In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $74.39/bbl last week, rising $1.53/bbl from the week before.

WTI’s gains were much smaller, with U.S. crude increasing only $0.56/bbl to average $68.14/bbl. There are few apparent price drivers in the week ahead, and thus we expect prices to generally trade sideways. Given the elevated price levels, we still expect a price correction to occur sometime this quarter.

Geopolitical: Positive

Lacking any other distinct drivers, prices could track with geopolitical sentiment over the next week. After an arguably successful North Korea-South Korea summit meeting, attention will now shift to the upcoming U.S.-North Korea meeting.

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar rose last week while Brent and WTI both increased.

Trader Sentiment: Neutral

Brent and WTI managed money net longs all fell last week as price gains moderated. Technical indicators suggest that prices may have been overheated. While there is unlikely to be a full reversal in sentiment, optimism about further price increases is likely diminishing.

Supply: Negative

According to Baker Hughes, the number of U.S. oil rigs rose by five last week. U.S. oil rigs now stand at 825, compared with 697 a year ago. This week will see the release of the latest U.S. monthly production numbers, which could weigh on prices. Evidence of renewed global oversupply continues to pose the greatest threat to prices. Despite OPEC’s recent technical committee’s finding that stocks are basically aligned with the current five-year average, the OPEC/non-OPEC supply deal remains secure as many members think current stocks are an inflated metric and that there is still work to be done to tighten markets.

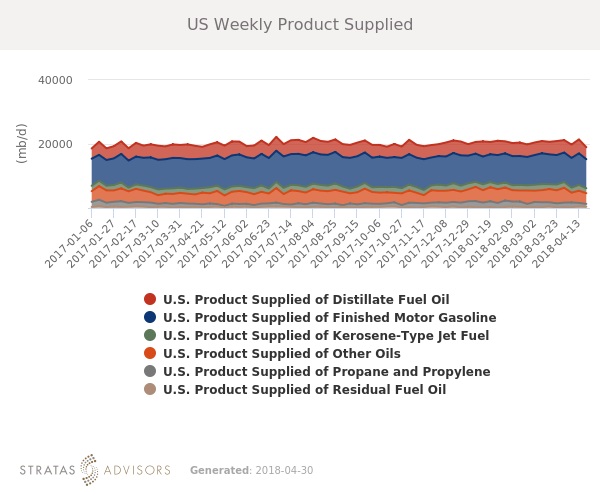

Demand: Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products, including fuel oil. Economic indicators so far presage strong consumer spending through the summer demand season. Refined product demand is likely to remain a supportive factor in the short-term.

Refining: Neutral

Margins were healthier last week as price rises moderated. Heading into summer driving season, margins should be generally improving on strong demand, but high crude prices could add pressure.

How We Did

Recommended Reading

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Post Oak Backs New Permian Team, But PE Faces Uphill Fundraising Battle

2024-10-11 - As private equity begins the process of recycling inventory, likely to be divested from large-scale mergers, executives acknowledged that raising funds has become increasingly difficult.

Oxy’s Hollub Drills Down on CrownRock Deal, More M&A, Net-zero Oil

2024-11-01 - Vicki Hollub is leading Occidental Petroleum through the M&A wave while pioneering oil and gas in EOR and DAC towards the goal of net-zero oil.

Post Oak Backs Third E&P: Tiburon Captures Liquids-rich Utica Deal

2024-10-15 - Since September, Post Oak Energy Capital has backed new portfolio companies in the Permian Basin and Haynesville Shale and made an equity commitment to Utica Shale E&P Tiburon Oil & Gas Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.