Vital Energy will buy an 80% stake in Point Energy Partners’ Delaware Basin assets for about $820 million, with Northern Oil and Gas acquiring the remaining 20% interest for $220 million. (Source: Shutterstock.com)

Vital Energy is teaming up with non-op E&P Northern Oil and Gas (NOG) to buy Point Energy Partners’ Delaware Basin assets in a transaction valued at $1.1 billion, Vital and NOG said on July 28.

Under the terms of the agreement, Vital and NOG will acquire Point Energy’s assets in an all-cash transaction. Vital Energy agreed to acquire 80% of Point Energy’s assets, with NOG acquiring the remaining 20%. Point Energy is a portfolio company of Vortus Investments.

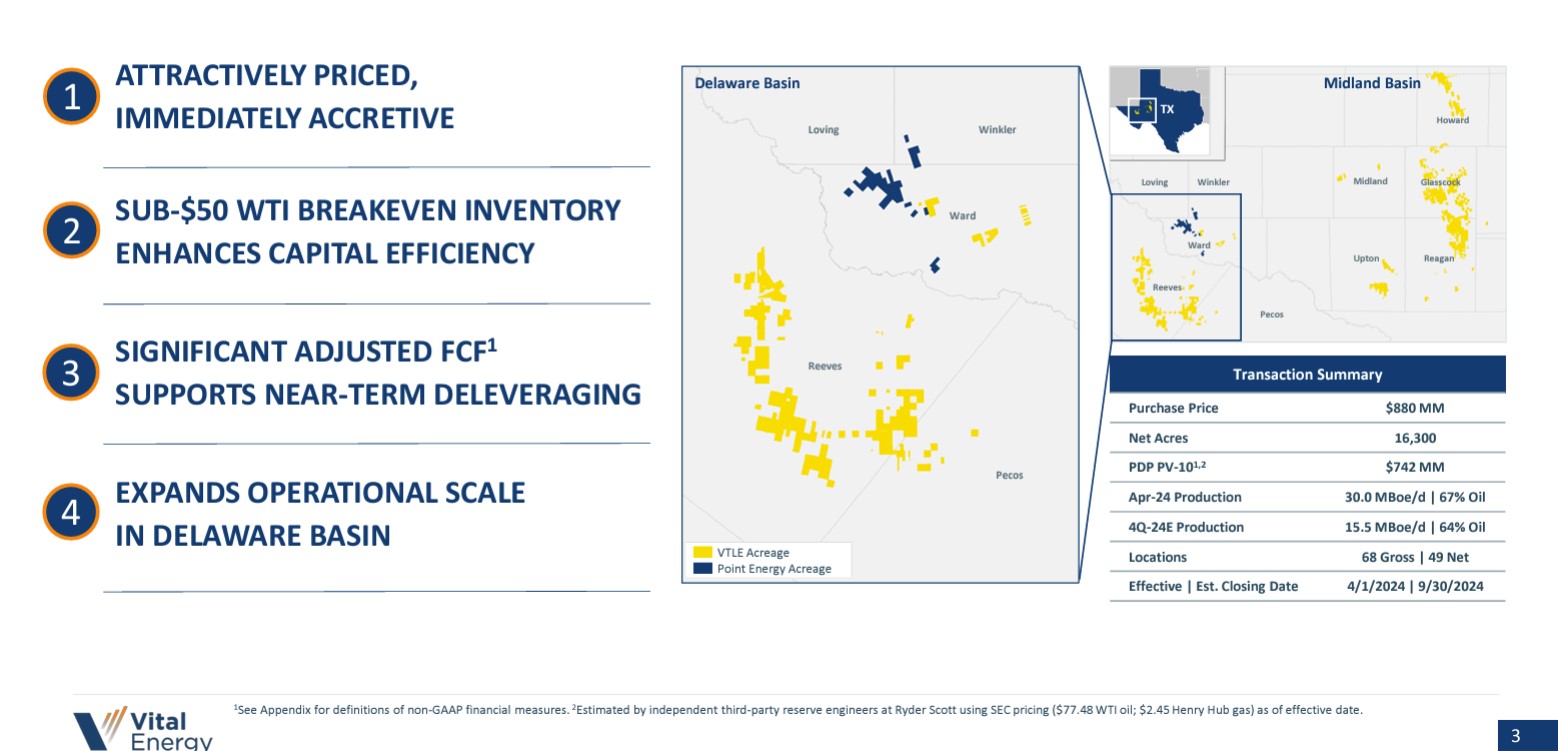

The transaction is expected to add 68 gross (49 net) inventory locations to Vital’s inventory, with an estimated average WTI breakeven oil price of $47/bbl. Point Energy’s assets include approximately 16,300 net acres and produce an average 30,000 boe/d, 67% oil. Vital said it is paying $1.4 million per undeveloped location, according to the company’s acquisition presentation.

NOG will pay about $220 million for its 20% interest in Point Energy. Northern said it will acquire assets primarily located in Ward County, Texas, that include approximately 4,000 net leasehold and mineral acres, 26.4 net producing wells, 1.6 net wells-in-process and about 12.1 low-breakeven net undeveloped locations. Upon closing, Vital will operate the assets. NOG will participate in development pursuant to cooperation and joint operating agreements entered into with Vital in connection with the acquisition.

For Northern, it’s the company’s second large-scale transaction this year as a third-party participant. In June, Northern was part of an three-way deal with SM Energy Co., which is acquiring Uinta Basin operator XCL Resources for about $2.55 billion. Northern’s end of the acquisition involves a 20% undivided interest in XCL’s oil and gas interests for $510 million.

During the past 15 months, Vital Energy has built a high-quality, core operating position in the Delaware Basin, complementing its substantial Midland Basin leasehold, the company said. The Point Energy transaction will increase the Vital’s Delaware position by approximately 25%, to 84,000-net acres. Pro forma, Delaware Basin production will comprise more than one-third of Vital’s oil production, the company said.

"This bolt-on is a great fit for us, adding high-value inventory and production in the heart of our core operating areas,” Vital President and CEO Jason Pigott said in a July 28 press release. “Furthermore, it expands our growing Delaware Basin position and balances our Permian operations.”

Pigott said the company expect to continue to demonstrate its ability to “capture, integrate and create substantial value on acquired assets through optimized development plans, lower capital costs and proven operating practices, resulting in higher future cash flows."

NOG CEO Nick O’Grady said the transaction further demonstrates the company’s position as the “most reliable and consistent partner for the purchase and development of high-quality properties.”

“The Point Assets sit directly in our area of interest and close to our existing Delaware holdings,” said Adam Dirlam, NOG’s President. “With our partners at Vital, we expect to responsibly develop these assets with an aligned plan that will deliver strong returns for our respective stakeholders over the coming years.”

Vital said the transaction is priced at approximately 2.4x the company’s next 12 months (NTM) consolidated EBITDAX. The price point “compares favorably” with Vital Energy’s current valuation and recent transactions in the basin, the company said.

The purchase price is substantially underwritten by the value of proved developed producing (PDP) reserves and eight work-in-process wells. Based on Securities and Exchange Commission pricing, third-party reserve engineer Ryder Scott estimates the PDP reserves value is $742 million and the work-in-process well is $71 million.

At closing, Vital said the transaction is projected to be immediately accretive to key financial metrics, including a more than 30% increase to the company’s NTM adjusted free cash flow and more than 20% increase to NTM consolidated EBITDAX.

Closing price adjustments are expected to total approximately $75 million, reducing total consideration to approximately $1.025 billion.

Vital Energy said it intends to fund its $820 million portion of the transaction—net of expected purchase price adjustments—through the use of its credit facility, which was recently expanded to $1.5 billion.

Wells Fargo, National Association has committed to the increased elected commitment upon closing of the transaction.

The transaction is expected to close by the end of third-quarter 2024 with an effective date of April 1, 2024, subject to customary closing conditions.

Houlihan Lokey is serving as lead financial adviser to Vital Energy with Citi serving as a co-adviser. Gibson, Dunn & Crutcher LLP is serving as legal counsel. Wells Fargo Securities LLC advised on the senior secured credit facility. DrivePath Advisors is serving as financial communications adviser.

Kirkland & Ellis LLP is serving as Northern’s legal counsel.

Jefferies LLC served as financial adviser and Akin Gump Strauss Hauer & Feld LLP is serving as legal counsel to Point and Vortus.

Recommended Reading

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

Talos Selects Longtime Shell Exec Paul Goodfellow as President, CEO

2025-02-03 - Shell veteran Paul Goodfellow’s selection as president, CEO and board member of Talos Energy comes after several months of tumult in the company’s C-suite.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.