For Vital, the transaction is expected to add 68 gross (49 net) inventory locations with an estimated average WTI breakeven oil price of $47/bbl. (Source: Shutterstock/ Vital Energy)

Point Energy Partners has closed a $1.1 billion cash sale of its Delaware Basin assets to Vital Energy and non-op E&P Northern Oil and Gas (NOG), Point Energy said on Sept. 23.

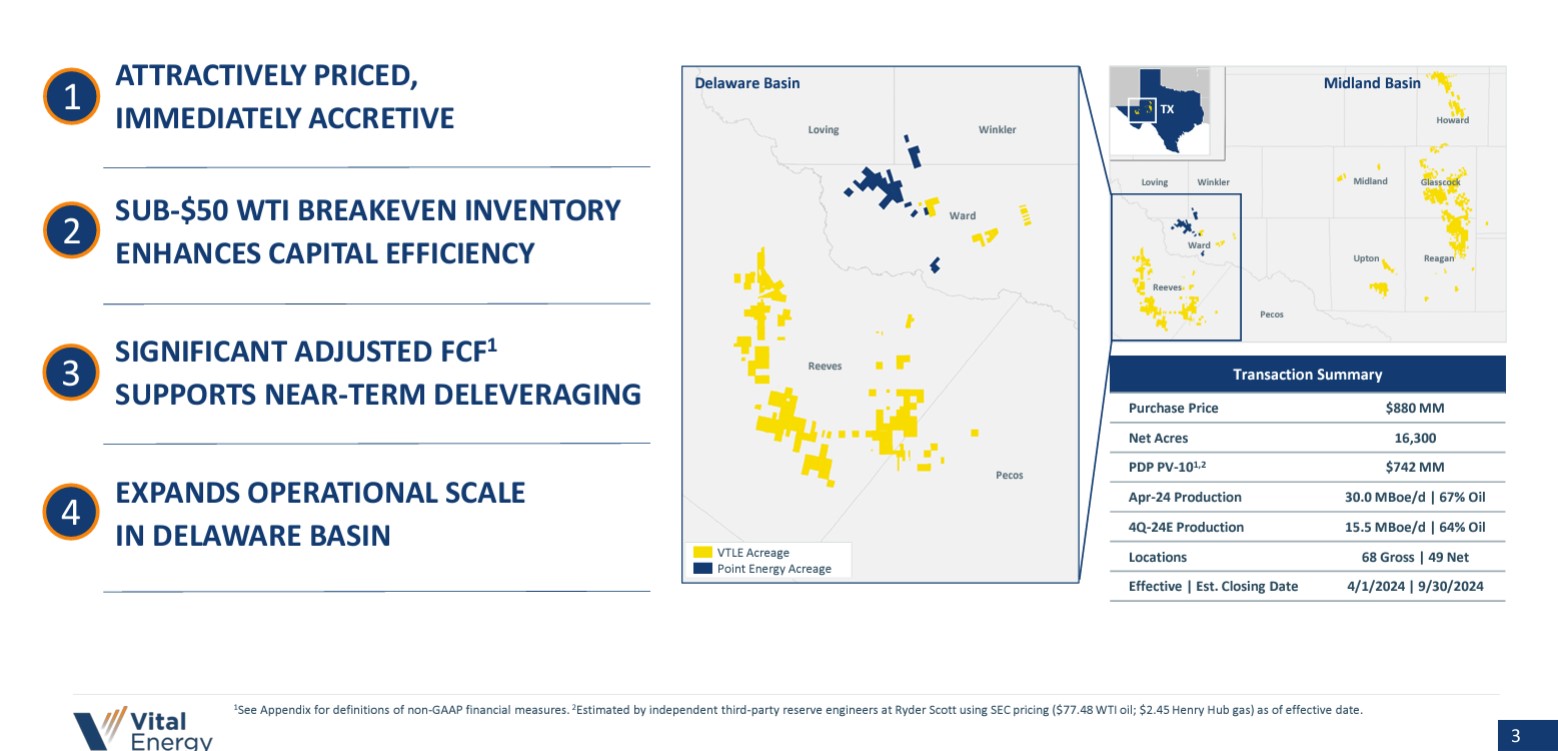

Under the terms of the agreement, Vital acquired 80% of Point Energy’s assets, with NOG acquiring the remaining 20%.

For Vital, the transaction is expected to add 68 gross (49 net) inventory locations with an estimated average WTI breakeven oil price of $47/bbl. Point Energy’s assets include approximately 16,300 net acres and produce an average 30,000 boe/d, 67% oil. Vital said it is paying $1.4 million per undeveloped location, according to the company’s acquisition presentation.

NOG paid about $220 million for its 20% interest in Point Energy. Northern said it will acquire assets primarily located in Ward County, Texas. When the deal was announced, NOG said that the assets included approximately 4,000 net leasehold and mineral acres, 26.4 net producing wells, 1.6 net wells-in-process and about 12.1 low-breakeven net undeveloped locations. Vital will operate the assets.

Point Energy said it had focused on optimal asset development, including the implementation of 15,000-ft laterals. The company advanced the development of the First Bone Spring and Wolfcamp C targets in the basin, setting industry standards for future E&P activity.

In addition to its production, Point Energy built midstream and mineral assets to complement the capital efficiency of its operations. This opportunistic approach has allowed the company to optimize resource management and enhance overall asset value, the company said.

Point Energy, a portfolio company of Vortus Investments Advisors, also it had reached an operational milestone by producing 40,000 net boe/d over a six year period from initial production of 300 net boe/d.

“This incredible achievement would not have been possible without our remarkable staff and team members who have all contributed to our success. Their dedication and expertise have been instrumental in driving our growth and innovation,” said Bryan Moody, CEO of Point Energy Partners. "We have enjoyed collaborating with and look forward to watching Vital and NOG build upon the success achieved to date on these assets."

Houlihan Lokey is serving as lead financial adviser to Vital Energy with Citi serving as a co-adviser. Gibson, Dunn & Crutcher LLP is serving as legal counsel. Wells Fargo Securities LLC advised on the senior secured credit facility. DrivePath Advisors is serving as financial communications adviser.

Kirkland & Ellis LLP is serving as Northern’s legal counsel.

Jefferies LLC served as financial adviser and Akin Gump Strauss Hauer & Feld LLP is serving as legal counsel to Point and Vortus.

Recommended Reading

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Expand Energy Picked to Join S&P 500

2025-03-10 - Gas pureplay Expand Energy will be elevated on March 24 from its position in the S&P MidCap 400 index.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Italy's Intesa Sanpaolo Adds to List of Banks Shunning Papua LNG Project

2025-02-13 - Italy's largest banking group, Intesa Sanpaolo, is the latest in a list of banks unwilling to finance a $10 billion LNG project in Papua New Guinea being developed by France's TotalEnergies, Australia's Santos and the U.S.' Exxon Mobil.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.