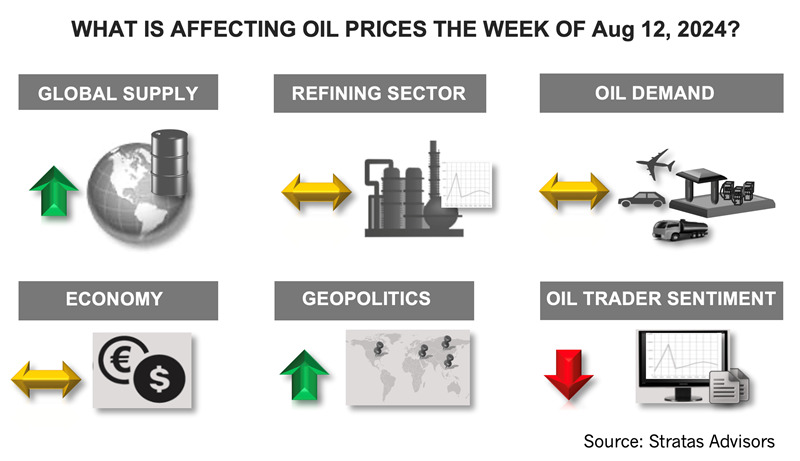

The price of Brent crude ended the week at $79.46 after closing the previous week at $77.42 after decreasing to $76.48 on Aug. 6. The price of WTI ended the week at $76.98 after closing the previous week at $74.14. The price of DME Oman crude ended the week at $78.24 after closing the previous week at $75.91.

Oil prices rebounded in the second half of the week with crude oil inventories in the U.S. decreasing for the sixth consecutive week and with better-than-expected news about the U.S. economy.

The nonmanufacturing managers index (PMI) for July from the Institute for Supply Management (ISM) increased to 51.4 from 48.8 in the previous month. The higher PMI stemmed from an increase in new orders and the first increase in employment since February of this year.

Additionally, the initial claims for unemployment benefits decreased to 233,000 from 250,000 the previous week, which was the largest weekly decrease in 11 months.

The geopolitical situation in the Middle East continues to be a source of concern and risk. The Biden Administration is still attempting to get a ceasefire in place along with a hostage deal in Gaza. Additionally, the U.S. is encouraging Iran and Hezbollah to hold back from launching an attack on Israel in response to assassinations executed by Israel on senior members of Hamas and Hezbollah. Last week, we highlighted that throughout the Israeli-Hamas conflict, Iran (and Hezbollah) has been relatively cautious and shown reluctance in making any military moves that would lead to a full expansion of the war. The risk, however, of a wider conflict is increasing, in part, because of the high-profile attacks by Israel, including the recent aerial attack on a school that killed at least 80 Palestinians. Additionally, we think the possibility of a ceasefire agreement remains low and that an agreement will not be reached during the upcoming week, despite pressure being applied by the Biden administration.

Concerns about the supply/demand fundamentals continue to weigh on oil prices. From a demand perspective, the main concern rests with the outlook for China’s demand with China’s economy continuing to struggle. Recent economic news about China’s economy is not helping to alleviate these concerns. Last week, it was reported that China’s exports increased by only 7% in July in comparison to the previous July, and significantly lower than the 15% growth that occurred in June. China is also facing the potential of new trade restrictions from numerous countries—not only from the U.S. and Europe but from countries across Asia. The disappointing news about exports follows the previous week’s news that the National Bureau of Statistics (NBS) purchasing managers' index (PMI) for manufacturing decreased to 49.4 in July from 49.5 in June, representing the third consecutive month of contraction.

In our latest update to our short-term outlook, we are forecasting that during the second half of 2024, global demand will average 2.35 MMbbl/d more than in the first half of the year. We are also forecasting that demand in the fourth quarter of this year will be 2.08 MMbbl/d more than in the fourth quarter of 2023. Coupled with our expectations for supply, we are forecasting that demand will outstrip supply by 1.32 MMbbl/d during the third quarter and by 1.62 MMbbl/d during the fourth quarter.

Additionally, we are forecasting the following:

- China product demand is forecasted to increase by 0.49 MMbbl/d during the fourth quarter of 2024 in comparison with the fourth quarter of 2023.

- India product demand is forecast to increase by 0.69 MMbbl/d during the fourth quarter of 2024 in comparison with the fourth quarter of 2023.

- U.S. product demand is forecasted to increase by 0.17 MMbbl/d during the fourth quarter of 2024 in comparison with the fourth quarter of 2023.

- Europe demand is forecasted to decrease by 0.14 MMbbl/d during the fourth quarter of 2024 in comparison with the fourth quarter of 2023.

For the upcoming week, we are expecting that oil prices will continue to move up this week and the price of Brent crude could test $82.00.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Golar LNG Enters $1.6B EPC Agreement for FLNG Project

2024-09-18 - Golar said the floating LNG vessel has a liquefaction capacity of 3.5 million tons of LNG per annum and is expected to be delivered in fourth-quarter 2027.

Federal Regulators Give Venture Global Permission to Introduce Natural Gas Into LNG Plant

2024-11-06 - Federal regulators have given Venture Global LNG permission to introduce natural gas into its Plaquemines export plant in Louisiana.

Williams Files for Temporary Permit to Keep $950MM Project Online

2024-09-11 - A temporary emergency certificate is necessary for Williams to continue operating the Regional Energy Access Project after the Court of Appeals shot down an original FERC certificate in July.

FERC Gives KMI Approval on $72MM Gulf Coast Expansion Project

2024-11-27 - Kinder Morgan’s Texas-Louisiana upgrade will add 467 MMcf/d in natural gas capacity.

Electricity and LNG Drive Midstream Growth as M&A Looms

2024-09-26 - The midstream sector sees surging global and domestic demand with fewer players left to offer ‘wellhead to water’ services.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.