

RELATED

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

Ohio Utica

Infinity, which filed preliminary IPO paperwork with regulators in October 2024, is one of the top private producers from Appalachia’s Utica shale.

The company has a portfolio of 93,000 net surface acres across the volatile oil window of eastern Ohio and the dry gas play in southwestern Pennsylvania. Infinity also owns Marcellus dry gas assets in Pennsylvania.

Infinity initially focused on Appalachia’s Utica and Marcellus dry gas shale plays. It acquired its first Pennsylvania properties in March 2018 before expanding through a series of acquisitions.

But given low natural gas prices, most of the company’s current development focuses on the Ohio Utica oil window—near where EOG Resources, Encino Energy and Ascent Resources have drilled horizontal wells with oily results.

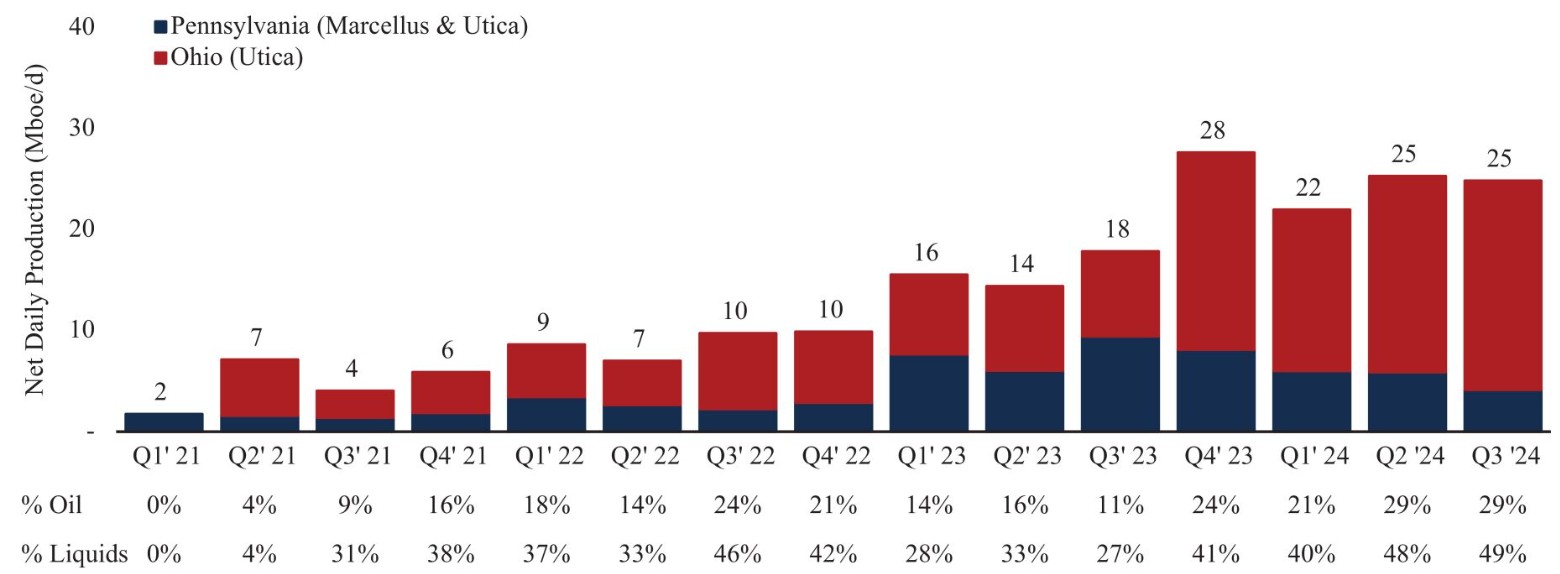

Infinity’s net daily oil production averaged 7,110 bbl/d during third-quarter 2024, up from around 2,000 bbl/d a year prior, according to investor materials.

The company’s total production averaged approximately 25,000 boe/d (29% oil, 49% liquids) during the third quarter.

Infinity operates in the core of the Ohio Utica oil window across Carroll, Tuscarawas, Harrison, Guernsey, Noble, Muskingum and Morgan counties, Ohio.

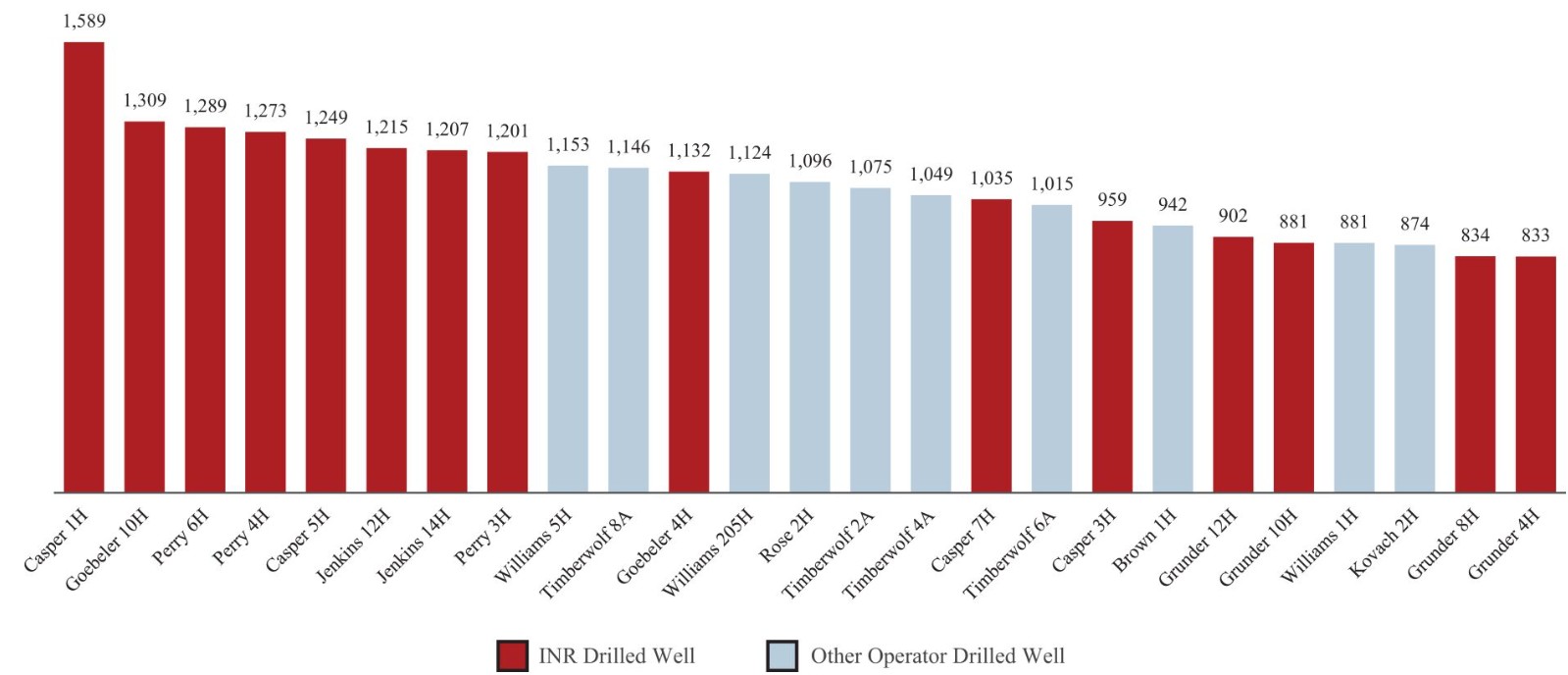

There were 208 wells drilled in the play between January 2021 and September 2024 with an IP-90 of 930 bbl/d normalized to a 15,000-ft lateral; Infinity’s Ohio Utica wells average 1,098 bbl/d.

Infinity has drilled 15 of the top 25 Utica horizontal wells in Carroll County, Ohio, since 2021, based on IP-90 rates.

CAPTION: INR has drilled the top eight wells drilled in Carroll County since 2021 based on IP-90 bbl/d rates, normalized to a 15,000-ft lateral. (Source: INR investor filings)

RELATED

Utica Oil E&P Infinity Natural Resources Latest to File for IPO

Recommended Reading

APA Reveals 2,700 bbl/d Test Results from Sockeye-2 in Alaska

2025-04-24 - APA Corp. said Sockeye-2, located in Alaska’s eastern North Slope, was drilled to a depth of approximately 10,500 ft and averaged 2,700 bbl/d during the final flow period.

Patterson-UTI Sees Uptick in Gas Activity, Oil Uncertainty

2025-04-24 - Natural gas activity picked up more than expected in the first quarter, with the Haynesville Shale leading the way, Patterson-UTI executives said.

Rhino Resources Makes Oil Discovery in Namibia’s Orange Basin

2025-04-24 - Rhino Resources’ Capricornus 1-X exploration well achieved a flow rate exceeding 11,000 bbl/d offshore Namibia.

Sabey Data Centers to Add Capacity in Washington State

2025-04-23 - The service provider Sabey Data Centers is expanding its operations in Seattle and East Wenatchee.

Scout Surface Solutions Acquires Kinetic to Expand Offerings

2025-04-21 - Scout Surface Solutions LLC is expanding its oil and gas services with the acquisition of Kinetic Pressure Control.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.