Prices rebounded in the second half of the week with Saudi Arabia announcing that it will extend its voluntary cut of 1.0 million bbl/d through September after oil prices dropped earlier in the week with the news of the downgrade of the U.S. debt by the Fitch, a rating agency. (Source: Shutterstock.com)

The price of Brent crude ended the week at $86.24 after closing the previous week at $84.41. The price movement aligned with our expectations that the price of Brent crude would move toward $87.00. The price of WTI ended the week at $82.82 after closing the previous week at $80.58. The price of DME Oman ended the week at $87.57 after closing the previous week at $85.08.

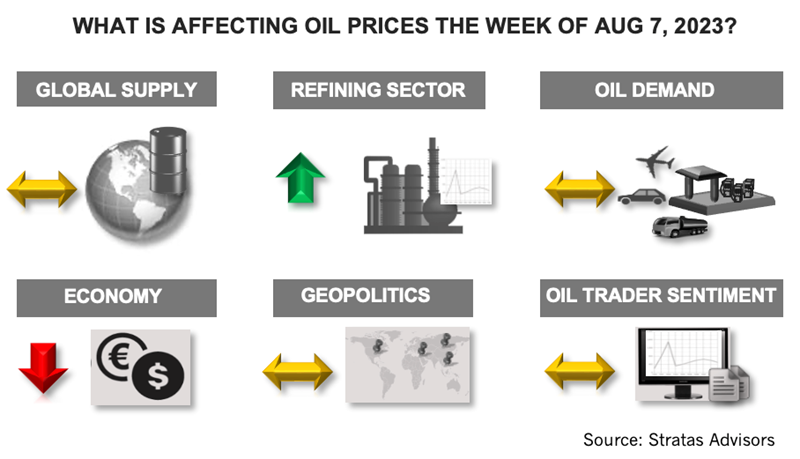

Prices rebounded in the second half of the week with Saudi Arabia announcing that it will extend its voluntary cut of 1.0 million bbl/d through September after oil prices dropped earlier in the week with the news of the downgrade of the U.S. debt by the Fitch, a rating agency.

Oil prices were also supported by the EIA reporting that U.S. crude inventories decreased by 17.05 million barrels (despite the major drawdown, crude inventories are still above the level of the previous year and the level of 2019). U.S. crude production continues to stagnant with U.S. oil production remaining unchanged from the previous week at 12.2 million bbl/d. Last week, the number of operating oil rigs in the U.S. decreased by four and now stands at 525 rigs, which compares to the pre-COVID level of 683 that occurred during the week of March 13, 2020.

There were also several geopolitical developments that occurred last week that have implications for the oil market:

- While there were peace talks taking place in Saudi Arabia, Ukraine continued with ramping up attacks on territory outside of Ukraine, including the recent attack on Novorossiysk, where Russia has a Black Sea port. It is also near where the Caspian Pipeline Consortium (CPC) operates an oil terminal for transporting oil from Kazakhstan. While the attack only resulted in a temporary ban on the movement of ships in the CPC water area, such an attack highlights the risk of the conflict expanding and having an impact on oil-related infrastructure.

- Developments in the Arab/Persian Gulf, involving Iran is another conflict that presents risks for oil-related infrastructure. Recently, Iran has armed its Revolutionary Guards’ navy with drones and missiles with a range of 600-miles. Concurrently, the U.S. has offered to place guards on commercial ships going through the Strait of Hormuz.

- The ongoing coup in Niger, which is a major exporter of uranium ore, does not directly impact the oil market, but it is an example of the risks associated with the significant geopolitical shifts taking place. The U.S. has been supporting Niger’s government and miliary, including the establishment of drone bases. The leaders of the coup are aligned with Russia, which has been expanding its presence in Africa.

- A sign of increased tensions between the U.S. (and allies) and China is the U.S. providing another $345 million of military aid to Taiwan, despite China demanding that the U.S. cease such military aid. Additionally, China’s inward foreign direct investment in 2Q declined to the lowest level since 1998 with the U.S. and allies moving to reduce economic connections with China.

For the upcoming week, we are expecting that the price of Brent crude oil will move sideways and will not break about $87.00.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Pitts: Oh, What a Tangled Web the Supermajors Weave

2024-07-23 - Exxon and Chevron and Guyana and Venezuela—‘Let’s Make A Deal’ meets ‘Love, South American Style.’

FTC Requests More Info on $17.1B ConocoPhillips, Marathon Oil Deal

2024-07-12 - The U.S. Federal Trade Commission’s request for additional information regarding ConocoPhillips’ $17.1 billion acquisition of rival Marathon Oil is likely to delay the transaction. Other recent energy M&A deals have faced similar “second requests” from the FTC.

Zachry Proposes Settlement Agreement to End Golden Pass LNG Standoff

2024-07-22 - Zachry, an engineering contractor for the Golden Pass LNG project, submitted a settlement agreement in bankruptcy court that would allow Exxon Mobil and QatarEnergy to move forward with the delayed project.

SLB: ‘As Expected’ ChampionX Deal to Undergo More Regulatory Review

2024-07-03 - Aggressive enforcement by the Department of Justice and Federal Trade Commission has delayed multiple high-profile, multibillion dollar oil and gas deals, with SLB’s ChampionX deal the latest.