Under the terms of the farm-in, Vaalco will carry its partners at commercial terms through the seismic reprocessing and interpretation stages and potentially drilling up to two exploration wells. (Source: Shutterstock)

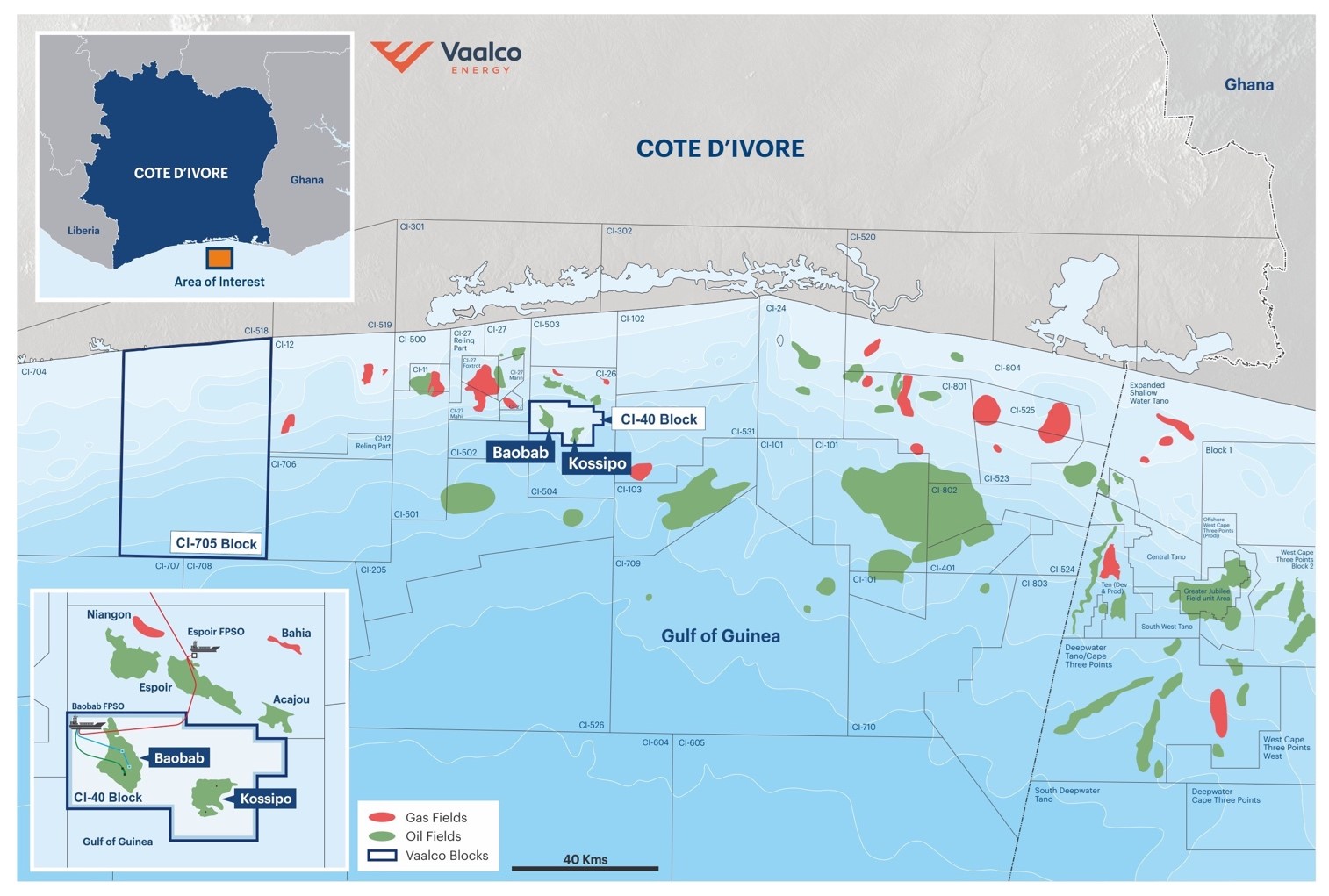

Vaalco Energy Inc. has farmed into West Africa’s CI-705 Block offshore Côte d’Ivoire, the company said March 3. Vaalco will become operator of the block with a 70% working interest and a 100% paying interest though a commercial carry arrangement and is partnering with Ivory Coast Exploration Oil & Gas SAS and PETROCI.

Vaalco invested $3 million to acquire its interest in the new block.

Block CI-705 covers approximately 2,300 sq km and is lightly explored with three wells drilled to date on the block. The water depth across the block ranges from zero to 2,500 m.

The CI-705 Block is located in the prolific Tano Basin and is approximately 70 km to the west of Vaalco’s CI-40 Block, where the Baobab and Kossipo oil fields are located, and 60 km west of Eni’s recent Calao discovery.

“We are very excited to expand our footprint offshore Côte d’Ivoire,” said Vaalco CEO George Maxwell. “When we announced our entry into country in 2024 as a non-operating partner in the CI-40 block, we noted our excitement to be expanding our West African focus in a well-established and investment-friendly country. We believe the CI-705 block is favorably located in a proven petroleum system, near existing infrastructure with access to a strong growing domestic market with attractive upside potential.”

Under the terms of the farm-in, Vaalco will carry its partners at commercial terms through the seismic reprocessing and interpretation stages and potentially drilling up to two exploration wells.

“Our initial assessment is that there are both oil and natural gas prospects on the block and we plan to conduct a detailed, integrated geological analysis to assess and mature our understanding of the block’s overall prospectivity,” Maxwell said. “We have demonstrated our ability to acquire, develop and enhance value with the accretive acquisitions we have executed in the past. We are also excited about the major projects that we have planned in 2025 and 2026, which are expected to deliver a step-change in organic growth across our portfolio. We are pleased to have yet another opportunity to add value and runway for Vaalco’s future.”

Recommended Reading

What's Affecting Oil Prices This Week? (March 24, 2025)

2025-03-24 - Oil demand will be picking up as we move into warmer months for the northern hemisphere. For the upcoming week, Stratas Advisors think the price of Brent crude will move higher and will test $73.

Oil Dives More Than 6%, Steepest Fall in 3 Years on Tariffs, OPEC+ Supply Boost

2025-04-03 - Oil prices swooned on April 3 to settle with their steepest percentage loss since 2022, after OPEC+ agreed to a surprise increase in output the day after U.S. President Donald Trump announced sweeping new import tariffs.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

What's Affecting Oil Prices This Week? (April 7, 2025)

2025-04-07 - From an upside perspective – a favorable resolution of the tariffs will push the price of Brent crude to $75 and the price of WTI to $70.

What's Affecting Oil Prices This Week? (Jan. 27, 2025)

2025-01-27 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will threaten $75.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.