Vermilion Energy Inc. recently agreed to acquire Leucrotta Exploration Inc. for a net cash purchase price of CA$477 million, expanding the company’s position in the Montney Shale play.

“The Leucrotta acquisition is an important component of our strategic plan as it is a scalable asset and is expected to provide us with 20+ years of high value Tier 1 drilling inventory,” Vermilion President Dion Hatcher commented in a release by the Calgary, Alberta-based company on March 28.

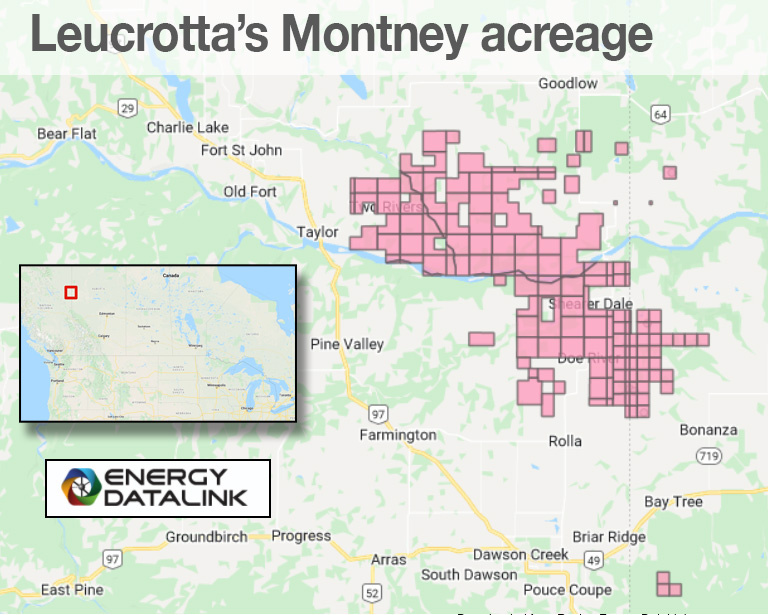

Leucrotta is a Canadian publicly listed Montney-focused oil and natural gas exploration and development company with lands located in the Mica area of Northeast British Columbia and Northwest Alberta. Vermilion’s acquisition of Leucrotta follows an agreement to acquire Equinor Energy Ireland Ltd. last November for CA$556 million (US$434 million).

The acquisition of Equinor Energy Ireland will add to Vermilion’s holdings in the Corrib gas field off the northwest coast of Ireland, which Hatcher said increases the company’s European gas exposure while also accelerating its debt reduction.

“With the successful completion of both deals, our $1 billion debt reduction target should be achieved by the end of this year, three years ahead of schedule, with a corresponding forecast net debt to FFO ratio of 0.4x which is well below our target range of 1.5x,” he said.

“In fact,” he continued “by the end of 2023, at current strip prices, Vermilion is projected to be net debt free. By the end of this year, we expect to have achieved our key near-term strategic objectives, and most importantly, we did so without the issuance of any additional shares which maximizes the free cash flow for our shareholders and eliminates any potential dilution.”

The Leucrotta acquisition is expected to close in the second half of May. The Corrib acquisition is set to close during the second half of 2022.

Under the arrangement for the Leucrotta acquisition, Vermilion will acquire all of the issued and outstanding Leucrotta shares for cash consideration of CA$1.73 per share.

After spending over two years evaluating the Leucrotta asset and other assets across the Montney fairway, Vermilion’s team has developed a deep technical understanding of each zone within the Montney, according to the company release.

The primary Leucrotta asset is the Mica property, comprised of 81,000 gross (77,000 net) contiguous acres of Montney mineral rights in the Peace River Arch straddling the Alberta and British Columbia borders. The asset is forecasted to produce approximately 13,000 boe/d in 2023, with anticipated capacity to grow to a sustainable plateau production base of 28,000 boe/d over the next few years.

The Vermilion team said it has conservatively identified 275 multi-zone, extended reach, drilling prospects to date, representing an expected two decades or more of low-risk, self-funding, high-deliverability drilling inventory with strong rates of return.

Vermilion is increasing its 2022 E&D capital budget to $500 million and increasing its annual production guidance to 86,000 to 88,000 boe/d to account for the Leucrotta acquisition, assuming the anticipated May closing date.

As part of the acquisition arrangement, a portion of the Leucrotta land base and approximately CA$43.5 million of cash will be transferred to a new company which will be managed by the existing Leucrotta team.

CIBC Capital Markets serves as exclusive financial adviser to Vermilion with respect to the Leucrotta acquisition. Torys LLP acted as legal counsel to Vermilion.

Recommended Reading

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Riverstone’s Leuschen Plans to IPO Methane-Mitigation-Focused SPAC

2025-01-21 - The SPAC will be Riverstone Holdings co-founder David Leuschen’s eighth, following the Permian Basin’s Centennial Resources, the Anadarko’s Alta Mesa Holdings and the Montney’s Hammerhead Resources.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.