Verdun Oil has amassed over 285,000 net acres across the Eagle Ford trend and the Giddings Field. (Source: Shutterstock.com)

Growing in the oil and gas business might seem a battle of inches, like slogging through the sodden trench warfare in the hills of Verdun in World War I. It seemed that way to the founders of Verdun Oil Co., so the name stuck.

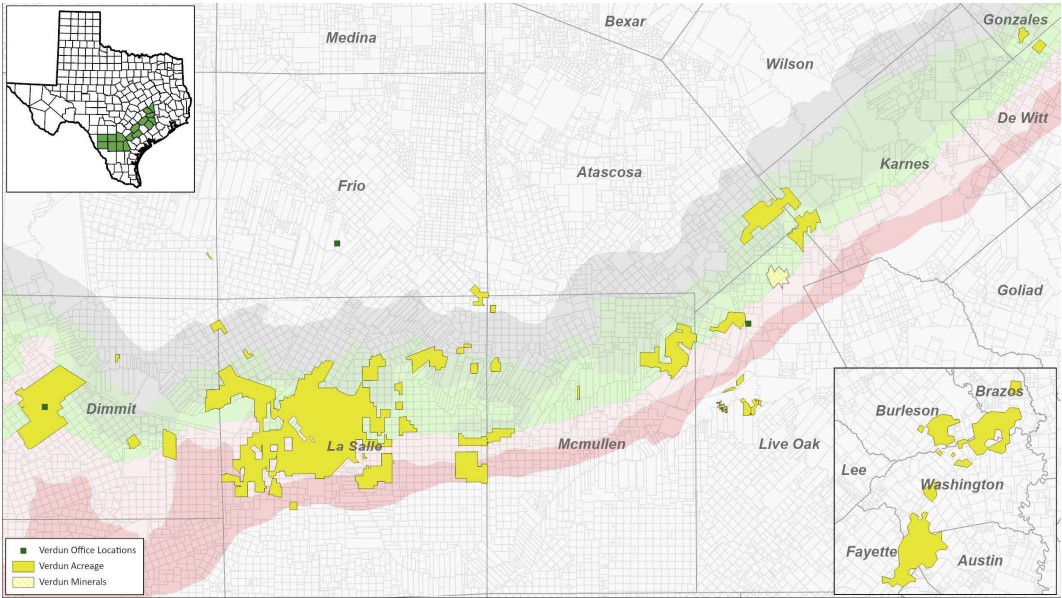

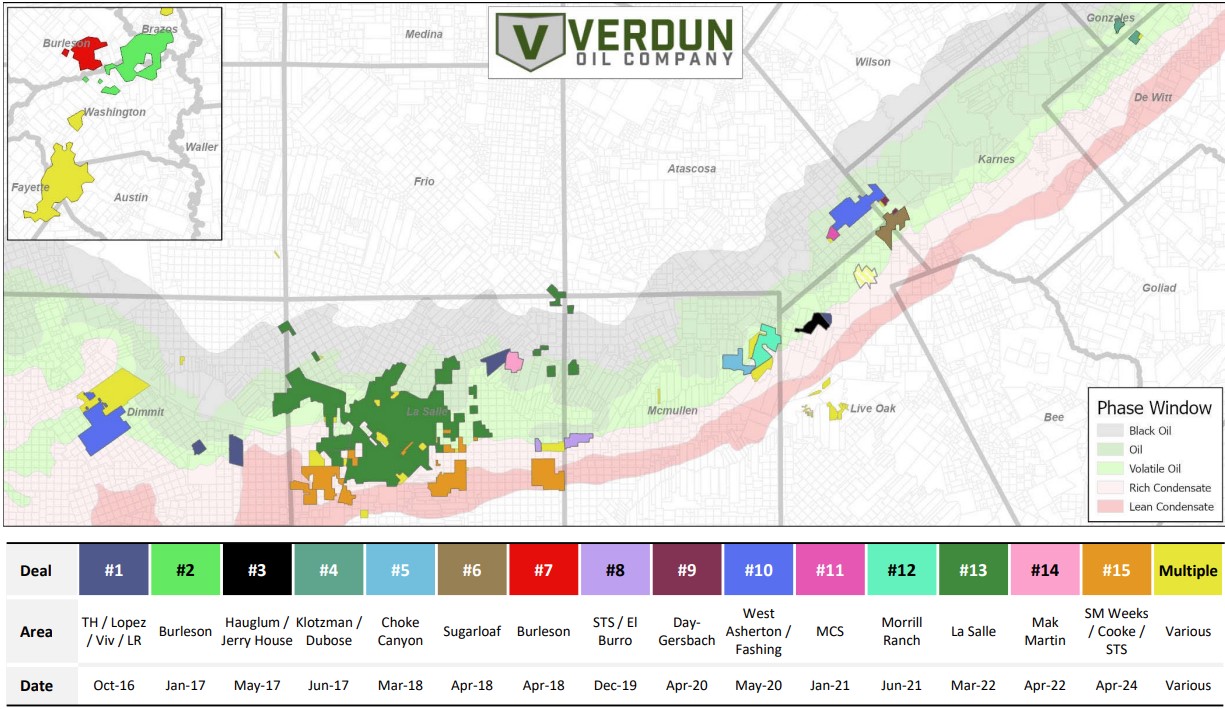

But Verdun Oil’s battleground isn’t in northern France—it’s in South Texas, where the EnCap-backed producer has fought to grow a position in the Eagle Ford and Austin Chalk plays since launching in 2015.

Today, Verdun is among the largest private producers remaining in South Texas, with more than 285,000 net leasehold acres (97% operated) and an output of 90,000 net boe/d (55% oil, 80% liquids). But even with thousands of gross locations at its disposal, the company is going over old ground to pursue refrac opportunities.

The company anticipates production rising above 100,000 net boe/d after Verdun brings online some curtailed dry gas production later this year and into 2025.

Verdun holds more than 230,000 net acres in the Eagle Ford trend and another 55,000 net acres in the Giddings Field.

And as public E&Ps search for future drilling runway, experts say Verdun Oil sticks out as a compelling target for acquisition by a larger Eagle Ford player.

“We’ve grown very large over the last nine years,” Verdun Oil CFO Daniel Savitz said Aug. 20 during the 2024 EnerCom Denver conference. This year the company expects “over $1.2 billion of operating cash flow and a capital budget of just under $500 million.”

It’s a far cry from Verdun’s humble beginnings: four guys in a room, with backgrounds coming from Hilcorp Energy, EOG Resources and ConocoPhillips. Today, Verdun employs a small army of around 250, including just over 100 based in its Houston office.

RELATED

Baytex Energy Joins Eagle Ford Shale’s Refrac Rally

Try again

Verdun has room to run in South Texas. The company has identified 1,090 gross drilling locations across its portfolio based on a two- to three-rig cadence—734 in the Eagle Ford, 356 in the Austin Chalk.

Refracs are another big story for Verdun: The company has identified approximately 700 well candidates suitable for recompletions, Savitz said.

“That’s an ongoing effort at our shop to evaluate existing wellbores and to see where we have the opportunity to increase production,” he said.

A growing number of producers in the Eagle Ford are leaning into refracs, re-entries, recompletions and other re-do jobs to breathe new life into declining wells with modern drilling techniques.

Refracs are a hot topic right now in mature shale plays such as the Eagle Ford and the Bakken.

For Verdun, refracs are old news. The company started developing its refrac strategy around 2018, when Verdun completed what is says was the first full linear isolation refrac performed in the Eagle Ford trend.

Refracs have been a consistent part of Verdun’s development strategy since.

Verdun believes recompletion projects can add net incremental reserves of 193 MMboe to its portfolio. The wells identified for recompletion projects have an average lateral length of 6,000 ft.

Verdun looks for a list of criteria when evaluating refrac candidates. A key question in that process: When was this well completed?

Eagle Ford horizontals completed before about 2016 tend to rely on antiquated completion techniques and liberal spacing with offset wells, Savitz said.

“Today, we’re right at 100 refracs performed,” Savitz said. The company has gained “a lot of institutional knowledge on what works and what doesn’t work, so it’s going to be a key part of what we do doing forward.”

RELATED

Where, When and How to Refrac—Weighing All the Options

South Texas M&A

Operators are scrambling across U.S. shale plays to buy up the highest quality inventory—lest their competitors get their grimy hands on them.

Over the past year, much of the dealmaking has happened in the Permian Basin, the nation’s top oil producing basin.

A growing list of Permian E&Ps have been acquired over the past two years, the largest of which were Pioneer Natural Resources, Endeavor Energy Resources and CrownRock LP (Diamondback Energy’s $26 billion acquisition of Endeavor is pending regulatory review).

But asking prices for Permian acreage, assets and mineral interests are sky high right now, leading some operators to look in lower-cost basins for incremental drilling runway.

Experts say the flight from high Permian prices could cause an uptick in Eagle Ford and Bakken deals.

Verdun Oil and WildFire Energy, backed by Kayne Anderson and Warburg Pincus, are two institutionally backed E&Ps that could be sellers in the Eagle Ford, Enverus Intelligence Research said in a second-quarter upstream M&A report.

Verdun put its own massive land position together through a series of transactions—more than 15 since inception. That includes a transformational acquisition of EP Energy’s South Texas properties completed in 2022, Savitz said.

After emerging from bankruptcy in 2020, EP Energy’s new owners sold the company’s assets in South Texas and Utah to EnCap for $1.5 billion. Verdun later sold the Uinta Basin assets in Utah to Crescent Energy and retained EP’s Eagle Ford property.

EnCap has sold billions of dollars’ worth of upstream investments in the Permian and the Bakken in recent years. With Verdun approaching a decade in the market, could EnCap look to sell the Eagle Ford operator?

“Really, whatever we decide to do with this business, we have options,” Savitz said. “We have a lot of runway.”

RELATED

Industry Consolidation Reshapes List of Top 100 Private Producers in the Lower 48

Recommended Reading

ChampionX’s Aerial Optical Gas Imaging Platform Secures EPA Approval

2025-03-05 - ChampionX Corp.’s aerial optical gas imaging platform combines optical technology with a gimbal system to detect and locate methane leaks.

Baker Hughes, Woodside Partner to Scale Net Power Platform

2025-03-06 - Net Power’s platform uses natural gas to generate power while capturing nearly all CO2 emissions, Baker Hughes said in a news release.

Equigas, CO2Meter to Partner in Offering Gaslab Detection Devices

2025-02-14 - The devices are used in industrial operations to monitor gas leaks and maintain air quality and safety compliance.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.