It's sunrise in Canadian, Texas, and the Cordillera team is sourcing water. Fracture-stimulation jobs in the Granite Wash liquids-rich play of the western Anadarko Basin use 250,000 barrels of fluid and operators are completing an average of a well a day in the Texas Panhandle and western Oklahoma counties that host this stacked bounty.

Privately held Cordillera Energy Partners III LLC has more than 8,000 wash and other locations to drill on its 400,000-gross- and 225,000-net-acre position. By adding 3,000 to 5,000 acres a month in the tightly held, 2.6-millionacre, 130-mile-wide fairway, where it has 40 to 50 landmen winning leases acre by acre, it's doubling its locations every two years.

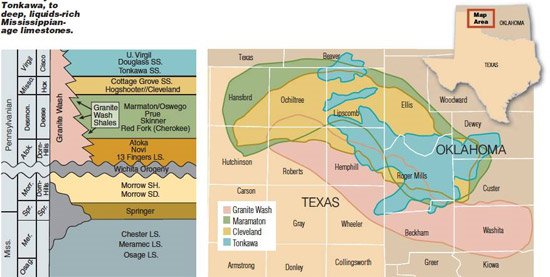

In terms of stacked plays, this one is the mother of all of them, says George Solich, Cordillera president and chief executive officer. Starting from the top, there are the Pennsylvanian-age Douglas, Tonkawa, Cottage Grove, Hogshooter, Cleveland, Marmaton, and the Cherokee group of sands—Oswego, Prue, Skinner and Red Fork.

Then, there are at least 11 members of the Granite Wash. Next are the deeper Atoka, Morrow and Springer followed by Mississippian-aged limestones, including St. Louis, Chester, Meramec and St. Genevieve.

"They're all on top of each other. What's unique about this part of the world is the amount of serendipity you have—all in one spot," Solich says.

In 2012, EnCap Investments LP-backed Cordillera plans to drill multi-formation, stacked laterals. In an inter-formational design, horizontal Tonkawa, Marmaton and Granite Wash horizontals will be made from the same pad. In an intra-formational design, it will attempt multi-Granite Wash, stacked laterals: horizontals in four of the five liquids-rich Granite Wash members, which sit at the top of the conglomerate.

Dry holes have been nil to date for Cordillera among its more than 300 vertical and horizontal wells in the western basin, which involves 15 counties, and they are rare among all operators across the play. The nomenclature is a bit of a challenge, though. Like northwestern Louisiana's Sligo and Pettet formations, names can be synonymous. In the western Anadarko, members of the Granite Wash are found in drilling records as Des Moines and Colony, for example, in Oklahoma; in Texas, they're simply known as Granite Wash and each zone carries an alphabetical designation—the A, B, C, D and so on.

The challenge is somewhat the same with the Cleveland and Marmaton. In Texas, each is distinct. In Oklahoma, distinguishing them is less rigorous as the upper Marmaton begins to wane. "Atoka Wash is below all of these zones and that's a whole other play that's just getting started," Solich adds.

Drilled for roughly a century, this was deep-gas country drilled primarily for the overpressured, prolific Morrow and Springer dry-gas zones at between 12,000 and 25,000 feet that have made record wells. For example, Buffalo Creek 1-17, a vertical Chesapeake Energy Corp. deep Springer, has made more than 60 billion cubic feet (Bcf) of gas and has paid out its cost more than 37 times to date.

As gas prices have waned over the years, drilling deep-gas targets has been put aside for more liquids-rich zones that are shallower and less expensive to drill. So, the deep-gas bounty remains for a better-gas-price day—offering yet another round of big reserves and revenues. But the gift to liquids-rich-production seekers is data from the 16,000 deep-gas vertical wells that have penetrated the shallower Granite Wash and some 6,500 others that disclose more of the western basin's wet-gas zones.

"No one looked at this as a great resource play until about five years ago," Solich notes.

The potential of the Granite Wash was masked for years because radioactive feldspar minerals in the wash wreaked havoc with gamma rays. Barrry McBride, Cordillera manager, geology, says, "It makes it look like it's a really dirty formation when, actually, it isn't at all."

A first horizontal well—after the now legendary Mitchell Energy & Development Corp. proved horizontal and multi-stage fracing success in the Barnett shale near the turn of the century—was tried in the western basin in 2004, followed by a few more. Solich, whose Denver-based Cordillera III was launched in 2007 after selling two successful iterations—both in the basin—drilled a horizontal wash well in 2007. Beginning in 2010, horizontal attempts have become standard.

"Horizontal drilling is changing this whole play dramatically," Solich says. In short order, 624 horizontal completions have already been made in the Granite Wash among all operators. At press time, another 235 had been spudded or were waiting on completion, and more than 200 permits for new wells had been issued.

Across the Greater Anadarko Basin, there were 225 rigs at work this summer on liquids-rich wells with 100 drilling the western basin. Among these, 65 were targeting Granite Wash; 20, the Cleveland; 10, the new Tonkawa light-oil play; and five, Marmaton.

Solich says, "Every Granite Wash zone measures up to some of the best formations in the U.S. The Granite Wash not only passes muster but it surpasses every resource play out there."

The liquids-rich Eagle Ford, Bakken and Marcellus too? Yes, he says. The 2.6-millionacre areal extent of this corner of the basin is smaller than the 11-million Eagle Ford, 8-million Bakken and 22-million Marcellus, but the thickness of Granite Wash pay—averaging some 2,700 feet—is formidable.

"What's the thickest part of the Eagle Ford? Two hundred feet? Marcellus, the same? Bakken, 50 or 70? From a 3-D perspective and factoring just four of the Granite Wash benches, you're looking at something 10 times the size of the Bakken per section, five times the Marcellus and 2.5 times the Eagle Ford. That's because of its thickness."

Some of the Granite Wash zones are so thick that more than one lateral in each may be required to fully tap it, he adds. "Granite Wash trumps everything you see. It's world class. That's why there are 65 rigs running in the Granite Wash right now."

And, the simple math doesn't consider the potential of overlapping Tonkawa, Marmaton, Cleveland, Cottage Grove and underlying Atoka, Morrow, Springer and Mississippian limestone formations, he adds.

Wash economics

Break-even hurdles are competitive too, according to analysts at Tudor, Pickering, Holt & Co. Securities Inc. For Bakken wells, $40 to $65 Nymex oil is needed to make a 10% aftertax internal rate of return, they estimate; the Eagle Ford condensate window, $40 to $66; the Eagle Ford oil window, $48 to $80; and in the Granite Wash, $49 to $55.

Permeability in these tight sandstone and carbonate washes and in the Tonkawa, Marmaton and Cleveland rocks ranges from 0.01 to 0.70 millidarcy and porosity ranges from 3% to 19%. Pressure gradient ranges from 0.4 to 0.65 psi per foot.

Granite Wash wells cost between $6.5- and $9 million, affected up or down mostly by depth of the targets, which changes from 9,400 feet in the northern area of the play to 15,000 feet in the south, and the size of the fracture-stimulation treatment. Frac stages number approximately 12. Some 3.7 million pounds of sand are used per completion. Frac fluid is simple slickwater.

Wells have had first-24-hour or initial production (IP) of up to 3,500 barrels of oil and 30 million cubic feet of wet, 1,280-Btu gas. The average horizontal IPs 9.5 million cubic feet of gas and 500 barrels of natural gas liquids (NGLs) per day, and the rates are increasing as operators improve frac techniques and make laterals longer where 4,680 feet is the maximum allowed.

Estimated ultimate recovery (EUR) is 7.3 Bcf equivalent. A recent Cordillera well, A.C. Smith 41-2HB, in the 120-foot-thick Britt bench, made 17 million cubic feet of wet gas and 632 barrels of oil in its first 24 hours.

Cordillera plans to have 10 to 14 rigs at work in 2012—half in the wash and half targeting Tonkawa and Marmaton—and 15 to 20 at work in 2013. Much of its acreage is held by production (HBP), so choosing locations isn't rushed to hold its position.

It is pushing the Granite Wash play, which has been known to be concentrated in the north-easternmost Texas Panhandle, distally to the east into Oklahoma and north into Hemphill County. "People think of this as a 'Texas Panhandle only' play, but it's pervasive throughout the area."

Solich estimates it will take 64,000 horizontal wells to develop the play, including all the Granite Wash benches. "It's going to be a multi-decade development."

In its plans for multi-formation, stacked laterals, potentially 54 Granite Wash, Marmaton and Tonkawa horizontal wells could be made from one section: four in each of the 11 washes, four in the Marmaton and four in the Tonkawa. "We are far from there technologically, though," Solich says. Some 275 Bcfe may be recoverable per section.

"The bottom line is that liquids-rich Granite Wash wells are the most economic wells drilled anywhere in the U.S. They are greater than 100% rate of return. I would rather be in this play than any of the shale plays. Period. That's how good this play is."

The company hit the 100-million-equivalenta-day net production mark—currently 70% wet gas and 30% oil on a 6:1 basis—in June and expects to hit 130 million equivalent per day by year-end: 6,200 barrels of oil and 93 million cubic feet equivalent of gas that carries five to six gallons of liquids per thousand cubic feet. As it increases its rig count, it expects to hit between 250 and 350 million equivalent a day by year-end 2015.

And, the Granite Wash's dry-gas zones that aren't being drilled today are very economic at a $6 Nymex gas price. "If you put $6 on the Nymex, it's hard to find zones out there that aren't going to make at least 50% returns."

Tonkawa, Cleveland

The Tonkawa, which sits above the Granite Wash, sets up primarily east-to-west reservoirs having oil legs and a gas cap. In the past half-century that it has been produced, operators focused on the gas, which flowed easily into vertical wellbores. The oil remains to be tapped, and the remaining gas offers itself up to help push the oil into horizontal wellbores as handy "solution gas."

Cordillera's Grand 1-14HC made 1,205 barrels of oil and 1.7 million cubic feet of 1,200-Btu gas in its first 24 hours online after a 10-frac-stage completion in a 40-foot Tonkawa section. "We think the recovery factor in the Tonkawa will be 15% to 20% on primary recovery because there is solution gas," says Kamil Tazi, Cordillera vice president, engineering and planning.

For now, economic Tonkawa is believed to be present under some 1.6 million acres in the western Anadarko. Top wells have been made by Cordillera, Chesapeake, Mewbourne Oil Co. and Rockford Energy Partners III LLC. Chesapeake has 16 rigs at work on Tonkawa and on the Cleveland sandstone that sits below it. It may increase the count to 25 or 30 in the coming years.

Aubrey McClendon, Chesapeake chairman and CEO, cites these as two of its top four liquids-rich plays. The others are Mississippi Lime in the northern basin and the new Utica shale play in Ohio. It also holds sizable positions in the liquids-rich Granite Wash, Eagle Ford, Permian and Niobrara plays.

Cleveland and Tonkawa wells have a combined EUR of 600,000 barrels of oil equivalent (BOE), Chesapeake estimates. The company discovered the Granite Wash horizontal play in 2007 and has 420 million cubic feet equivalent a day of gross operated production there. It discovered the Tonkawa horizontal play in 2008 and was an early developer of the horizontal Cleveland. From the latter two, Chesapeake's gross operated production is 25,000 BOE per day gross.

It holds 720,000 net acres—or 20% to 30% of the total prospective for Cleveland and Tonkawa—of its more than 2 million acres in the Greater Anadarko Basin. "One reason you've not heard too much about these plays is that Chesapeake's…position…is so dominant that no other public E&P company has been able to build a meaningful competing interest and talk up the play," McClendon says.

To date, it has drilled 116 Cleveland and Tonkawa horizontals with finding and development costs of about $12 per BOE. On 160-acre spacing, it estimates it has 4,400 net locations for the two formations and possibly some 2 billion BOE of net, unrisked potential.

"These two plays will remain primary drivers of Chesapeake's surging liquids production in the years ahead," McClendon says.

Privately held, Tulsa-based Rockford Energy Partners has made a play of the Granite Wash and, more recently, the Tonkawa. Backed by private-equity firm SFC Energy Partners LP, the E&P was formed in April 2008 as a fourth start-up by Chuck Perrin, president and CEO. He's been working the Anadarko Basin since 1979, first with Citgo, then with Apache Corp. and more recently with his privately held Sapient Energy Corp. and Rockford I, II and now III.

Could he have imagined just 10 years ago the long-plied basin would see this new attention? "No, I really didn't. I think the rest of the industry would agree. As you know, even in the late 1990s, we were seeing waterfall decline curves year over year and it really looked like the Lower 48 was a depleted asset.

"To imagine we could go back in these old oil fields with new horizontal drilling and fracture stimulation and find a hell of a lot more oil and gas, I can't say I saw that coming. But there's an adage that the best place to find oil is in an oil field. It continues to ring true."

Perrin and the Rockford team noticed horizontal success in the western Anadarko by GHK Co., Chesapeake, EOG Resources Inc., Highland Oil & Gas LLC and Jones Energy Ltd., for example, in the past few years and got to work on its own horizontals there in 2009, targeting the Tonkawa in four operated wells and also making an operated oil discovery from Cottage Grove.

"We're continuing to focus on the Tonkawa, but the Cottage Grove is now a stand-alone, economic target. That's a new, underexploited discovery. It's a little deeper than Tonkawa. We drilled three vertical pilot holes to look at Cottage Grove before completing in the Tonkawa," Perrin says.

Some operators' IPs out of Tonkawa are as much as 1,250 barrels of oil and 2 million cubic feet of wet gas a day. Rockford's 10-2H Inselman in southern Ellis County, Oklahoma, made 525 barrels of oil and 1.5 million of gas from about 8,400 feet. Chesapeake's 1011H Day, completed last year in Hemphill County, Texas, went online at 487 barrels of oil and 1.4 million of gas.

Perrin estimates EUR from horizontal Tonkawa wells is 180,000 to 200,000 barrels of oil and 1 Bcf of gas. "This play has been a little bit under the radar. It's been pretty hot out here for a couple of years and I suspect that, in the next few quarters, we will see some of the competing private-equity-backed companies bring their assets to market. There's a lot of acreage trading for large amounts of money."

Rockford itself may be among them, as Perrin is considering divesting Rockford III by year-end, as leasing costs have grown to as much as $4,000 an acre. "We were fortunate to get in there in the summer of 2009 by making two small producing-reserve acquisitions and with new leasing. We jumped out to the east of the play, in front of the leasing frenzy in the western area, and put together two townships of contiguous acreage. We have confirmed commercial Tonkawa there and that is also where we made the Cottage Grove oil discovery."

Rockford is using 3,600- to 4,200-foot laterals and nine to 14 frac stages. Besides its four operated Tonkawa and one deeper Cottage Grove well, it has participated in 36 others. "Our game plan, when we got in this, was to buy small leasehold interests in the western window and go to school on other operators. We wanted to learn as much as we could before we started drilling our own wells."

The wells cost $4- to $4.5 million each and may decline soon to $3.5 million each as efficiencies and best practices are gained. "We've actually seen one operator drill four wells for under $3.5 million each," Perrin says.

Meanwhile, at Oklahoma City-based Chesapeake, which was founded in 1989, the Anadarko Basin is home. Steve Dixon, executive vice president, operations, and chief operating officer, says the basin holds so many hydrocarbons, it's no surprise it's not over. "We're just getting started with horizontal drilling on what we will be able to mine from the basin," he says.

In a portion of its Granite Wash play, the company plans to offer units in a drilling trust, raising a forecasted $600 million to fund further development.

On its short list to do in the play is to further define the Tonkawa's sweet spot. "We have quite a bit of vertical-well control to see where it is present, but very few horizontals have been drilled so far. We are putting a number of rigs on it, so well control is increasing."

And, it continues to add acreage over Tonkawa where permeability is 0.001 to 0.04 millidarcy, porosity is 6% to 12%, pressure is 3,000 to 4,500 psi, and production is about 60% oil, 15% NGLs and 25% gas.

EUR on its Tonkawa wells is more than 400,000 BOE each on 160-acre spacing, says John Kapchinske, Chesapeake senior vice president , geosciences.

Looking at the entire western Anadarko stratigraphic column, how many formations could be productive with laterals in them at, say, $80 oil? "Well, there are so many, really," Dixon says. "In the washes, there are multiple zones, stacked. There are multiple members even of the Cleveland. It's a very rich basin."

211 and counting

At press time, Jones Energy spudded its 500th well in its 23-year history, and 211 of these are just Cleveland horizontals it began drilling in 2004. In the past year, it's been averaging one a week. The Metalmark Capital LLC-backed, privately held E&P founded by third-generation Texas geologist Jonny Jones has doubled staff to 56 in the past 18 months alone.

Gross operated production from its Cleveland wells is 45.6 million cubic feet of wet gas and 4,078 barrels of oil a day. On a net basis, it is roughly half that and at a net capex cost in the play since inception of some $250 million.

"There are more than 1,100 horizontal wells drilled now in the Cleveland and we've made about 20% of those, which is pretty amazing for our size," says Mike McConnell, president and COO of the Austin, Texas-based company. Running at about the same pace is super-independent EOG Resources Inc.

Jones' year-end 2010 proved reserves totaled 7.3 million barrels of oil, 200 Bcf of dry gas and 22.3 million barrels of NGLs. "It's amazing the effect of NGLs right now in our revenues: 70% of our production is natural gas, but 67% of our revenues come from either oil or NGLs. We are definitely focusing on more li- quids-rich Cleveland locations and more crude," McConnell says.

There are drier areas of the Cleveland play. The company holds exposure to approximately 112 sections over Cleveland, all HBP, but it isn't drilling the 15% to 20% window that offers drier gas. These targets will be tapped when natural gas prices improve. "Right now, we're just taking advantage of the fact that NGL prices are very high and it's adding to our numbers," McConnell says.

Its four rigs at work include one targeting Granite Wash, one on Cleveland and two on the Arkoma Basin's Woodford shale in eastern Oklahoma, where it picked up HBP acreage earlier this year from privately held Southridge Energy LLC and Pablo Energy II LLC.

In the Cleveland, it has taken completions in the past year from nine frac stages to 20, but it has dropped back to 11 lately to reduce costs and minimize exposure to mechanical and flowback problems. Stephen Roberts, Jones senior vice president, Anadarko Basin, says, "Now we have about four months of data to compare 11 stages with 20 with a recommendation coming soon on precisely how many stages are most effective on our wells."

McConnell believes there is more experimentation with frac techniques in the Cleveland today than in any time in its recent history. "By cutting down the number of stages, we've had significant cost savings. We may not be getting as much production as fast, but we are focusing on margin per well. We have 250 locations left to drill in the Cleveland, so we want to get this right and optimized."

Its Cleveland wells cost some $3 million each; with only 11 frac stages, less.

It has adjusted its lateral length too. Roberts says, "We are getting 4,200 to 4,400 feet of lat- eral, which is the maximum you can do within state requirements. We are also drilling negative-vertical section wells to maximize lateral length when necessary."

Prices for Cleveland leasehold are ranging from $300 an acre where potential is less known to $2,000, and Jones isn't buying. "It's hard for us to want to buy leases for $2,000 an acre when we have years' worth of drilling program without any lease cost," McConnell says.

Besides that, virtually all of Jones' Anadarko Basin leasehold—over Cleveland, Granite Wash and other formations—is HBP. "It's important to us to not be a captive of leasehold expirations. We can move rigs around to the most economic areas. We slowed down in the Cleveland a bit in the past couple months because we are in no hurry. It is a gift to not have to chase leasehold expiration, which is a problem for a lot of companies. We've worked hard to be in that position."

The company expects it will have drilled 41 Cleveland wells this year, and it may come back over its leasehold in the future for wet Marmaton and dry Atoka gas. Of the latter, Mc-Connell says, "We look at that as a natural-gas option on our acreage. If the price for gas went up to $6, the Atoka opens up, where today we're not going to drill it. I don't think anyone is drilling Atoka today."

At press time, Jones brought a Granite Wash well online at 6 million cubic feet of wet gas a day, choked back, in Hemphill County with 15 frac stages for significantly less than the $4.3 million expected. Of the potential of the western Anadarko Basin, McConnell says, "It's phenomenal."

From tertiary to primary

Apache Corp. has seen the western Anadarko Basin from primary recovery to secondary and tertiary—and now back to primary, with the application of horizontal wellbores and multistage fracing. The Houston-based company, founded in 1954, discovered several vertical Granite Wash fields in the 1970s and produces from 12 of these today in sweet spots that made vertical wells economic.

"Horizontal drilling has made a lot of the areas between the sweet spots prospective," says Rob Johnston, Apache vice president, central region. "So, all of a sudden there's been a big push to lease up all the areas between those sweet spots. We're finding some of the best horizontals are not drilled in the sweet spots but between them, where you still have pressure."

The first increased-density—or secondary-recovery—verticals were drilled in the western basin in the late 1970s and early 1980s. Johnston likens the play today to then—"all of a sudden, we have our second wind."

Besides Granite Wash, formations Apache is targeting with a roughly 10-rig program are Cleveland, the oily Cherokee clastic carbonate in Harper County where it has made 20 producers out of 22 attempts, and Hogshooter sandstone. Earlier this year, it added 20,000 acres in the western basin.

Over the productive Granite Wash, Apache controls some 200,000 gross acres and about half of that is net; over Cleveland, 43,000 gross and 26,000 net; and Cherokee, 90,000 gross. Virtually all of it is HBP. Johnston notes that Oklahoma producers will often emphasize gross, and not just net, leasehold, because even a small interest in a unit can get a well drilled in the state.

In Hogshooter, Apache is leading operators in testing horizontals, drilling six successful lateral producers in the formation for some $7.5 million each and making a first-30-day IP average of 1,100 barrels of oil and 2.7 million cubic feet a day of wet gas. It might take a look at Cottage Grove too. For now, it's taking a pass on Tonkawa and the deep St. Louis limestone, Johnston says.

Apache is also the first company to test multi-lateral wellbores—that is, two horizontal wells, one in each of two wash members, from the same surface wellbore—in the Granite Wash, which offers seven distinct members in Apache's acreage. The depth difference of the two wash zones the well tapped is about 500 feet. The frac in each was complementary, says Tim Sullivan, Apache reservoir-engineering manager, central region, "which is what we were hoping for."

The lower zone tested 6 million cubic feet of wet gas a day. After it was produced for a while, the upper zone was tested for another 6 million. Eventually, the production was commingled. NGL content was about 300 barrels a day per zone.

Johnston says, "It worked out well. We drilled two wells for about the cost of 1.7 wells. It adds a lot of complexity to drilling and completion design, but we'll do it again and I'm sure the industry will too."

In the Cleveland, the success rate is equally high. The challenge there is staying in zone, says Ken March, exploitation manager, central region. "If you get out of the zone, you don't make a well. We don't have any wells you can call a dry hole, but we do have a range of IPs and reserves and it's a function of how well you keep your lateral in zone."

Horizontal drilling in the western Anadarko has changed everything, Johnston says. "Who would have thought acreage would cost over $2,000 an acre in an area where we used to pay $300? But it's giving us enough to do for a few years."

How many years? "We have thousands of locations identified, so a long time."

It's an incredible statement for an international oil and gas company whose long-plied onshore U.S. plays compete with somewhat virgin plays abroad. "Yet this was Apache's first play and continues to play a vital role on a going-forward basis," Johnston says.

"It's ironic that a mature gas region, where we are operating on acreage acquired in the 1970s, is generating rates of return here that are as good as in some of our new, very-underexploited regions."

Take-away

The liquids-rich Anadarko Basin is changing the American NGL production profile too. Gross U.S. NGL output had declined from a record 2.034 million barrels a day in 2001 to 1.459 million in 2006. A new record was set at 2.036 million in September 2010, according to the EIA, and the figure has continued to grow since.

Research firm Bentek Energy LLC, in a year-end 2010 report, "The Rich Get Richer," cites "the liquids fairway" from South Texas to the Bakken oil play in North Dakota and Saskatchewan, plus the wet-gas window of the Marcellus shale play in Appalachia, as making the revival. The new onshore supply is offsetting declining Gulf of Mexico wet-gas volumes as drilling there remains impaired by the U.S. Bureau of Ocean Energy Management, Regulation and Enforcement.

Prices for NGLs are at a premium as a result of the 1:22 oil to gas price differential. NGLs are trading for more than $57 a barrel or, on a million-Btu basis, for $15.80 per million Btu, compared with dry gas at $4 and West Texas Intermediate crude oil at $14.83.

"New pipeline and fractionation capacity projects are under way," Bentek notes. "Petrochemical companies are pursuing the capability to run higher volumes of ethane. Gathering systems and gas-processing plants are under construction from South Texas to the Rockies to Appalachia."

As the center of U.S. NGLs production is shifting west, away from the Gulf of Mexico, "the increased distance of much of the new production from 'fractionator alley' and the petrochemical markets along the Gulf Coast is driving new midstream investments in pipelines, gas-processing plants and other facilities necessary to support increasing NGL volumes."

To take the growing NGL output from the Anadarko Basin to Gulf Coast end-users, DCP Midstream LLC plans to convert and reverse ConocoPhillips' Seaway refined-products pipeline to deliver 150,000 barrels of NGLs a day, instead, to the Gulf Coast by mid-2013.

In addition, Midcontinent operator Oneok Inc. has plans to expand its Midcontinent-to-Gulf NGL pipeline. And, at press time, Enterprise Products Partners LP and partners announced plans for the new Texas Express Pipeline that will take an initial 280,000 barrels of NGLs a day—expandable to 400,000—to the Gulf Coast for fractionation and end-use.

Bentek forecasts NGL production out of the Greater Anadarko Basin will increase 60% by 2020.

Getting oil out of the western Anadarko is also a challenge. Brad Eubanks, production manager for Apache's central region, says getting volumes from the western Anadarko to market "is constantly a problem but so far we're able to keep up. It's just a product of our own success and the industry's success. We tripled our oil production this year and we tripled it last year. We're in a gas region but we're drilling a lot of oily wells. Moving that oil in a basin that was all gas has become a real challenge."

Cordillera's Solich says, "This is a renaissance, something I've never seen in my career. Right in the midst of this old, prolific basin, these rocks are going to produce every bit, if not more, than the shale plays. It's part of the horizontal-completion revolution."

He notes that the basin—for all its growing output, relatively low well costs and repeatability—doesn't make headlines like the Marcellus, Eagle Ford and Bakken. "Maybe we should have called it a shale," he quips. In fact, there is shale mixed within the Granite Wash conglomerate.

"We laugh about it. But, I'll repeat this: When you stack up the potential of the western Anadarko, it will be greater and more economic than most of the shale plays. I would rather be in this play than any of the shale plays. Period."

Recommended Reading

Aethon Dishes on Western Haynesville Costs as Gas Output Roars On

2025-01-22 - Aethon Energy’s western Haynesville gas wells produced nearly 34 Bcf in the first 11 months of 2024, according to the latest Texas Railroad Commission data.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

Antero Stock Up 90% YoY as NatGas, NGL Markets Improve

2025-02-14 - As the outlook for U.S. natural gas improves, investors are hot on gas-weighted stocks—in particular, Appalachia’s Antero Resources.

BP’s Eagle Ford Refracs Delivering EUR Uplift, ‘Triple-Digit’ Returns

2025-02-14 - BP’s shale segment, BPX Energy, is seeing EUR uplifts from Eagle Ford refracs “we didn’t really predict in shale,” CEO Murray Auchincloss told investors in fourth-quarter earnings.

Comstock Doubling Rigs as Western Haynesville Mega-Wells’ Cost Falls to $27MM

2025-02-19 - Operator Comstock Resources is ramping to four rigs in its half-million-net-acre, deep-gas play north of Houston where its wells IP as much as 40 MMcf/d. The oldest one has produced 18.4 Bcf in its first 33 months.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.