The price of Brent crude ended the week at $77.42 after closing the previous week at $81.13. The price of WTI ended the week at $74.14 after closing the previous week at $77.16. The price of DME Oman crude ended the week at $75.91 after closing the previous week at $80.57.

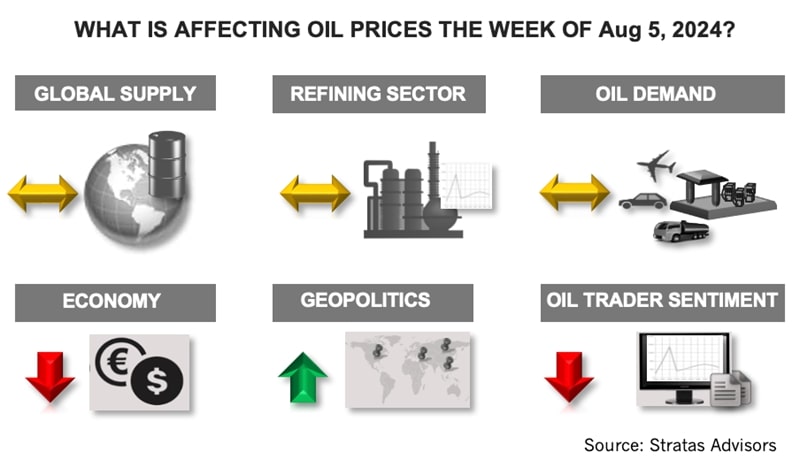

We expected that the price of Brent crude would test $82 during the week and intraday trading on Aug. 1, the price of Brent reached $81.67 before falling back sharply by the end of the week. The increase in prices was the result of heightened geopolitical tensions in the Middle East and the decrease in crude oil inventories in the U.S. for the fifth consecutive week. The price reversal stemmed, in part, from the disappointing U.S. jobs report, which was only one element of disappointing news associated with the U.S. economy.

- The latest U.S. jobs report shows that the U.S. added only 114,000 non-farm jobs in July and the number of jobs added in June was revised downward to 179,000. Additionally, the unemployment rate increased to 4.3%, which is the highest since October 2021. For the previous 12 months, the monthly increase in jobs averaged 215,000.

- The manufacturing PMI from the Institute for Supply Management (ISM) for July decreased to 46.8 from 48.5 in June (reading below 50 indicates contraction) – and is the lowest reading since November. According to the ISM manufacturing PMI, the manufacturing sector has contracted for four consecutive months and 20 out of the last 21 months. Furthermore, the number of employees in the manufacturing sector, according to the St. Louis Fed has been flat since November 2022. The outlook for the manufacturing sector does not look promising in terms of growth with the purchasing managers' index (PMI) for new orders for July decreasing to 47.4 from 49.3 in June.

- While the inflation rate has significantly decreased, inflation has remained above the 2.0% target set by the U.S. Federal Reserve. The change in the personal consumption expenditures (PCE) was 2.5% in June and 2.6% in May.

The economic news coming out of China also did not help oil prices

- The National Bureau of Statistics PMI for manufacturing decreased to 49.4 in July from 49.5 in June, which is the third consecutive month of contraction. The decrease was the result of declining new orders and lower prices with factory gate prices at the lowest level in 13 months. The manufacturing sector and factory gate prices have been negatively affected by weak domestic demand and weak demand from export markets, which contracted for the third consecutive month. Additionally, manufacturing employment decreased in July and has not increased since February 2023.

- China's non-manufacturing sector is also showing signs of stress with the National Bureau of Statistics PMI, which includes services and construction, decreasing to 50.2 from 50.5 in June.

- While the economy has been stagnating, it does not appear that the Chinese government is planning to provide any significant economic stimulus. Instead, the government is indicating that the focus will remain on long-term goals, which include the development of advanced technologies. Last week, the deputy director of the National Development and Reform Commission stated that “pain must be experienced in the process of pushing for high-quality development”.

While the disappointing economic news outweighed the geopolitical concerns last week, geopolitics remains a source of concern and risk.

- The conflict in the Middle East has heated up with Israel launching an aerial attack on Beirut last Tuesday in response to Hezbollah’s rocket attack on the Golan Heights that took place on July 27. Additionally, last week, Israel assassinated the Hamas leader, Ismail Haniyeh, when he was in Tehran.

- While the Biden Administration is still pushing for a ceasefire between Israel and Hamas, the Biden Administration has limited influence with President Biden not running for reelection. The election dynamics in the U.S. further limit the administration’s influence since both parties – Democrats and Republicans – are competing to see who can be more supportive of Israel. Consequently, Israeli Prime Minister Benjamin Netanyahu is comfortable with maintaining his aggressive approach, as indicated by Netanyahu reiterating his position on Aug. 1 that Israel was determined to achieve total victory over Hamas. Further proof is provided by reports that Israel would consider launching a preemptive strike on Iran if Israel had evidence that Iran was preparing to attack Israel.

- So far, throughout the Israeli-Hamas conflict, Iran (and Hezbollah) has been relatively cautious and shown reluctance in making any military moves that would lead to a full expansion of the war. We are expecting that will remain the case even with these latest developments. While Iran is likely to respond, we think the military action will be more perfunctory than an actual attempt to do major damage. Regardless, the risk of a wider conflict still exists, and the risk is greater now than a week ago.

Despite the heightened geopolitical tensions, we are expecting that oil prices will be under pressure again this week with oil prices being affected by the selloff in the equity market. Of course, if there is a major escalation in the Middle East, oil prices will bounce – although the extent and the duration of the bounce will be moderated by the current economic concerns and the potential impact on supply/demand fundamentals associated with the oil market.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

Artificial Lift Firm Flowco Seeks ~$2B Valuation with IPO

2025-01-07 - U.S. artificial lift services provider Flowco Holdings is planning an IPO that could value the company at about $2 billion, according to regulatory filings.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.