January’s total permit count for oil and gas wells in the U.S. is the second-lowest in the last 10 years. (Hart Energy; P.V.R.Murty, Martial Red/Shutterstock.com)

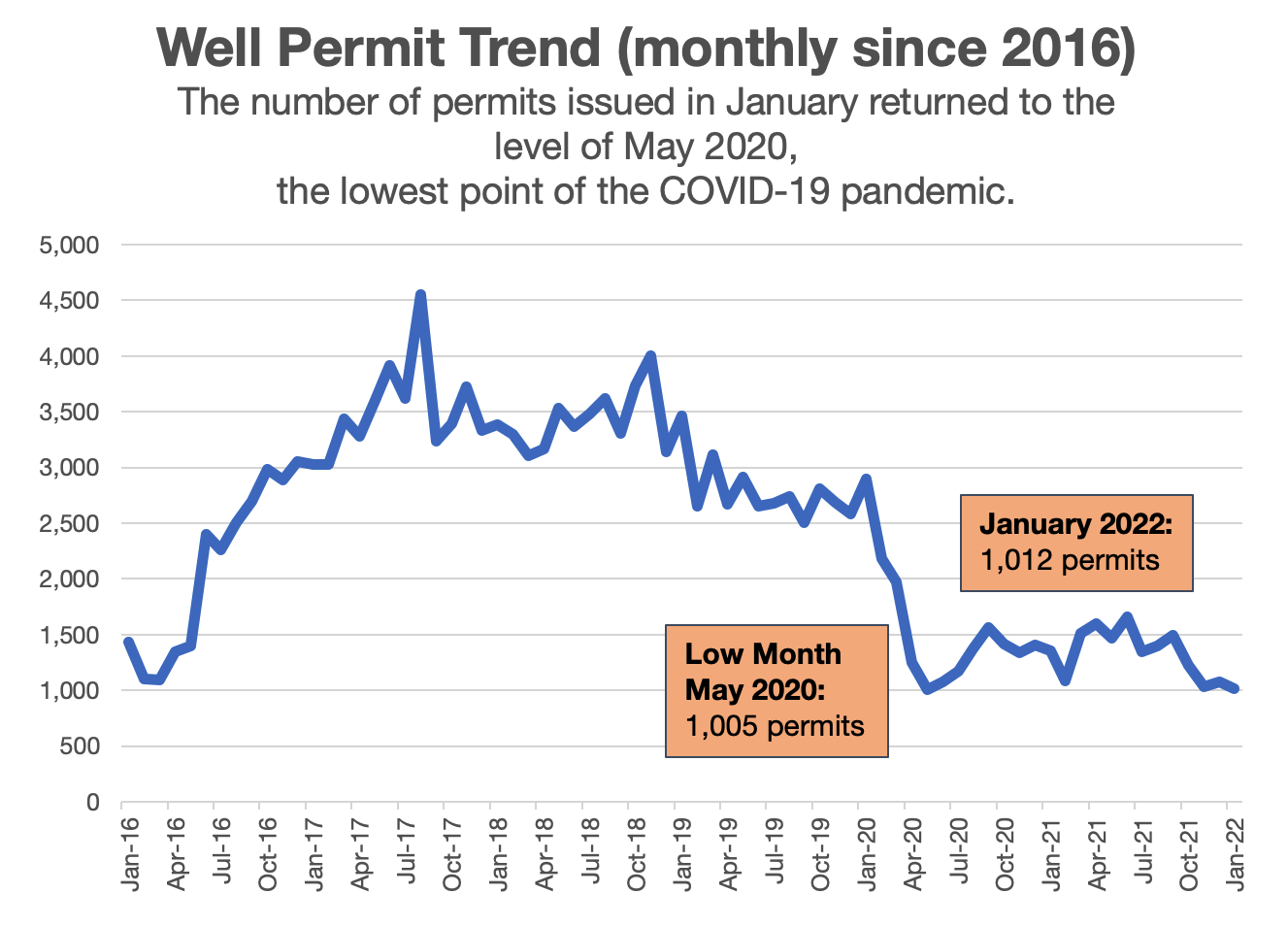

The U.S. well permit count in the full month of January sunk to its lowest level since the nadir of the COVID-19 pandemic in May 2020, and was the second-lowest total in the last 10 years. The count of 1,012 permits was down 25% from the total of a year earlier.

The slump in permits, shown in data reported by Rextag, aligns with a report from the Energy Information Administration (EIA) that the trend of rising net imports of crude is expected to continue in 2022. In 2021, net imports exceeded exports, reversing the role of the U.S. as a net exporter that was established in 2020. That year was marked by a sharp decrease in oil demand as a result of the pandemic.

Texas dominated the list of permits issued in the period ending in mid-February with 733. The Permian Basin is home to the leading counties in the state for the permits. Three counties—Webb, Atascosa and Live Oak—are located in the Eagle Ford Shale.

Pioneer Natural Resources Co. and XTO Energy Inc. dominated permitting in Martin County, Texas, in the Permian. Endeavor Energy Resources LP led companies acquiring permits in the No. 2 county, Midland.

The only non-Texan among the top 10 was McKenzie County, N.D., in the Bakken, where Ovintiv Production Inc. secured 16 permits and Oasis Petroleum North America LLC secured eight. The counties of Stephens, Kingfisher and Blaine led permitting in Oklahoma, where Citation Oil & Gas Corp., Ovintiv and Devon Energy Corp. were the major players.

| Permitted Wells by Operator | |

|---|---|

| EOG | 36 |

| Exxon Mobil Corp. | 28 |

| OXY | 28 |

| Laramie | 23 |

| Endeavor Energy Resources |

23 |

| Pioneer Natural Resources | 22 |

| Permitted Wells by State | |

|---|---|

| Texas | 733 |

| Oklahoma | 120 |

| Colorado | 85 |

| Louisiana | 65 |

| Wyoming | 47 |

| North Dakota | 42 |

| Permitted Wells by County | |

|---|---|

| Martin, Texas | 60 |

| Midland, Texas | 50 |

| Howard, Texas | 49 |

| Loving, Texas | 46 |

| Upton, Texas | 40 |

| Reeves, Texas | 36 |

Recommended Reading

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.