The price of Brent crude ended the week at $79.77 after closing the previous week at $79.66. The price of WTI ended the week at $76.74 after closing the previous week at $76.98. The price of DME Oman crude ended the week at $78.37 after closing the previous week at $78.24.

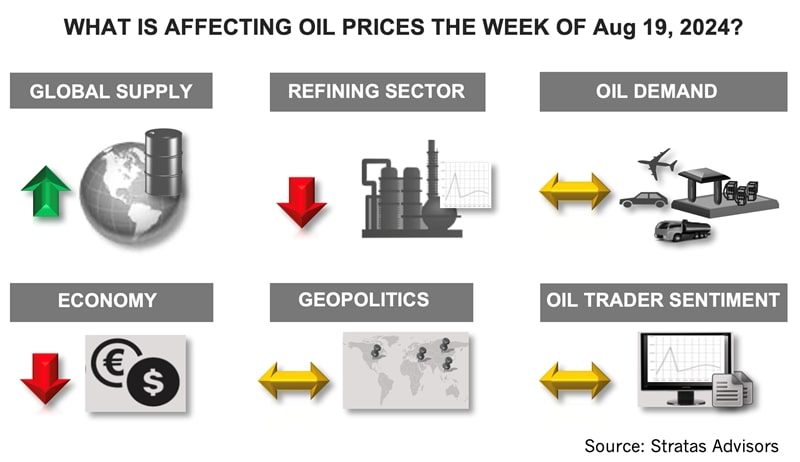

At the beginning of last week, we were expecting that the price of Brent crude could test $82 – and the price of Brent crude did reach $82.30 on Aug. 19 before drifting downward through the rest of the week. One reason for the price movement was that the latest Energy Information Administration report released on Aug. 14 indicated that U.S. crude inventories increased by 1.36 MMbbl, breaking the string of six consecutive weeks of inventory draws. U.S. crude inventories, however, are less than the level of the previous year (431 MMbbl vs. 440 MMbbl) and less than the inventory levels in 2019 (431 MMbbl vs. 441 MMbbl).

Further pressure on oil prices came from more disappointing economic news coming out of China.

- Prices of new homes are decreasing at the fastest rate in nine years. The decrease in housing prices places significant pressure on Chinese consumers since 70% of household wealth is derived from real estate.

- China’s manufacturing sector continues to struggle as indicated by the growth in factory output decreasing for the third consecutive month in July with factory output increasing by only 5.1% on an annual basis after increasing by 5.3% in June.

- Unemployment increased to 5.2%. Youth unemployment is especially high, reaching 17.1% in July, which is the highest level so far this year. The jobless rate for those between 25 and 29 years old increased to 6.5%.

- Investments in fixed asset investment increased by only 3.6% in July, which is a decrease from 3.9% in June.

Countering the negative news was some positive news about the U.S. economy, especially with respect to the most recent inflation data. According to the latest CPI report provided by the Bureau of Labor Statistics, consumer prices increased by 2.9% on an annual basis in July, which is the first reading below 3% since 2021. Core inflation (excludes food and energy), however, came in at 3.2%, but still the lowest reading since April 2021. Besides the lower inflation rate, there was some positive news pertaining to the U.S. consumer. Initial claims for unemployment benefits decreased for the second consecutive week and are the lowest since early July of this year. Additionally, retail sales for July increased by 1% from June.

We also saw the initial signs that the sentiment of oil traders is becoming less bearish. Last week, traders of WTI increased their net long positions by increasing their long positions and reducing their short positions. The increase in net long positions of 10% was the first increase after three consecutive weeks of decreases. Traders of Brent crude also increased their net long positions by increasing their long positions while decreasing their short positions. The result was an increase in net long positions of 174% after falling the previous week to an extremely low level of net long positions.

Looking forward, as we highlighted in last week's note, we are forecasting that the supply/demand fundamentals will be improving with demand growth picking up and exceeding supply during 3Q and 4Q. While the fundamentals will provide support for oil prices, we are expecting that oil prices will be moderated by the extent of spare supply capacity. We are also expecting that geopolitics will have only a marginal impact on oil prices.

Although the geopolitical situation surrounding the Middle East and Ukraine remains worrisome with the potential to disrupt oil markets, we are expecting that Iran and Russia will continue to exhibit constraint, as they have done so far in responding to military actions taken against them – even those taking place within their borders. While the constraint may stem from fear of reprisal or from the lack of capabilities, there still has been constraint – and we do not see that changing.

For the upcoming week, we are expecting that oil prices will move sideways with the positive factors being offset by the negative factors.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Michigan Appeals Court Allows Enbridge’s Line 5 Permits to Stand

2025-02-21 - Enbridge’s Line 5 still faces a court battle against the state in a case brought by the government.

Polar LNG Express: North American NatGas Dynamics to Change with LNG Canada

2025-02-21 - The next major natural gas export project in North America has a location advantage with Asian markets. LNG Canada opens up a new pathway that will change the price dynamics for producers.

Cheniere’s Corpus Christi 3 Project Sends First Commissioned LNG Cargo

2025-02-20 - Cheniere Energy executives say the Corpus Christi Stage 3 project has been ahead of schedule in commissioning its first LNG cargo.

Targa Buys Back Bakken Assets After Strong 2024

2025-02-20 - Targa Resources Corp. is repurchasing its interest in Targa Badlands LLC for $1.8 billion and announced three new projects to expand its NGL system during its fourth-quarter earnings call.

Kinder Morgan Completes Bakken G&P Acquisition from Outrigger Energy II

2025-02-18 - Kinder Morgan closed on a $640 million deal for a Bakken natural gas gathering and processing network in the Williston Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.