LNG exporter Venture Global nearly halved the price per share, while increasing the number of shares it expects to offer. (Source: Shutterstock.com, Venture Global)

U.S. LNG exporter Venture Global is expecting a smaller raise Jan. 23 in pricing its IPO, according to an updated Securities and Exchange Commission filing.

The Arlington, Virginia-based company’s Jan. 13 expectation was to sell 50 million Class A shares at between $40 and $46 each. An update on Jan. 22 is for selling 70 million shares at between $23 and $27 each.

The overallotment was revised to 10.5 million shares, up from 7 million.

Venture Global’s enterprise value will be $65 billion if the top price is achieved Jan. 23, according to Reuters. Initially, the company had targeted a valuation of $110 billion.

The stock, which is to be listed on the New York Stock Exchange under the ticker symbol “VG,” is expected to begin trading Jan. 24.

The IPO’s bookrunners and co-managers total 21, including Goldman Sachs, J.P. Morgan and BofA Securities.

New plant

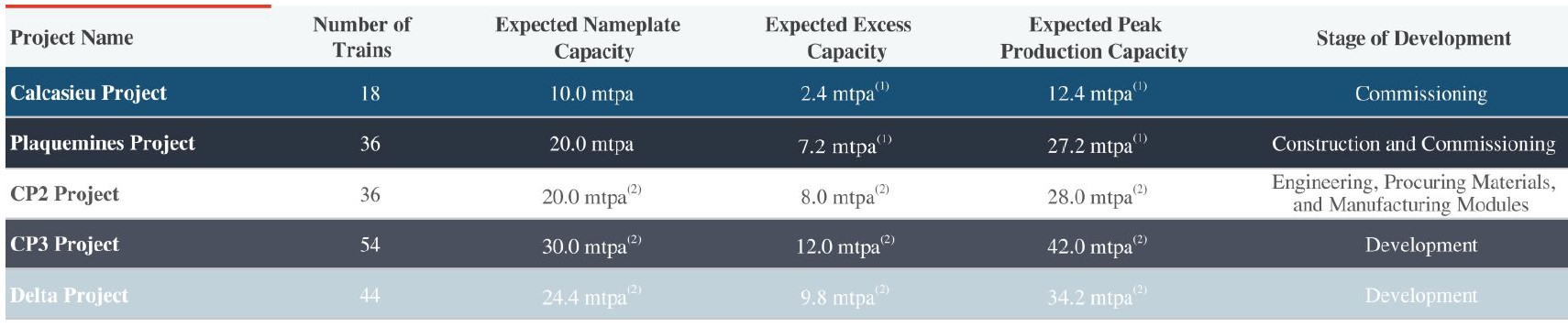

Venture Global’s S-1 was originally filed Dec. 20, just as Venture Global’s second plant—Plaquemines on the Mississippi River south of New Orleans—began loading a first tanker, Venture Bayou.

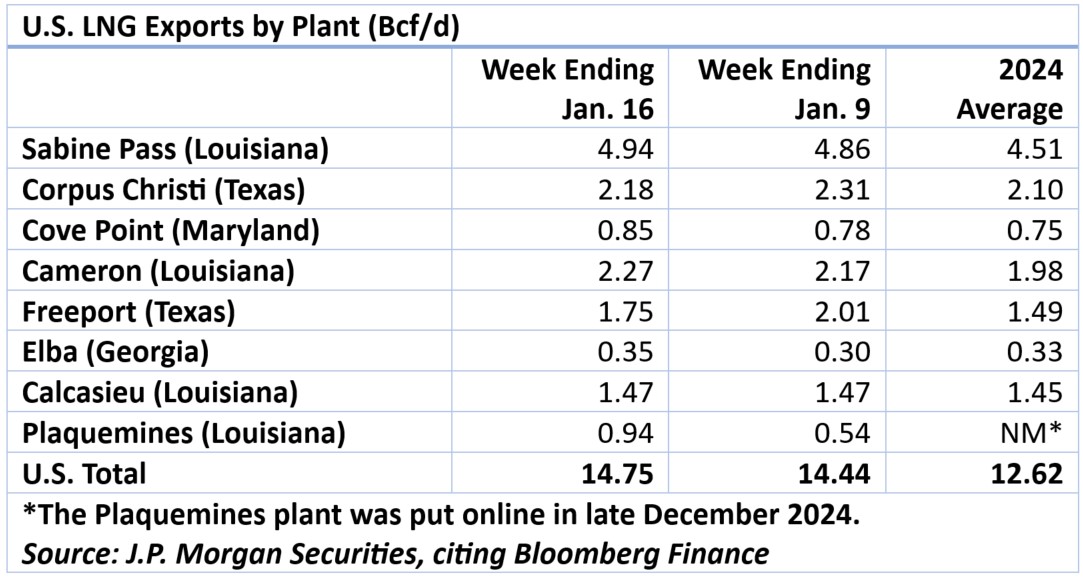

Last week, its average output was 940 MMcf/d, according to J.P. Morgan Securities analyst Arun Jayaram, citing Bloomberg Finance data.

The production was part of the 14.75 Bcf/d of LNG shipped from U.S. export plants that week.

At press time, the Umm Chugwailina has been moored at the plant since Jan. 18.

The Port of New Orleans closed Jan. 19 as the approaching Winter Storm Enzo dropped snow and icy road conditions along the U.S. Gulf Coast. The port expects to reopen Jan. 24, according to its website.

Another LNG tanker, Diamond G Metropolis, was anchored at the river’s mouth, waiting for Umm Chugwailina to exit.

98% voting power

Venture Global Partners II, which is controlled by the LNG operator’s cofounders—energy banker Michael Sabel and attorney Robert Pender—will have 98% of voting power post-offering, according to the S-1.

Sabel and Pender control Venture Global’s Class B shares.

PIMCO (Pacific Investment Management Co.) owns 93.1% of the company’s Class A shares. Its post-offering voting power is expected to be 1.8%.

Class A shares will have one vote each, while Class B shares will have 10 votes each, according to the S-1.

Recommended Reading

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

Exclusive: Metal Tariffs Unlikely to Disrupt Lower 48 Supply Chain

2025-03-25 - With tariffs discussions creating uncertainty in the energy sector, Luca Zanotti, Tenaris’ U.S. president, said he sees minimal impact with tariffs on oil country tubular goods, in this Hart Energy exclusive interview.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Petrobras to Deploy Baker Hughes Completion Technology Offshore Brazil

2025-03-20 - Baker Hughes will be combining its completions technologies with conventional upper and lower completions solutions at Petrobras’ offshore developments.

E&P Highlights: March 17, 2025

2025-03-17 - Here’s a roundup of the latest E&P headlines, from Shell’s divestment to refocus its Nigeria strategy to a new sustainability designation for Exxon Mobil’s first FPSO off Guyana.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.