Canada’s Vermilion Energy Inc. will acquire Westrbrick Energy’s Alberta Deep Basin assets, including 700 locations, for CA$1.075 billion.

Canada’s Vermilion Energy Inc. has entered into an agreement to acquire gas-heavy production and assets from privately held Westbrick Energy Ltd. for CA$1.075 billion ($US746 million), Vermilion said Dec. 23.

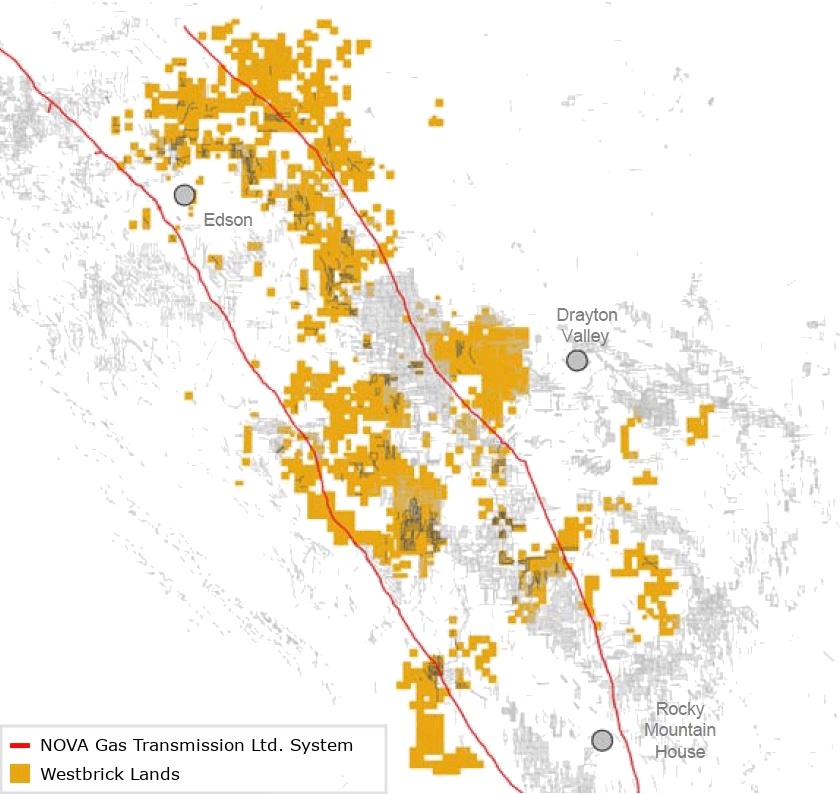

Vermilion said it will acquire Calgary, Alberta-based Westbrick’s portfolio of Alberta Deep Basin assets, including more than 700 drilling locations and 50,000 boe/d (75% gas, 25% liquids) and four operated gas plants with 102 MMcf/d of capacity.

Vermilion will acquire 770,000 net acres of land, although the deal excludes undeveloped Duvernay rights on approximately290,000 net acres retained by Westbrick shareholders.

"The strategic acquisition of Westbrick represents a significant step forward in Vermilion's North American high-grading initiative to increase operational scale and enhance full-cycle margins in the liquids-rich Deep Basin," Dion Hatcher, president and CEO of Vermilion, said in a press release. "The Deep Basin is an area Vermilion has been operating in for nearly three decades and is currently the largest producing asset in the Company.”

The acquired inventory provides enough runway to keep production flat for more than 15 years while generating significant free cash flow to enhance the company's long-term return of capital framework, Hatcher said.

At closing, Vermilion will average production of approximately 135,000 boe/d, with greater than 80% of its production derived from its global gas franchise. The company’s assets include liquids-rich gas in Alberta and British Columbia and gas-weighted production in Ireland, Germany, Netherlands and Croatia.

Vermilion said it’s significant debt reduction—totaling more than $1 billion since 2020—created balance sheet capacity to execute the deal. The company said the acquisition will yield a 15% increase in excess free cash flow per share in 2025.

The acquisition will be funded through Vermilion's undrawn CA$1.35 billion (US$ 936 million) revolving credit facility.

TD Securities Inc. is acting as exclusive transaction financial adviser to Vermilion. Dentons Canada LLP is acting as legal counsel to Vermilion.

RBC Capital Markets and Scotiabank are acting as joint financial advisers to Westbrick and Osler, Hoskin & Harcourt LLP as legal counsel.

Recommended Reading

Q&A: Patterson’s OFS Perspective on the Shale Boom, Pandemic and Current Upswing

2025-02-27 - Former Basic Energy Services CEO Roe Patterson details his perspective on the shale boom and the lessons learned to get back to the current upswing in the industry.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.