In the week since our last edition of What’s Affecting Oil Prices, Brent crude increased 62 cents/bbl week-close to week-close. Brent prices averaged $51.11/bbl last week and will carry momentum into the week ahead, averaging $52/bbl. For the upcoming week Stratas Advisors expects that crude inventories will draw in line with seasonal norms. Crude stocks in the U.S. are expected to fall approximately 3.8 MMbbl. Stratas Advisors also expects the Brent-WTI differential will average $3.50/bbl.

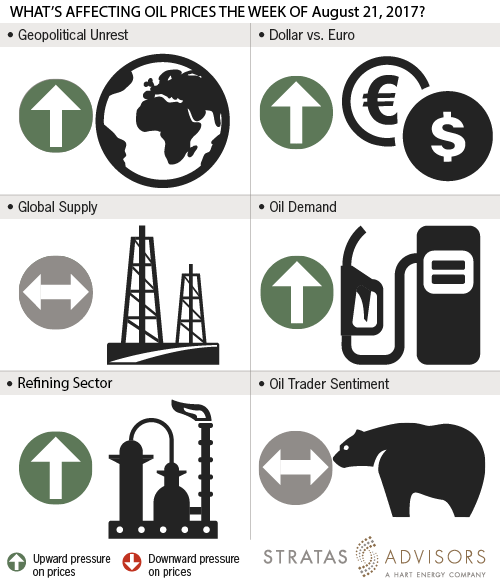

Geopolitical: Positive

Geopolitics, as it relates to oil, will continue to drive volatility, but is unlikely to have an immediate fundamental impact. However, the few active hotspots that bear watching are more likely to hamper oil supply, helping prices. Venezuela’s slow collapse remains a perennial issue, but there have been no new developments to indicate a timeline.

Dollar: Positive

While fundamentals and sentiment still outweigh the dollar’s impact on crude prices, the two have moved more in sync lately. The dollar fell toward the end of last week as Brent rallied. In absence of significant fundamental developments, Brent’s move was likely at least partly attributable to the dollar’s fall.

Trader Sentiment: Neutral

Trader sentiment will be a neutral factor in the week ahead as Brent remains near overbought territory. Traders will remain sensitive to any negative fundamentals, including reports about planned OPEC export levels. Last week’s CFTC report showed that managed money net longs are still above average, with Brent managed money net longs especially elevated. NYMEX and ICE WTI Managed Money net longs fell 5,668 and 4,137, respectively. ICE Brent Managed Money net longs increased 58,255. This is consistent with the WTI-Brent spread trend we have seen with Brent’s gains outpacing WTI’s.

Supply: Neutral

Last week the number of operating oil rigs in the U.S. fell by five, according to the weekly report from Baker Hughes. U.S. oil rigs now stand at 763 compared to 406 at the same time last year. In the latest weekly estimates from the U.S., domestic crude production increased. The EIA’s latest Drilling Productivity Report reported that production per rig continues to fall in both the Eagle Ford and Permian regions in a sign that US production may have trouble growing as fast as some market participants fear it will, a positive for prices.

Demand: Positive

Demand remains supportive, with both U.S. gasoline and diesel product supplied well-above the five-year average. In Europe, ARA total product stocks built on an increase in gasoil stocks, but stocks remain close to their five-year average. While U.S. product supplied numbers dipped last week, this is more indicative of week-to-week noise than any fundamental shift in demand.

Refining: Positive

Margins increased everywhere except the U.S. last week. In the U.S., the WTI crack at the Gulf Coast fell 61 cents/bbl to $13.64, still one of its highest points this year. Margins in Europe saw the largest increase, with Rotterdam Brent Hydroskimming increasing 98 cents/bbl and Mediterranean Urals Cracking increasing 95 cents/bbl. As the summer driving season starts to wind down and gasoline demand decreases, runs will likely also back off on lower margins.

Recommended Reading

USD Partners Expects to Sell Final Asset by Mid-April

2025-01-22 - USD Partners was obligated to sell the Hardisty terminal after entering a forbearance agreement with its lenders in June 2024.

Berry Announces Jeff Magids as New CFO

2025-01-21 - Jeff Magids was appointed as Berry Corp.’s new CFO on Jan. 21 in replacement of Mike Helm, effective immediately.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.