Key Points

Bloomberg scrapes imply that gas field production was 250 MMcf/d higher when compared to the past week, but imports from Canada increased by 0.78 billion cubic feet (Bcf) while Mexico exports also increased by 0.44 Bcf. Average residential and commercial consumer demand was strong at 28.95 Bcf/d, a 21% increase week-on-week due to cold weather prevailing in all regions except the West. Power generation demand dropped by more 8 Bcf during the report week as is expected during winter months.

Our analysis leads us to expect a minor 3 Bcf draw will be reported by the U.S. Energy Information Administration (EIA) on Nov. 14. This would be in contrast to the 25 Bcf five-year average build as well as the consensus whisper expectation of a 3 Bcf build. If any export pickup occurs (perhaps into Mexico, which should also be facing the current colder than normal blast), we could even see a larger withdraw this week, although that is not our current expectation.

Key Hub Price Call

Henry Hub prices closed at $2.73/MMBtu on Nov. 11, which is the highest since March. Henry Hub spot prices have steadily risen to reach the $2.80/MMBtu range because of NOAA forecasts of a prevailing cold front over this week and weekend. Given the wintry weather’s early arrival in the most populated parts of the U.S., it is likely that the spot price will be best supported in these areas. However, prices will likely trend downward since there is less upside in view as we rotate deeper into November and into December, which NOAA expects to be warmer on average.

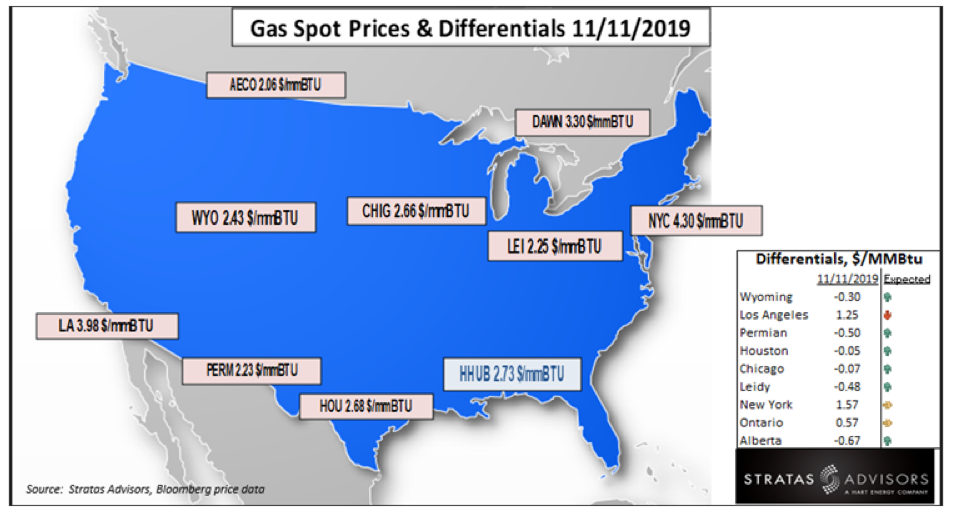

Key Gas Price Differential Calls

The rapid swing to cold weather this week has boosted prices in Central and Midwest U.S., and in the Rockies from the Canadian Alberta Hub to the Opal Hub in Wyoming. Depending on weather patterns, we see the already-narrowed differentials to Henry Hub potentially widening again as the cold weather recedes and weather reverts to the above-normal temperature expectations. Until the onset of a sustainably cold winter, we expect the weather patterns to keep price differentials volatile.

Storage: Neutral

We estimate a very minor draw of 3 Bcf to be reported by EIA for the week ended Nov. 8. This follows an injection of 34 Bcf the prior week, which was below analyst expectations. If any export pickup occurs (perhaps into Mexico, which should also be facing the current colder than normal blast), we could even see a larger withdrawal this week. Nevertheless, the stocks are at 3,729 Bcf, which is close to the five-year average compared to last winter. This summer’s injection levels have been near-record with 2,574 Bcf that have been placed into storage since April 2019. Several supra-normal injections were reported in the summer months that helped to increase the natural gas stocks rapidly. All in, we see storage as a neutral factor this week’s gas prices.

Weather: Neutral

NOAA’s six- to 10-day forecasts show an Arctic blast coming down into central U.S. all the way to North Texas and moving east into the Midwest and the east-central U.S. this week. As the cold front moves through the U.S., temperatures are expected to plunge into the -10s to 20s, resulting in very strong demand. The West will mostly remain warm and dry. Accordingly, weather has already exerted a strong positive pressure for price activity so far this week. Weather is not likely to get more severe, so the affect this week will likely be neutral, caught between the headline risk of cold actual temperatures and the likelihood for a reversion to warmer more seasonal temperatures and demands.

Supply: Negative

Supply levels have remained strong and continue to post marginal increases, which we estimate this week at 0.24 Bcf/d or 1.71 Bcf. Record production during the summer months has led to oversupply and vastly improved storage. We have plenty of buffer entering winter. All in, we expect supply to be a negative driver for gas prices this week.

Demand: Positive

The cold front in the East and Midwest last week resulted in higher residential and commercial demand than the prior week. Week-on-week, the average residential and commercial demand has risen by a whopping 6.17 Bcf/d, or 43 Bcf. Demand for power generation decreased by 1.16 Bcf/d while industrial use demand marginally increased by 0.5 Bcf/d. Accordingly, the weakness in combined industrial and power is being overlooked as residential/commercial demand heats up, so we think that offers a weak positive effect on prices this week.

Flows: Positive

For a second week in a row, flows to LNG terminals show a week-on-week gain. We expect flows this week to average 7.23 Bcf/d, an increase of 0.18 Bcf/d from the previous week. The slight increase can be considered a positive factor this week.

Trader Sentiment: Neutral

The CFTC’s Nov. 8 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on Nov. 5 were 185,793 net short while reportable commercial operator positions came in with a 155,052 net long position. Total open interest was reported for this week at 1,213,349 and was down 26,694 lots from last week’s reported 1,240,043 level. Sequentially, commercial operators this reporting week were cutting longs by 18,825 while adding to shorts by 2,248. Financial speculators cut shorts and cut longs for the week (-27,159 vs -1,103, respectively). We see trader sentiment as a neutral factor for this gas prices.

Recommended Reading

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

PE Firm Voyager to Merge Haynesville OFS Firm with Permian’s Tejas

2025-03-17 - Private equity firm Voyager Interests’ Haynesville Shale portfolio company VooDoo Energy Services will merge with Tejas Completion Services as part of a transaction backing Tejas, Voyager said.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.