The price of Brent crude ended the week at $74.31 after closing the previous week at $71.07. The price of WTI ended the week at $71.06 after closing the previous week at $67.15. The price of DME Oman crude ended the week at $74.38 after closing the previous week at $70.78.

At the beginning of the week, we did not think that the price of Brent crude would break above $73, but oil prices got support in the latter half of the week, in part, from another draw on U.S. crude inventories, indications that China will be implementing additional fiscal and monetary stimulus, coupled with reports the Biden administration is considering imposing additional sanction on Russian oil exports.

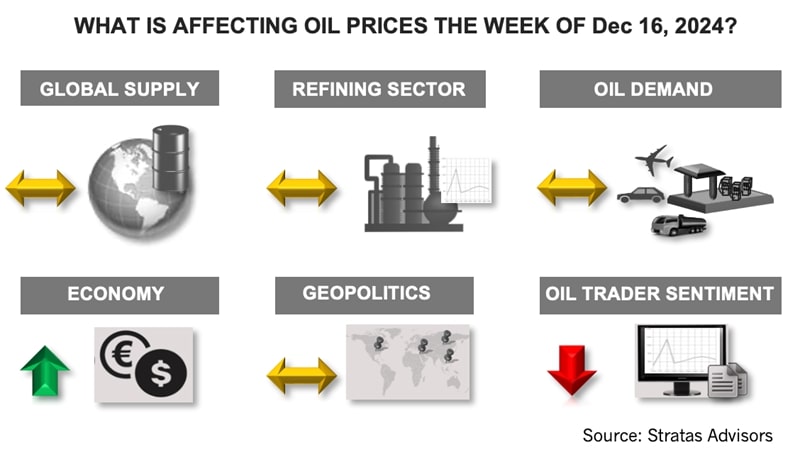

For the upcoming week, we are expecting that oil prices will move sideways with more downside risk than upside potential. It is difficult to find a factor that will give a boost to oil prices.

- We are expecting that the Federal Reserve will cut interest rates by 25 basis points at its next meeting scheduled for Dec. 18, but so is the market, and as such, the interest rate cut is already reflected in the oil price;

- The supply/demand fundamentals are unlikely to provide a boost with limited potential for any surprise to the upside – especially with China’s economy continuing to struggle; and

- While there is still plenty of uncertainty pertaining to geopolitics, there are indications that the Middle East could be entering a period during which there will be a respite in the tit-for-tat between Israel and Iran (and proxies), while the situation in Syria could proceed in the short-term without devolving into sectarian violence and clashes fostered by outside parties.

With respect to the outlook for 2025, in its latest oil market report, the International Energy Agency (IEA) is forecasting a supply surplus of 950,000 bbl/d in comparison to oil demand – even if members of OPEC+ maintain their current supply cuts during 2025, in part, because of IEA’s forecasted increase in the non-OPEC supply of 1.50 MMbbl/d. In contrast, we are forecasting that oil demand will outpace supply by around 300,000 bbl/d during 2025. The difference in our forecast and IEA’s forecast stems from our demand forecast, which is higher than IEA’s, in conjunction with our forecast for non-OPEC supply, which is lower than IEA’s forecast. We are also expecting that members of OPEC+ will continue to maintain discipline in aligning supply with demand so as not to undermine oil prices.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Energy Spectrum, UGI JV Buys Three Appalachia Gathering Systems

2025-01-28 - Pine Run Gathering LLC, a joint venture between Energy Spectrum Partners and UGI Corp., purchased three gathering systems in Pennsylvania from Superior Midstream Appalachian LLC.

Major Interest: Chevron, Shell Join Vaca Muerta Crude Pipe Project

2025-01-20 - Oil producers are pumping record levels from Argentina’s Vaca Muerta shale. Chevron and Shell have backed a new crude pipeline project that aims to boost takeaway capacity—and exports—of Vaca Muerta oil.

Shale Outlook Permian: The Once and Future King Keeps Delivering

2025-01-11 - The Permian Basin’s core is in full-scale manufacturing mode, with smaller intrepid operators pushing the basin’s boundaries further and deeper.

Gibson, Baytex Energy Enter Infrastructure Partnership in Duvernay

2025-03-12 - Baytex Energy, in partnership with Gibson Energy, is building midstream infrastructure in the Pembina Duvernay play that is expected to be completed by fourth-quarter 2025.

Langford Enters Midland Basin with Murchison Oil and Gas Deal

2025-01-14 - Langford Energy Partners closed on an acquisition of 8,000 acres in the Midland Basin from Murchison Oil and Gas LLC.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.