(Source: Shutterstock.com)

Vital Energy Inc. is a Midland Basin pure play no more, following an agreement to purchase EnCap-backed Forge Energy II Delaware LLC’s assets in a Permian Basin in deal totaling $540 million cash.

Vital, based in Tulsa, Oklahoma, said May 12 that it has signed a definitive joint purchase and sale agreement to establish a core operating position in the Delaware Basin. The deal is the second the company has made this year following an April acquisition for Driftwood Energy Operating LLC in the Midland Basin.

Under the acquisition agreement, signed with an unnamed third-party, Vital will purchase 70% of Forge’s assets for $378 million. The third party will purchase the remaining 30% of the assets for $162 million. Vital will operate the assets.

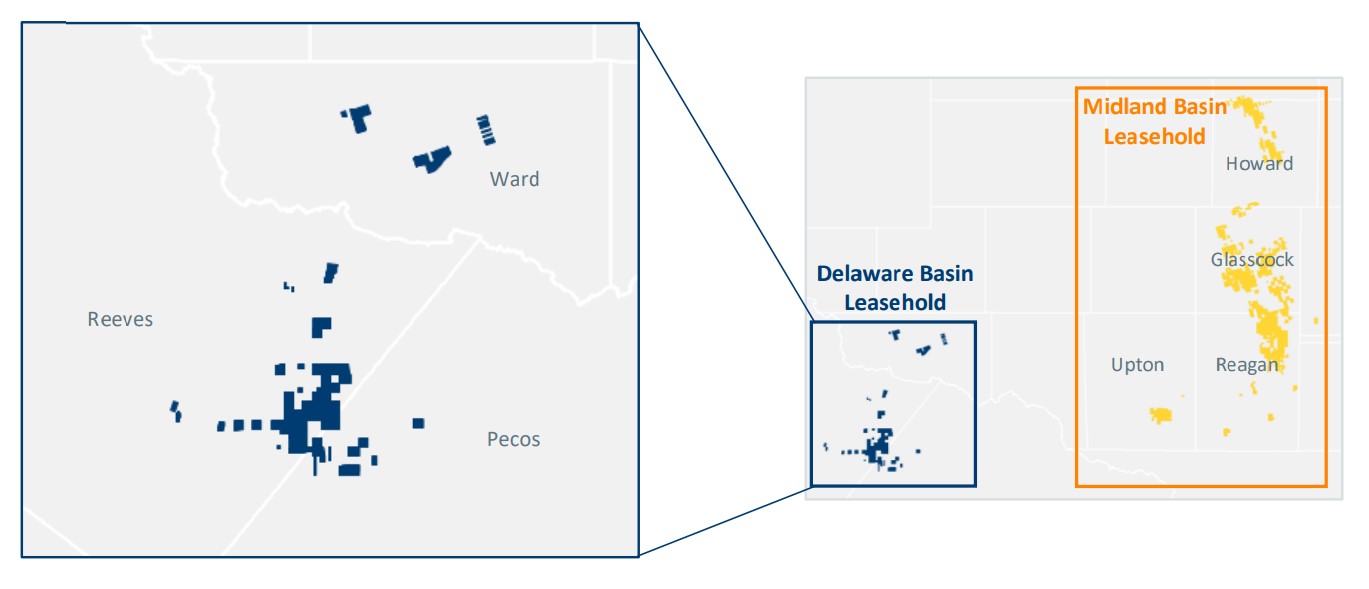

As Permian operates scramble to buy up inventory, Vital said the acquisition adds about 100 gross locations in Pecos, Reeves and Ward counties, Texas, across 24,000 net acres. The deal expands Vital’s Permian footprint to about 198,000 net acres and adds and average production of 9,500 boe/d, 65% oil, net to Vital.

The transaction adds locations in the 2nd and 3rd Bone Spring and Wolfcamp A formations. Vital Energy said the wells breakeven at an average price of approximately $50 per Nymex WTI barrel. The company also sees potential upside in the stacked formations.

The company, formerly known as Laredo Petroleum, plans to operate one rig on the acquired properties, increasing its total Permian rig count to three.

The company said the transaction is valued about 2.5x its next 12 months consolidated EBITDA based on strip pricing as of April 28, “in line with recent transaction values in the basin and estimated to be 20% accretive to next 12 months’ free cash flow [FCF]” and FCF per share.

Vital anticipated the purchase will be leverage neutral within 18 months at $75 Nymex WTI.

Vital Energy said it plans to fund the acquisition through the use of its credit facility. The transaction is expected to close in late second-quarter 2023 with an effective date of March 1, 2023, subject to customary closing conditions.

“This accretive acquisition is attractively priced and significantly expands Vital Energy’s Permian focus, adding a core operating area in the Delaware Basin,” said Jason Pigott, Vital Energy’s president and CEO. “We have a proven track record of building value through our disciplined acquisition strategy. Today’s deal significantly enhances our outlook for free cash flow generation which we will use to pay down debt and strengthen our balance sheet."

Houlihan Lokey and KeyBank are serving as financial advisers to Vital Energy and Latham & Watkins is serving as legal counsel. RBC Richardson Barr is serving as financial adviser to Forge and O’Melveny & Myers is serving as legal counsel. O’Melveny served as legal counsel to Forge Energy II.

Recommended Reading

DOE Approves Non-FTA Permit Extension for Golden Pass LNG

2025-03-05 - Golden Pass LNG will become the ninth U.S. LNG export facility following the U.S. Department of Energy’s approval for an extension of its non-free trade agreement permit.

Venture Global Asks FERC to Open Next Plaquemines LNG Block

2025-03-03 - The additional train start-up of Venture Global’s Plaquemines LNG facility would bring the overall project halfway to completion.

Venture Global Asks FERC to Approve Calcasieu Pass Opening

2025-03-25 - Shell’s CEO says he expects an update to the company’s ongoing arbitration with Venture Global.

Court Rejects Activists’ Protest of Woodside LNG Pipeline Project

2025-03-31 - Woodside Energy Group prevailed against environmental groups’ arguments to stop a pipeline to Louisiana LNG in a case that originated before the Australian company bought the project.

Segrist: Permit Reform Rumbles as US Seeks to ‘Unleash American Energy’

2025-03-19 - The White House has called for changes to a heavily criticized system, but new rules require a lot more work.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.