Vista Energy, one of the top producers in Argentina’s Vaca Muerta shale play (pictured), aims to grow larger through M&A. (Source: Shutterstock.com)

Vista Energy is ramping up oil and gas production from Argentina’s prolific Vaca Muerta Shale amid a competitive landscape for M&A, CEO Miguel Galuccio said.

Vista is Argentina’s second-largest oil and gas producer, ranking behind state-owned oil company YPF.

As competition to purchase U.S. shale assets heats up, analysts say producers are weighing their options in international shale plays, like Argentina’s Vaca Muerta or Canada’s Montney Shale.

Competition for assets within Argentina is intense, Galuccio said during Vista’s second-quarter earnings call on July 12.

U.S. supermajor Exxon Mobil Corp. is reportedly exploring a $1 billion sale of its shale assets in the Vaca Muerta play. Galuccio said Vista is participating in Exxon’s Argentina divestment process.

“I think we are a competitive bidder,” Galuccio said during Vista’s earnings call. “It’s a very competitive process.”

Exxon was granted a 35-year concession in Vaca Muerta for the Bajo del Choique-La Invernada Block by the Neuquén provincial government in 2015.

The concession includes a 99,000-acre block located around 58 miles northwest of Añelo and 114 miles northwest of Neuquén city.

Across its Argentina portfolio, Exxon held 2.9 million net acres as of year-end 2023, 2.6 million of which were offshore.

Exxon completed 4.4 net development wells within Argentina in 2023, per regulatory filings. The company began the process to divest the assets around August 2023, according to a Reuters report.

Exxon’s Vaca Muerta assets would be “nice to have” for Vista, Galuccio said—but emphasized that an unsuccessful bidding process wouldn’t impact the company’s plans going forward.

“We will compete hard to see what is the result,” Galuccio said.

Other major Vaca Muerta producers include YPF, Shell Plc, Pluspetrol and Pan American Energy, according to Vista regulatory filings.

RELATED

Pitts: Is Vaca Muerta Argentina’s Permian?

Vaca Muerta rising

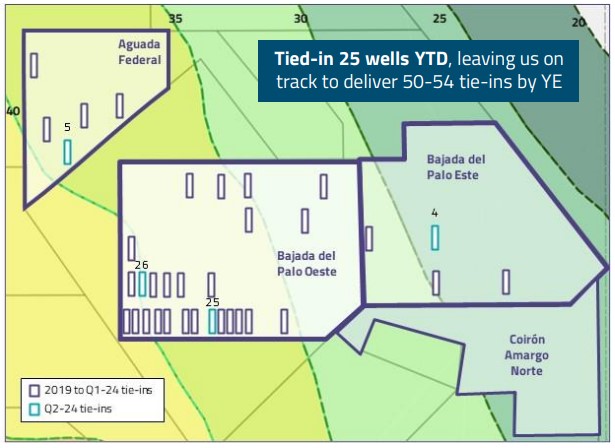

Vista and its peers have seen activity in the Vaca Muerta play increase notably over the past five years, from 962 wells tied-in by the end of 2019 to 1,709 as of year-end 2023.

Production from Vaca Muerta averaged 686,100 boe/d during 2023, a 20% increase over 2022 levels. Vaca Muerta oil production averaged 305,700 bbl/d last year.

Rystad Energy forecasts suggest Vaca Muerta oil output could surpass 1 MMbbl/d by 2030 as operators search for runway outside of North American shale. However, the firm cautioned that growth hinges on Argentina solving transport capacity bottlenecks.

Vista has been part of Vaca Muerta’s ramp up. The company’s oil production averaged 57,204 bbl/d in the second quarter, up 46% year-over-year and a 21% increase over the first quarter.

Total second-quarter production averaged 65,288 boe/d, “mainly driven by solid well performance and ramp-up of activity in Vaca Muerta,” the company said.

During the second quarter, Vista invested $266.8 million in drilling, completion and workover projects in Vaca Muerta, the bulk of which went toward drilling 14 wells and completing 14 others.

The company’s drilling activity could potentially accelerate heading into 2025. Vista recently signed a contract with global services giant SLB for a second frac set to be deployed in Vaca Muerta during the second half of this year.

“We expect the set to be fully operational for us towards year-end, adding capacity to the three high-spec drilling rigs and one frac set we currently operate,” Galuccio said during the call. “This new contract will give us additional flexibility to potentially accelerate our activity as of 2025.”

RELATED

Argentina's Vaca Muerta Could Pump 1 MMbbl/d of Crude by 2030, Rystad Says

Recommended Reading

Tracking Frac Equipment Conditions to Prevent Failures

2024-12-23 - A novel direct drive system and remote pump monitoring capability boosts efficiencies from inside and out.

Cummins, Liberty Energy to Deploy New Engine for Fracking Platform This Year

2025-01-29 - Liberty Energy Inc. and Cummins Inc. are deploying the natural gas large displacement engine developed in a partnership formed in 2024.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

Baker Hughes: US Drillers Keep Oil and NatGas Rigs Unchanged for Third Week

2024-12-27 - U.S. energy firms this week operated the same number of oil and natural gas rigs for third week in a row.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.