The price of Brent crude ended the week at $72.91 after closing the previous week at $74.31. The price of WTI ended the week at $69.47 after closing the previous week at $71.06. The price of DME Oman crude ended the week at $73.03 after closing the previous week at $74.38.

At the beginning of last week, we expected that oil prices would move sideways with more downside risk than upside potential because it was difficult to find a factor that would give a boost to oil prices. The threat of a U.S. government shutdown did not help matters.

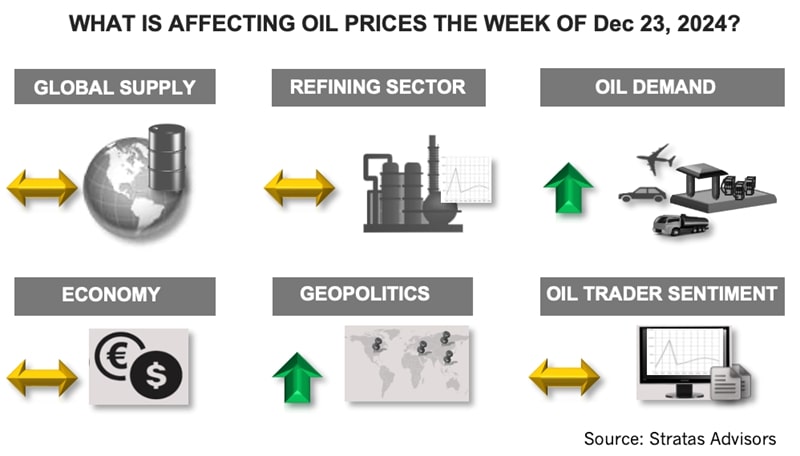

For the upcoming week, we think oil prices will get a boost from the oil demand associated with the holiday season. We are also expecting that oil prices will get a boost from recent geopolitical news. Over the weekend, the Prime Minister of Israel stated that Israel will continue to go after the Houthis in Yemen, in response to a missile from Yemen hitting the Tel Aviv area. It was reported by a local Israeli television station that while the attacks from the Houthis are not viewed as being necessarily coordinated with Iran, most of the Israeli military thinks that Israel should attack Iran – and that Israel needs to do everything to ensure that Iran does not return to Syria and Lebanon. Over the weekend, Ukraine launched drones that hit residential buildings in Kazan, a Russian city that is 1,000 km away from the Ukrainian border. In response, Putin stated that Ukraine will face many times more destruction. Russia has the ability to retaliate with hypersonic missiles, drones, and ballistic missiles that have a range of 3,000 miles (5,000 km) with the ability to carry multiple warheads including nuclear warheads.

Some downward pressure will come from the economic outlook. As we expected, the Federal Reserve reduced interest rates by 25 basis points at its meeting last week; however, the Federal Reserve also indicated that it will be cautious with respect to the pace of rate cuts during 2025. The resulting strength of the US dollar will also not help. The U.S. Dollar Index increased last week, finishing the week at 107.81 from the previous week of 106.9 – and the highest level this year – and up from 100.38 on September 27, 2024.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

DNO to Buy Sval Energi for $450MM, Quadruple North Sea Output

2025-03-07 - Norwegian oil and gas producer DNO ASA will acquire Sval Energi Group AS’ shares from private equity firm HitecVision.

Hunting Buys EOR Technology Rights from Its Founding Shareholders

2025-03-07 - Hunting Plc is acquiring the rights to organic oil recovery, an EOR technology—including 25 patents and distribution rights—from its founding shareholders.

Vitesse Energy Closes $220MM Acquisition of Bakken Pureplay Lucero

2025-03-07 - Vitesse Energy Inc. agreed to purchase Bakken E&P Lucero Energy Corp. in December in an all-stock transaction valued at $222 million.

Amplify Updates $142MM Juniper Deal, Divests in East Texas Haynesville

2025-03-06 - Amplify Energy Corp. is moving forward on a deal to buy Juniper Capital portfolio companies North Peak Oil & Gas Holdings LLC and Century Oil and Gas Holdings LLC in the Denver-Julesburg and Powder River basins for $275.7 million, including debt.

Ring Sells Non-Core Vertical Wells as it Closes in on Lime Rock

2025-03-06 - Ring Energy Inc. said it sold non-core vertical wells with high operating costs as it works to close an acquisition of Lime Rock Resources IV’s Central Basin Platform assets.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.