The price of Brent crude ended the week at $78.22 after closing the previous week at $79.77. The price of WTI ended the week at $74.96 after closing the previous week at $76.74. The price of DME Oman crude ended the week at $77.96 after closing the previous week at $78.37.

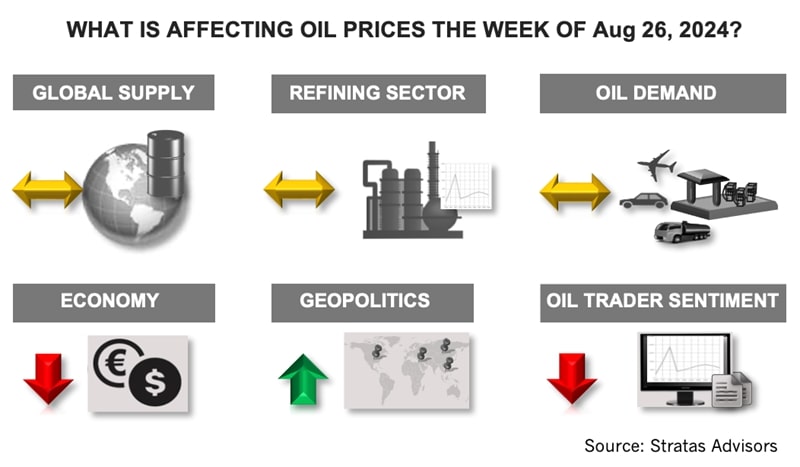

Oil prices finished lower even though the Energy Information Administration report indicated that U.S. crude inventories decreased by 4.65 MMbbl. Crude inventories in the U.S. are less than the level of the previous year (426 MMbbl vs. 434 MMbbl) and less than the inventory levels in 2019 (426 MMbbl vs. 438 MMbbl).

For the upcoming week, we are expecting that oil prices will get some support from geopolitics. At the beginning of this past weekend, Israel launched an attack against Hezbollah in Lebanon, which Israel states was taken because Hezbollah was preparing for a missile and drone attack on Israel. Since the initial attack by Israel, Hezbollah and Israel have been exchanging attacks across the Lebanon border. Additionally, while negotiations are continuing, little progress has been made in reaching a ceasefire agreement with respect to Gaza.

At the same time, the Russia-Ukraine conflict is on an escalatory path. Ukrainian and Russian troops are still fighting in Russia’s Kursk region. The Associated Press has reported that Russia continues to make gains and is advancing to within a few kilometers of the city of Pokrovsk, which is an important logistics hub. The capture of Pokrovsk will move Russia closer to gaining control of the entire Donetsk region. The U.S. continues to provide support for Ukraine and has recently announced another round of military assistance of $125 million, which consists of air defense munitions, ammunition and anti-armor missiles - -and there have been calls to allow Ukraine to utilize longer range weapons for attacks within Russia.

While the Russia-Ukraine conflict is intensifying, the impact on the oil market has been muted because the volumes of Russian oil exports have not been deterred. The establishment of the new flow patterns is now accepted by the oil market with China and India being the largest buyers of Russian crude oil. Additionally, the price of Urals is no longer trading at a significant discount. According to Reuters, Russian exporters have arranged to sell Urals crude oil for delivery to Indian refiners at a discount of $3/bbl - $3.50/ bbl. In early 2023, the discount was around $20/ bbl.

In a recurring theme, oil prices will be moderated by disappointing economic news. The big news last week was the significant downward revision in the number of jobs created in the U.S. during the period of April 2023 to March 2024. The Bureau of Labor Statistics reduced the number of jobs created for this period by 818,000 jobs with the following breakdown:

- Professional and business services – 358,000 fewer jobs;

- Leisure and hospitality – 150,000 fewer jobs;

- Manufacturing – 115,000 fewer jobs; and

- Trade, transportation and utilities – 104,000 more jobs

With the revision, which was the largest revision since 2009, the average monthly job additions decreased from 242,000 to 174,000. Additionally, the downward revision highlights that there has not been a rebound in the manufacturing sector with essentially no increase in the number of people working in the manufacturing sector since September 2022 – and even with the post-COVID-19 rebound the number of people working in the manufacturing sector is no more than in November 2019.

Economic news for China has been disappointing – and last week’s news continues the trend. Emblematic of the manufacturing challenges being faced by China is the steel industry. Last week, the Ministry of Industry and Information Technology (MIIT) suspended an upgrade program, in part, because of increasing financial losses, which are approaching the levels of 2008. The sector is facing overcapacity and the need to shift to smaller, more efficient, and less-polluting facilities. During the first seven months of the year, China’s steel output is running 2.2% below the output of last year, according to the National Bureau of Statistics.

For the upcoming week, we are expecting that oil prices will move upwards but that the price of Brent crude will not break through $82 without some additional geopolitical disruption.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

2024 E&P Meritorious Engineering Awards for Innovation

2024-11-12 - Hart Energy’s MEA program highlights new products and technologies demonstrating innovations in concept, design and application.

No Good Vibrations: Neo Oiltools’ Solution to Vibrational Drilling Problems

2024-09-10 - Vibrations cause plenty of costly issues when drilling downhole, but Neo Oiltool’s NeoTork combats these issues, enhancing efficiency and reducing costs.

Fugro’s Remote Capabilities Usher In New Age of Efficiency, Safety

2024-11-19 - Fugro’s remote operations center allows operators to accomplish the same tasks they’ve done on vessels while being on land.

Push-Button Fracs: AI Shaping Well Design, Longer Laterals

2024-11-26 - From horseshoe wells to longer laterals, NexTier, Halliburton and ChampionX are using artificial intelligence to automate drilling and optimize completions.

Liberty Capitalizes on Frac Tech Expertise to Navigate Soft Market

2024-10-18 - Liberty Energy capitalized on its “competitive edge” when navigating a challenging demand environment in third-quarter 2024, CEO Chris Wright said in the company’s quarterly earnings call.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.