Viper Energy has entered into a definitive purchase agreement to buy mineral and royalty interests from Morita Ranches Minerals LLC in a cash-and-equity deal valued at about $330 million. (Source: Shutterstock, Viper Energy)

Viper Energy has entered into a definitive purchase agreement to buy mineral and royalty interests from Morita Ranches Minerals LLC in a cash-and-equity deal valued at about $330 million.

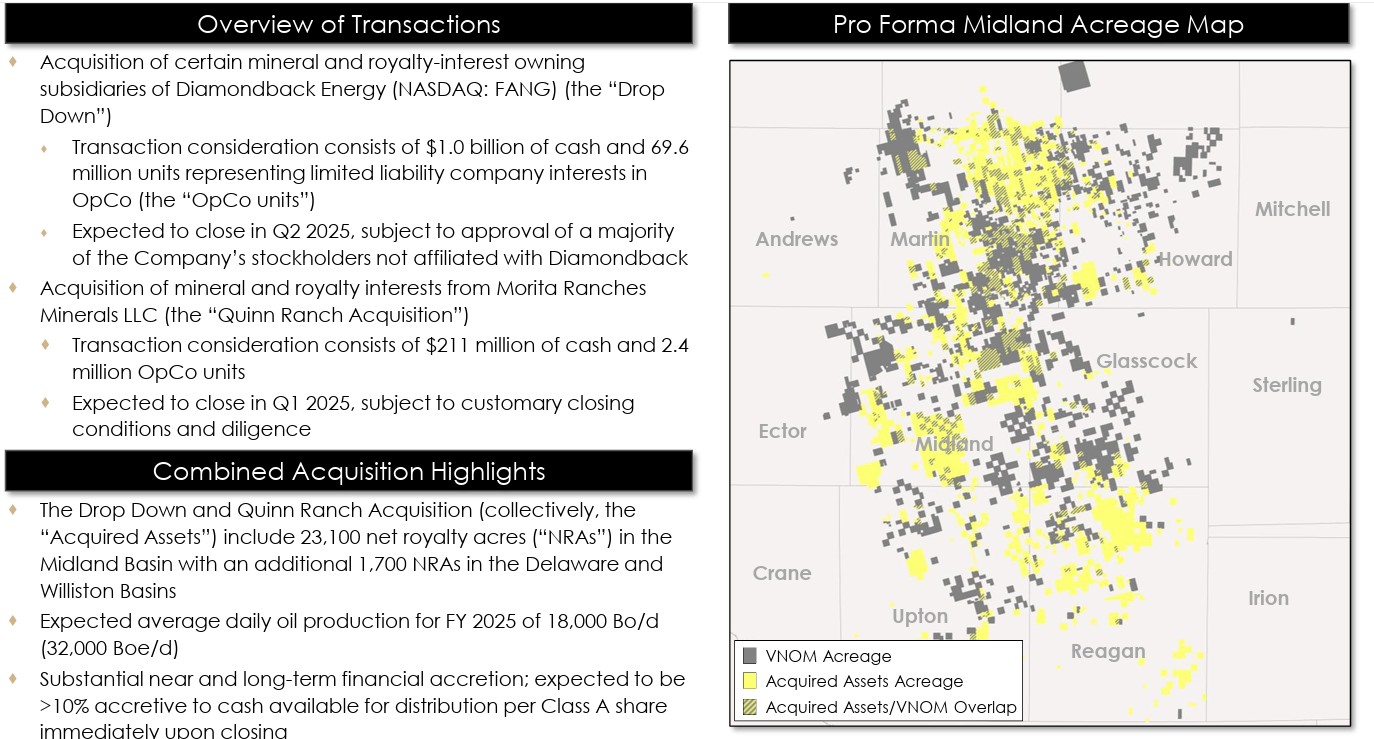

Viper will acquire interests in approximately 1,691 net royalty acres located in the Midland Basin’s Howard County, Texas, from Morita in what it called the “Quinn Ranch Acquisition,” according to a Securities and Exchange Commission filing.

Viper announced the deal Jan. 30 alongside its $4.45 billion dropdown from Diamondback Energy. Viper is a subsidiary of Diamondback Energy.

David Deckelbaum, managing director at TD Cowen, told Hart Energy the Diamondback dropdown to Viper is essentially a form of capital structure arbitrage. He compared it to deals in the past by MLPs designed to unlock value.

“MLPs traded 12x, your upstream company trades at 5x, so you drop down all your midstream assets to the MLP” to get a multiple better than the core business.

However, he said the current environment has made such deals outsized as the scales of the companies involved has become so vast.

“A drop down should not be a $5 billion transaction,” he said.

In a Jan. 31 report, Deckelbaum said that assuming the announced 32,000 boe/d (~56% crude) and a $70 WTI price deck, “we calculate roughly $520 [million] of 25E EBITDA translating to an 8.5x multiple on the deal vs our current 25E FANG EV/EBITDA multiple of 5.5x.”

“Viper also notes future upside with FANG completing 300-325 gross locations on the acquired acreage at an estimate 6% NRI, which is expected to drive FANG-operated production from an average of 11 MBD in 2025 to 14 MBD in 2026.”

The deal also gives Diamondback, which will receive $1 billion in cash from Viper, some cushion ahead of potential share sales related to its $26 billion acquisition of private Midland Basin producer Endeavor Energy Resources, which closed in September.

“While the issued shares give FANG plenty of flexibility to lean into insider sales when necessary, the deal also serves as a cash buffer ahead of any potential share sales related to the Endeavor acquisition,” Deckelbaum wrote. “Recall, over 13.2 [million] shares ($2.3bn) issued for the Endeavor acquisition were sold in September 2024. As a result of the sale, related shareholders entered into a 170-day lock-up period, opening a window for the next potential sale beginning in March.”

Viper gave additional production guidance related to the Morita/Quinn acquisition and Diamondback dropout.

At closing, of the Quinn Ranch acquisition, Viper said its guidance for the first quarter oil production would average 30,000 bbl/d to 31,000 bbl/d (54,000 boe/d to 56,000 boe/d).

Provided the Diamondback dropdown closes by the second quarter, Viper’s average daily production will range between 47,000 bbl/d to 49,000 bbl/d (85,000 boe/d to 88,000 boe/d).

At the midpoint of guidance, Viper’s daily oil production will be 61% higher than the company’s fourth-quarter 2024 oil volumes, the company said.

Viper will acquire the Morita interests in exchange for $211 million in cash and approximately 2.3 million units. Based on the $49.55 per share 30-trading day average sales price of Viper’s common stock, the units are worth $118.9 million.

Viper will fund the cash portion of the deal through a combination of cash on hand and borrowings under the company's credit facility. The transaction is expected to close in first-quarter 2025, subject to customary closing conditions.

Truist Securities analyts said the Morita acquisition adds “even more core inventory.”

Combined with the Diamondback dropdown, “While we view the deals as positive given the appropriate value for significant core assets, our price target [for Viper] declines to $68 from $78 due to more equity and slightly lower production than we had estimated,” Truist analyst Neal Dingmann wrote in a Jan. 31 report.

Akin Gump Strauss Hauer & Feld LLP is serving as Viper’s legal adviser, and Vinson & Elkins LLP is serving as legal adviser for Morita Ranches Minerals LLC.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.