In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $70.01/bbl last week, up $1.55/bbl from the week before.

Brent’s increase outstripped WTI, which averaged $65.03/bbl, up only $0.87/bbl after a lackluster report from the EIA on March 28. This week prices will likely lose some momentum, averaging $68.50/bbl.

Geopolitical: Neutral

There is minimal news on the geopolitical front that is likely to influence prices this week. While perennial issues such as the decline in Venezuela and unrest in Libya remain, we do not expect them to become more impactful in the short term.

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar and crude oil both rose last week. The dollar is seeing some fluctuation over concerns about recent tariffs enacted by the White House and retaliatory tariffs enacted by China.

Trader Sentiment: Positive

Nymex WTI and ICE Brent managed money net long positioning increased slightly last week. Overall market sentiment remains supportive but positioning has been moderating on a lack of new bullish indicators. Sentiment is seeing some support from statements by OPEC members that the production deal may be extended into 2019.

Supply: Negative

According to Baker Hughes, the number of U.S. oil rigs fell by seven last week. U.S. oil rigs now stand at 797, compared to 662 a year ago. Evidence of renewed global oversupply continues to pose the greatest threat to prices. On a somewhat supportive note, the Dallas Federal Reserve’s quarterly business survey provided more concrete evidence that service costs for U.S. drillers are rising, potentially slowing the rate of U.S. production growth.

Demand: Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products, including fuel oil. Economic indicators so far presage strong consumer spending through the summer demand season and refined product demand is likely to remain a supportive factor in the short-term.

Refining: Neutral

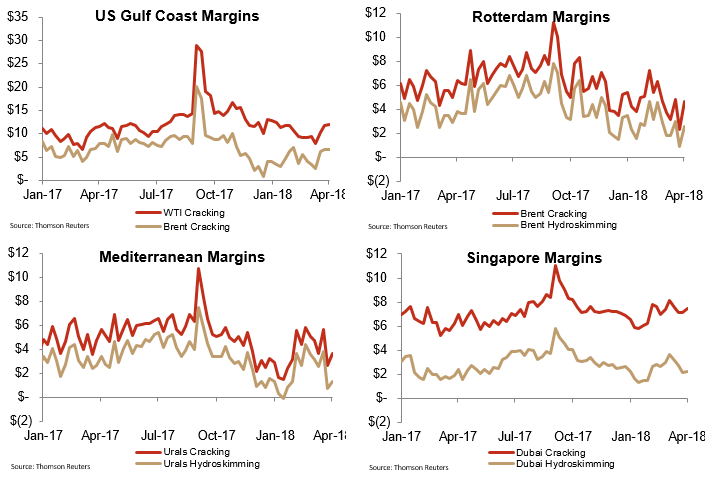

Margins rose in almost every enclave last week, despite higher crude prices. Brent cracking in Rotterdam increased $2.32/bbl while Urals cracking in the Mediterranean increased $0.97/bbl. This comes despite Brent increasing $1.55/bbl last week.

How We Did

Recommended Reading

EnerMech Secures Contract with Major North Sea Operator

2024-11-13 - EnerMech will monitor the condition of the U.K. assets in accordance with safety and operational standards.

No Good Vibrations: Neo Oiltools’ Solution to Vibrational Drilling Problems

2024-09-10 - Vibrations cause plenty of costly issues when drilling downhole, but Neo Oiltool’s NeoTork combats these issues, enhancing efficiency and reducing costs.

2024 E&P Meritorious Engineering Awards for Innovation

2024-11-12 - Hart Energy’s MEA program highlights new products and technologies demonstrating innovations in concept, design and application.

AI: Herald of New Shale Age or Last-ditch Effort to Save Industry?

2024-10-03 - AI’s ability to optimize may usher oil and gas into a new age—or simply improve on past unconventional recovery methods—depending on who you talk to.

APA, Palantir Expand Partnership to Deploy New AI Across E&P Operations

2024-09-25 - APA Corp. will introduce new AI capabilities to its oil and gas operations with Palantir Technologies’ Artificial Intelligence Platform (AIP) software.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.