In the week since our last edition of What’s Affecting Oil Prices, Brent fell $0.54/bbl last week to average $73.11/bbl while WTI fell $0.89/bbl to average $67.91/bbl.

The Brent-WTI spread now stands at slightly over $5/bbl after getting as tight as $2.61/bbl in the second-half of July. We expect the spread to widen further as WTI loses support from the Syncrude outage. We expect Brent to average $73/bbl in the week ahead with no strong supporting factors apparent.

Iraqi production volumes and exports are reportedly coming in at record levels this summer which should help assuage fears of a supply shortage. In Asia, Chinese bookings of U.S. crude fell sharply after Beijing announced that U.S. crude would be subject to a 25% tariff. However, as analysts expected would happen, other locations took the opportunity to absorb additional volumes, with Indian purchases of U.S. crude nearly tripling from July to August of this year. The most recent tariff list released by Beijing removed U.S. crude, so Chinese volumes could again increase in coming months. If Indian and Chinese purchases both remain strong heading into fall, this will be a positive for U.S. prices, which typically weaken as domestic refining runs seasonally decline.

Geopolitical: Neutral

Geopolitics will be a neutral factor in the week ahead.

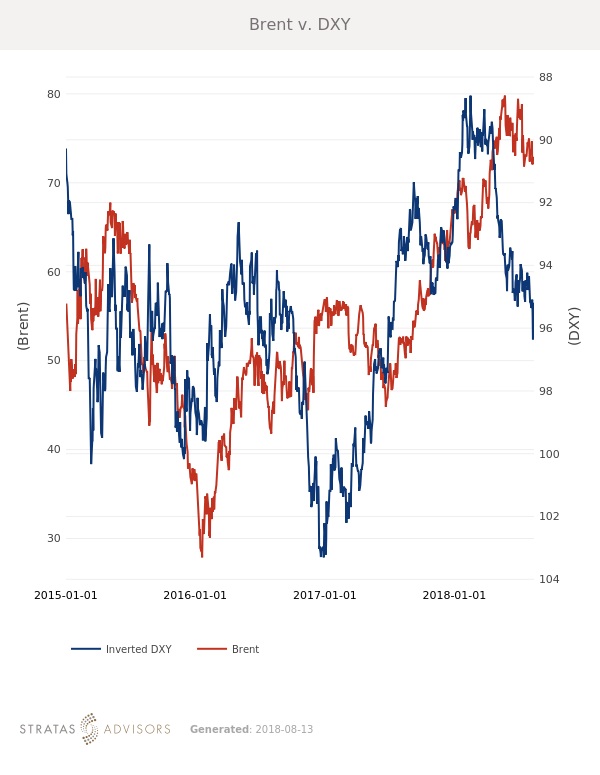

Dollar: Neutral

The dollar will be a neutral factor in the week ahead as fundamental and sentiment-related drivers continue to have more impact on crude oil prices.

Trader Sentiment: Neutral

Supply: Neutral

Supply will be a neutral factor in the week ahead. While some concerns remain about medium term supply given upcoming sanctions against Iran, Iraqi production and exports have been setting records this summer, which is likely to alleviate some fears.

Demand: Positive

Demand will be a positive factor in the week ahead. If Indian and Chinese purchases of US crude remain strong heading into fall, this will be a positive for US prices, which typically weaken as domestic refining runs seasonally decline.

Refining: Positive

How We Did

Recommended Reading

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

2025-03-13 - Hedge fund giant Citadel’s acquisition includes approximately 60 undeveloped Haynesville locations, sources told Hart Energy.

Stonepeak Acquires Stake in Woodside’s Louisiana LNG for $5.7B

2025-04-07 - Investment firm Stonepeak purchased a 40% interest in a project Australia’s Woodside Energy bought last year for $900 million.

Glenfarne Deal Makes Company Lead Developer of Alaska LNG Project

2025-03-28 - Glenfarne Group LLC is taking over as the lead developer of the Alaska LNG project with the acquisition of a majority interest in the project from Alaska Gasline Development Corp.

Will TG Natural Resources Be the Next Haynesville M&A Buyer?

2025-03-23 - TG Natural Resources, majority owned by Tokyo Gas, is looking to add Haynesville locations as inventory grows scarce, CEO Craig Jarchow said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.