In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $67.83/bbl last week, down $2.17/bbl from the week before.

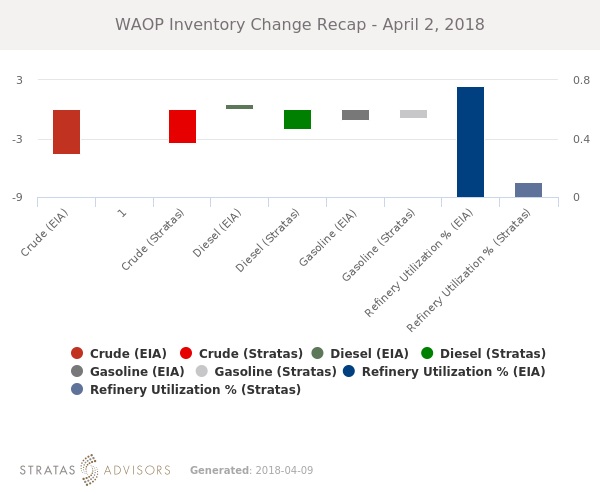

West Texas Intermediate (WTI) suffered a similar fate, falling $1.95/bbl last week to average $63.08/bbl. This came about despite a surprise draw in U.S. crude stocks and market concerns about the evolving trade dispute between the U.S. and China. This week could see prices stabilize with Brent averaging $68/bbl.

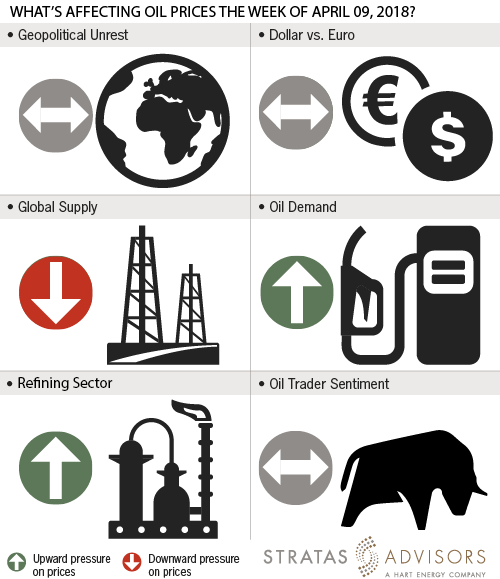

Geopolitical: Neutral

There is minimal news on the geopolitical front that is likely to influence prices this week. While perennial issues such as the decline in Venezuela and unrest in Libya remain, analysts do not expect them to become more impactful in the short term.

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar rose slightly last week while Brent and WTI both fell.

Trader Sentiment: Neutral

Nymex WTI and ICE Brent managed money net long positioning decreased slightly last week. Overall market sentiment remains supportive, but positioning has been moderating on both a lack of new bullish indicators and increasing concerns about the evolving U.S. and China trade dispute.

Supply: Negative

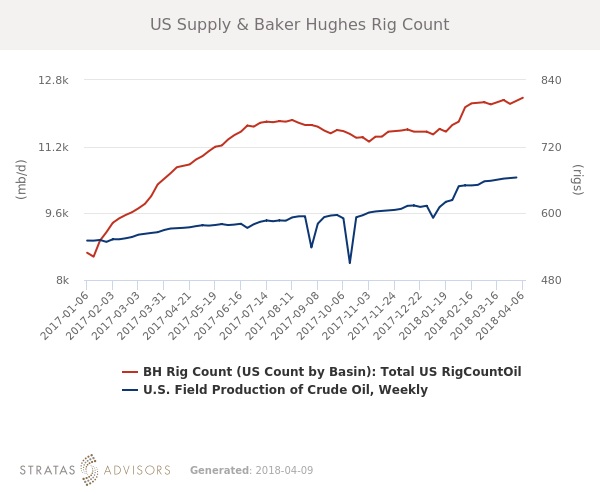

According to Baker Hughes, the number of U.S. oil rigs rose by 11 last week. U.S. oil rigs now stand at 808, compared with 672 a year ago. Evidence of renewed global oversupply continues to pose the greatest threat to prices.

Demand: Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products, including fuel oil. Economic indicators so far presage strong consumer spending through the summer demand season, and refined product demand is likely to remain a supportive factor in the short-term.

Refining: Positive

Margins rose in almost every enclave last week, due in large part to crude prices falling. Brent fell $2.17/bbl. Brent cracking and hydroskimming in Rotterdam both increased nearly $4/bbl. Margins remain at or above the five-year average in all enclaves, a boon for crude oil demand.

How We Did

Recommended Reading

Marketed: ConocoPhillips Bakken Shale Opportunity

2024-09-04 - ConocoPhillips has retained EnergyNet for the sale of working interest participation in three wells located in the Bakken Shale in McKenzie County, North Dakota.

Glenfarne: Latest Customer Means Texas LNG is Ready for FID

2024-09-12 - Construction on Glenfarne’s Texas LNG is scheduled to begin this year, though the project is one of two LNG sites that had permits pulled after a court ruling in August.

FTC Oks Chevron-Hess Deal, Bans John Hess from Board

2024-09-30 - Federal regulators signed off on a blockbuster tie-up between Chevron and Hess Corp. but banned CEO John Hess from sitting on the Chevron board.

Venezuela Lost Citgo, But the Battle’s Not Over Yet

2024-10-04 - Amber Energy’s $7.3 billion purchase of Citgo fell well short of analyst’s valuations. PDVSA Ad Hoc expects to appeal the decision soon in its battle to protect its claim on Citgo.

Quantum Teams Looking for Acquisitions ‘Off the Beaten Path’

2024-10-14 - Blake Webster, partner at Quantum Capital Group, said the private-equity firm’s portfolio teams are looking to buy from sellers looking for cash buyouts, though not necessarily in the usual places.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.