In the week since our last edition of What’s Affecting Oil Prices, Brent fell $3.31/bbl last week to average $59.53/bbl. WTI fell $2.64/bbl to average $51.17/bbl.

Oil prices rebounded over the weekend after the news that President Trump and President Xi Jinping came to an agreement to hold off on increasing tariffs on $200 billion of Chinese goods from 10% to 25% on January 1. The agreement provides 90 days for both sides to come to an agreement on trade and intellectual property rights. As of Dec. 2, Brent had risen above $62/bbl. For the week ahead, we expect prices to average $65/bbl with upside possible based on the outcome of the OPEC meeting.\

OPEC is scheduled to meet on Dec. 6 to discuss the current state of oil markets and a possible extension of the current production agreement. Consensus appears to be building for a production cut. However, what form this will actually take remains to be seen. At the June meeting, Saudi Arabia declared it would add nearly a million barrels back to markets by ceasing to over-comply with the current production agreement.

Although Saudi Arabia did reduce over-compliance, it took several months. OPEC may decide to reduce production, or could instead choose to focus on reducing over-compliance from those countries that are still producing less than their quotas. After this week’s meeting, OPEC will be one country less, with Qatar announcing on Monday that it would be leaving the organization in order to focus on its natural gas production.

Geopolitical: Neutral

Dollar: Negative

Trader Sentiment: Positive

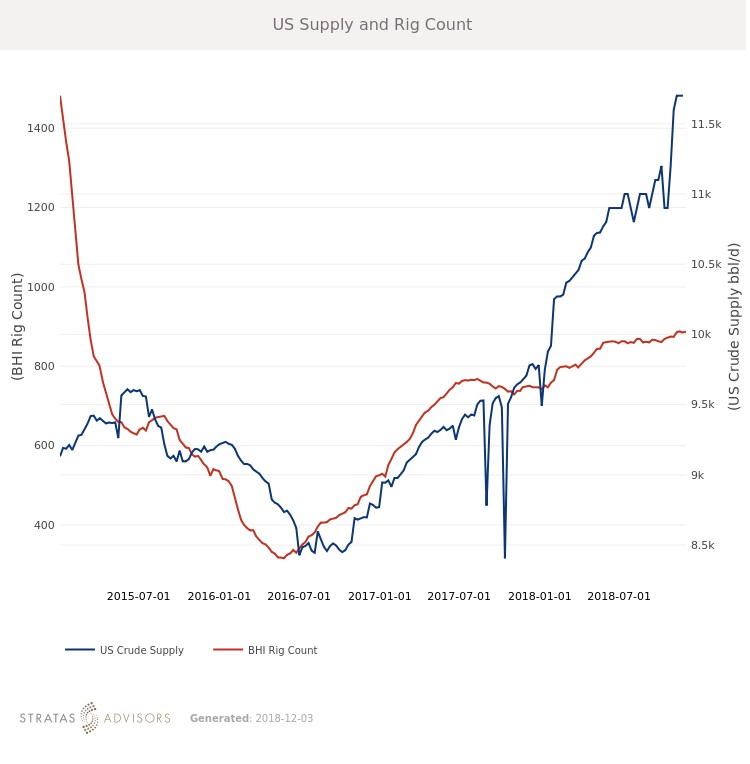

Supply: Positive

Demand: Positive

Refining Margins: Positive

How We Did:

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.