Vitesse Energy will acquire Lucero Energy’s Bakken/Three Forks assets, including 25 net remaining locations, 1.9 net DUCs and 20 wells that are candidates for recompletions. (Source: Shutterstock.com)

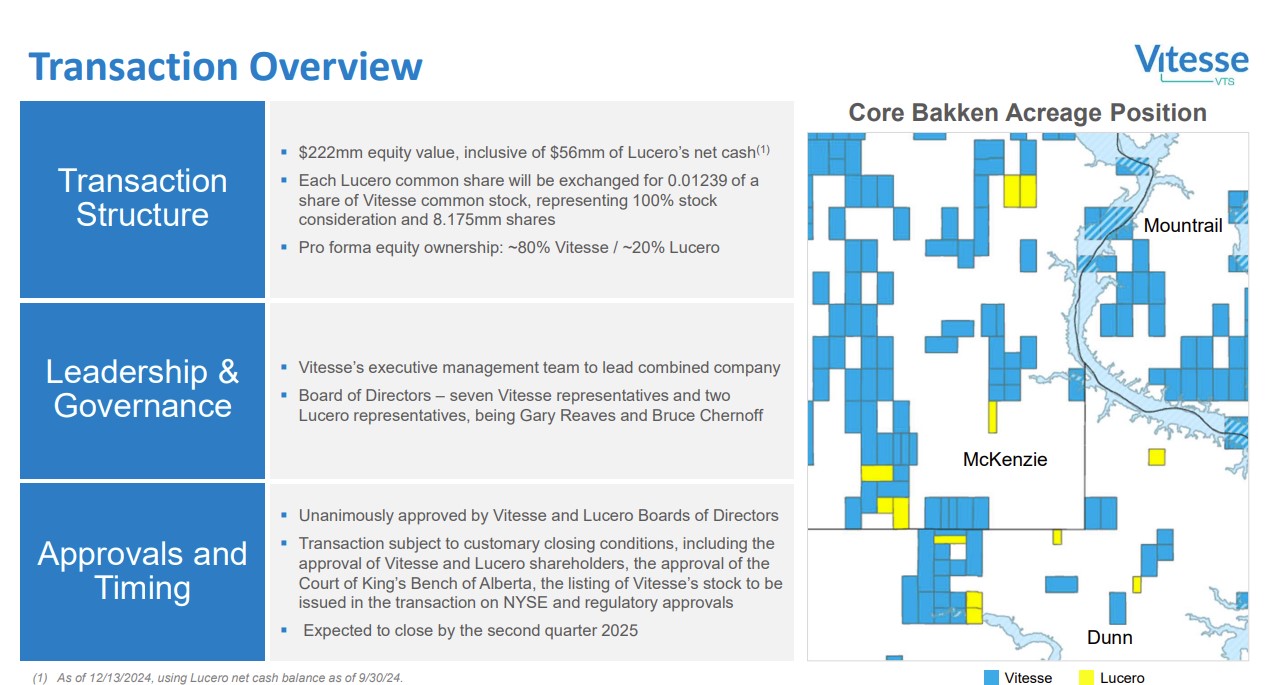

Vitesse Energy has entered an agreement to acquire Bakken pure-play Lucero Energy Corp. in an all-stock transaction valued at $222 million, Vitesse said Dec. 16.

Under the terms of the agreement, Lucero shareholders will receive 0.01239 of a share of Vitesse common stock for each common share of Lucero. Under those terms, the pro forma company will be 80% owned by Vitesse stockholders and 20% by Lucero stockholders.

Lucero is based in Calgary, Alberta and was formerly known as PetroShale, focused in the Bakken/Three Forks of the Williston Basin. The company is traded on the TSX Venture Exchange.

Lucero’s operations will provide additional scale to Vitesse’s assets across the Bakken, Vitesse said. Lucero averaged approximately 6,400 boe/d, 58% oil, during third-quarter 2024, Vitesse said. The company has 25 net remaining locations, 1.9 net DUCs and 20 wells that are candidates for recompletions, according to a Vitesse investor presentation.

Lucero held no outstanding debt and $56 million cash as of Sept. 3. Vitesse expects to use a portion of the cash held by Lucero at closing to reduce outstanding borrowings under Vitesse’s revolving credit facility. Vitesse is targeting about $3 million of general and administrative synergies annually. At close, Vitesse’s said its near-term net-debt-to-adjusted-EBITDA ratio will be ~0.3x.

“We are acquiring a high-quality company that has been very well managed and will be a terrific complement to our existing business. We are excited to add an operated leg to our strategy, while keeping our emphasis primarily on non-op,” Bob Gerrity, Vitesse’s chairman and CEO, said in a Dec. 16 press release. “This opens the door to acquiring operated and non-operated packages that are accretive to our dividend, while giving us proportionately more control over our future capital spending. In addition, this transaction supports our ability to pay the dividend, and the anticipated increased liquidity furthers our ability to make future acquisitions.”

Lucero President and CEO Brett Herman, said the company is proud of the significant steps taken to enhance Lucero’s asset base, operational performanc, and balance sheet over the past several years.

“Combining with Vitesse will provide Lucero shareholders with immediate value for their investment and the opportunity to participate in the future upside from ownership in a stronger, larger company with enhanced shareholder returns,” Herman said. “The transaction creates a unique oil weighted company with assets in the core of the Williston Basin exhibiting lower production declines, high operating netbacks, and strong capital efficiencies. I want to thank our employees for their dedication and hard work over the years that allowed us to build such a great organization and reach this exciting milestone.”

As part pf the deal, Vitesse will issue approximately 8.175 million common stock expected to be issued at closing. The issuance of shares in the transaction is subject to the approval by a majority of stockholders.

Jefferies LLC initiated this transaction and is serving as lead financial adviser, and Evercore is also acting as financial adviser to Vitesse and provided a fairness opinion to Vitesse’s board of directors. Baker Botts LLP and Blake, Cassels & Graydon LLP are serving as legal advisors to Vitesse.

RBC Capital Markets is serving as financial adviser to Lucero and has also provided an opinion to Lucero's board that the consideration to be received by company shareholders is financially fair. Peters & Co. is serving as financial adviser and also provided a fairness opinion.

Burnet, Duckworth & Palmer LLP and Davis Graham & Stubbs LLP are serving as legal advisers to Lucero.

Recommended Reading

Crescent Energy Closes $905MM Acquisition in Central Eagle Ford

2025-01-31 - Crescent Energy’s cash-and-stock acquisition of Carnelian Energy Capital Management-backed Ridgemar Energy includes potential contingency payments of up to $170 million through 2027.

Petro-Victory Buys Oil Fields in Brazil’s Potiguar Basin

2025-02-10 - Petro-Victory Energy is growing its footprint in Brazil’s onshore Potiguar Basin with 13 new blocks, the company said Feb. 10.

Apollo Funds Acquires NatGas Treatment Provider Bold Production Services

2025-02-12 - Funds managed by Apollo Global Management Inc. have acquired a majority interest in Bold Production Services LLC, a provider of natural gas treatment solutions.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

VAALCO Acquires 70% Interest in Offshore Côte D’Ivoire Block

2025-03-03 - Vaalco Energy announced a farm-in of CI-705 Block offshore West Africa, which it will operate under the terms of an acquisition agreement.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.