VTX Energy’s founder was previously among the leadership that built and sold an adjacent southern Delaware operator, Brigham Resources, for $2.6 billion. (Source: VTX Energy)

Vitol-backed VTX Energy has quickly ramped its southern Delaware Basin production from 500 gross bbl/d of oil and condensate in late 2022 to 42,000 gross bbl/d south of Monahans, Texas.

Since accumulating and taking over operations in a roughly 46,000-net acre position straddling Pecos and Reeves counties in 2023, the Austin, Texas-based E&P completed 33 new wells through April, according to Texas Railroad Commission (RRC) data.

The RRC keeps newer completions data in a confidential status for six months.

In its first deal after a 2022 founding, VTX acquired 35,000 net acres from Stellus Capital Management-backed Delaware Basin Resources in the spring of 2023 and another roughly 12,000 net from Patriot Resources’ PRI Operating in September 2023.

Gene Shepherd, VTX founder and CEO, told Hart Energy on Sept. 23 that the turnaround in output from the property was the result of VTX’s application of drilling and completion (D&C) practices from the team’s prior work in the Delaware and in other oil basins.

“We’ve been able to be more efficient with the drillbit and bringing the wells on sooner. That’s been a big contributor to the production growth,” he said.

Also, he said, “we’ve benefited [in the new property] from D&C formulas we’ve proven in the past.”

Shepherd previously co-built and sold southern Delaware operator Brigham Resources, which Diamondback Energy purchased in 2017 for $2.6 billion.

He was also part of Powder River Basin operator ATX Energy Partners and early Bakken wildcatter Brigham Exploration, which was sold in 2011 to Equinor for $4.4 billion.

Waha next door

Many of VTX’s first 33 new-well completions were ones it picked up in the property as DUCs, Shepherd said.

While its May and June production shows a sharp decline in output in RRC files, VTX hasn’t curtailed production, Shepherd said. Instead, he said there was a delay in getting production reports to the RRC but the data should be updated in state files going forward.

VTX’s wells are a few miles west of Coyanosa, Texas, and are in and around the Waha gas hub.

The proximity to Waha doesn’t result in any gas-pricing advantages, though, Shepherd said. At times, like other Permian Basin operators, it experiences negative prices for its gas.

But VTX is roughly 80% hedged on its gas through year-end and more than 90% hedged in 2025, he added.

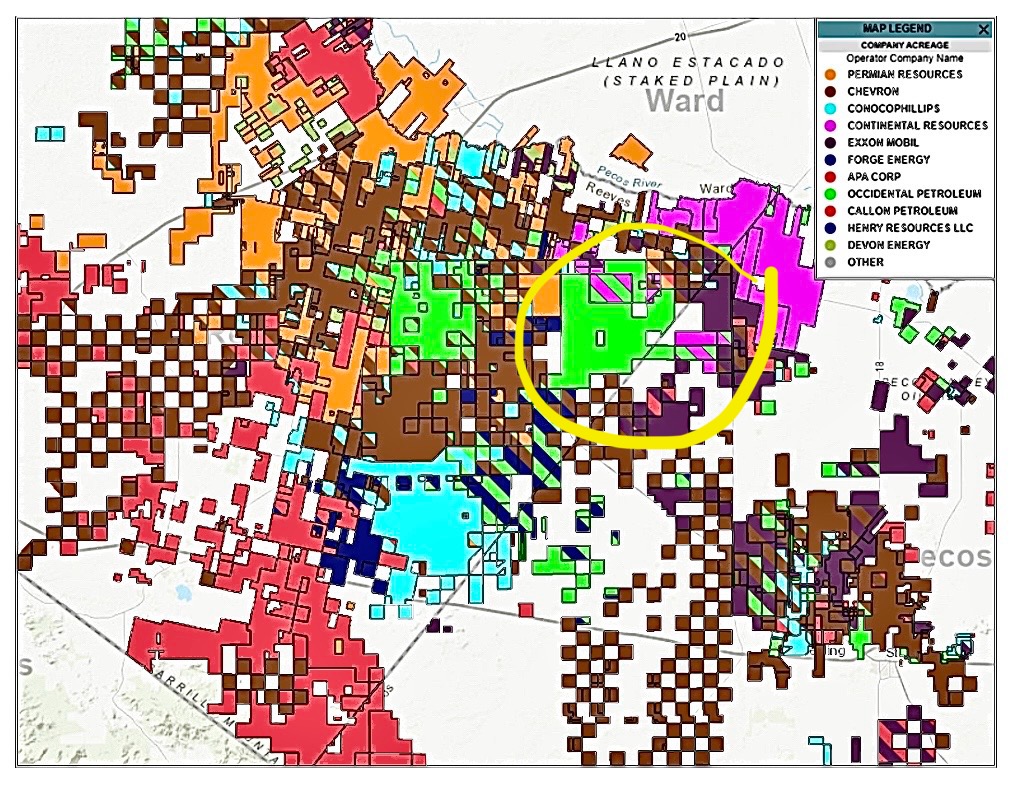

Its wells straddle the Reeves-Pecos counties’ border in and around Diamondback, Continental Resources and Exxon Mobil’s onshore U.S. E&P unit XTO Energy.

Some of the neighboring Diamondback property was bought from Brigham Resources.

The VTX property is also in the area of Permian Resources’ recent Barilla Draw asset acquisition from Occidental Petroleum.

Reeves County completions

VTX is landing laterals in the Wolfbone-Trend Area Field and Sandbar-Bone Spring Field, according to RRC data.

In Reeves County, in four Redfish Unit 12B wells completed in April, 24-hour IP tests surfaced between 819 bbl and 1,320 bbl.

Redfish 12B #33H was made in Sandbar-Bone Spring at 10,000 ft with a 10,308-ft lateral, testing 1,082 bbl of oil, 1 MMcf of casinghead gas and 1 MMcf of gas.

The #24H has a 10,320-ft lateral in Wolfbone at 11,000 ft, testing 819 bbl, 1.8 MMcf of casinghead gas and 835 Mcf of gas.

The #15H and #14H were also landed in Wolfbone at 11,000 ft. The #15H produced 1,287 bbl, 1.5 MMcf of casinghead gas and 1 MMcf of gas from a 10,065-ft lateral in its first 24-hr test.

The #14H tested 1,320 bbl, 1.4 MMcf of casinghead gas and 1.1 MMcf of gas from a 10,329-ft lateral.

Production data since completion is not yet released from confidential status by the RRC.

Pecos County completions

Meanwhile, in Pecos County, five Roosterfish Unit wells tested between 428 bbl and 1,299 bbl in the first quarter, according to RRC data.

Landed in Sandbar-Bone Spring at 10,000 ft, Roosterfish #622H produced 906 bbl, 508 Mcf of gas and 150 Mcf of casinghead gas from a 7,678-ft lateral.

Also in the Sandbar-Bone Spring, the #611H surfaced 557 bbl, 334 Mcf of gas and 155 Mcf of casinghead gas from a 7,684-ft horizontal.

At 12,000 ft in the Wolfbone-Trend Area, the #211H made 428 bbl, 479 Mcf of gas and 240 Mcf of casinghead gas from a 7,674-ft lateral.

But at 11,000 ft in Wolfbone, the #122H produced 1,299 bbl, 2 MMcf of gas and 339 Mcf of casinghead gas from a 7,680-ft lateral.

Meanwhile, also at 11,000 ft in Wolfbone, the #222H tested 754 bbl, 1.6 MMcf of gas and 214 Mcf of casinghead gas from a 7,631-ft horizontal.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.