The price of Brent crude ended the week at $87.00 after closing the previous week at $85.43. The price of WTI ended the week at $80.63 after closing the previous week at $80.63. The price of DME Oman crude ended the week at $87.28 after closing the previous week at $85.07.

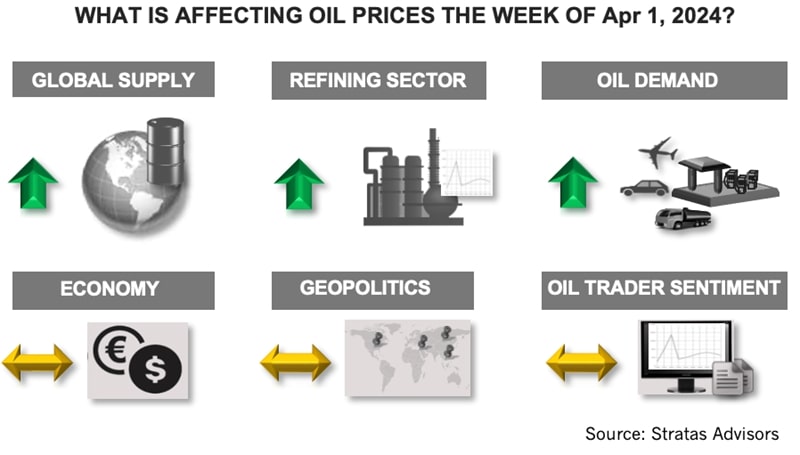

We have been forecasting that oil prices would increase with tightening supply/demand conditions coupled with increasing geopolitical risks. With last week’s increase, oil prices have reached the highest level since late October 2023.

Last week, we updated our short-term outlook (through 2025) for the crude oil markets. We are expecting that the fundamentals will remain supportive of oil prices with oil demand increasing during this period. We are also expecting that OPEC+ will continue to manage supply in a proactive manner, which will help establish a floor under oil prices. At the same time, we are expecting non-OPEC supply growth to be more modest during 2024 and 2025 than seen in 2023. There are risks to the forecast – especially with respect to the macro-level factors, including the possibility of an economic downturn, as well as geopolitical developments that could spin out of control.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Trump Ambiguous Whether Canadian-Mexico Tariffs to Include Oil

2025-01-31 - At a news conference, President Trump said that he would exclude oil from tariffs before backtracking to say that he “may or may not” impose duties on crude.

Analysts: How Trump's Tariffs Might Affect Commodity, Energy Sectors

2025-02-03 - Trump's move has sparked volatility in the commodities market. Oil prices rose, with WTI up 2.4% at $74.27 a barrel and Brent crude futures adding 1% to $76.40 a barrel.

Cushing Crude Storage Levels Near All-Time Lows

2025-01-16 - Near-empty tanks can cause technical and price problems with oil, an East Daley Analytics analyst says.

Trump Stirs Confusion with Support, Spurning of Canadian Oil

2025-01-24 - President Trump signed an order that could boost Canadian crude imports — and then said the U.S. doesn’t need Canadian crude.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.